The capital markets have a crucial role to play in Asia’s transition to a low-carbon future, according to a panel of experts at IFR’s Green and Sustainable Finance webcast.

China’s commitment last year to become a net zero carbon economy by 2060, cemented into policy in the National People’s Congress meetings in March, is arguably the biggest single pledge in the global battle against climate change.

Eliminating 30% of the world’s carbon dioxide emissions is a huge commitment – and one that will require an estimated Rmb140trn (US$21.6trn) of investment over the next 20 years, according to CICC.

“China has only 30 years from its carbon emissions peak to reach carbon neutrality, while the EU and the US have 70 years and 50 years, respectively. For China, it is a huge challenge to achieve this goal with such limited time,” said Dr Peng Wensheng, CICC’s chief economist and head of research.

“China has relied greatly on heavy chemical industry and coal usage, but to achieve carbon neutrality will require major adjustments in China’s economic structure. In particular, the employment, income of residents and government tax in the northern part still depend a lot on traditional energy industry, which suggests greater pressure for structural reform in that region.”

The capital markets have already made some significant progress.

The domestic bond market has recorded over Rmb200bn of green issuance a year, and is growing rapidly.

“According to CBI and other international organizations, 2021 will be very likely a milestone year for Chinese green and carbon-neutral bonds,” said Li Zhiming, head of internationalisation for fixed income in CICC’s investment bank. “It is estimated that the total amount of relevant issuances in China may reach Rmb5trn-Rmb8trn in 2021, that is 20% to 25% of the global total.”

International investors are paying close attention.

“Few things have gotten investors more excited over the last year or so than when China came out with its net zero target,” said Marty Dropkin, head of Asian fixed income at Fidelity International.

“We don’t question anymore the link with returns, whether it be in equity or in fixed income. We know over the long term that stronger ESG credentials and a stronger focus on sustainability leads to better returns. So investors get really excited when they hear a country come out with an edict like China did.”

One major challenge for China will be scaling up its renewable power sector to reduce the country’s reliance on coal and fossil fuels, and this is where the bulk of new investments will be focused.

“Achieving carbon neutrality also brings new development opportunities,” said Peng. “Because of its huge manufacturing and market capacity, China has natural advantages in developing the green energy industry, which further provides an opportunity for China to transform from an importer of fossil energy to an exporter of green energy.”

Asia moving forward

In many ways China’s commitment mirrors a trend that is taking place across Asia.

Amy Tan, head of debt capital markets origination for Asia ex-Japan at JP Morgan, sees “a fundamental shift” underway across the region.

“In the longer term, a lot of financing is going to have some element of ESG within it or related to it,” she said.

Atul Jhavar, head of sustainable capital markets for Asia Pacific at Barclays, points to renewable energy as an example of the role the capital markets can play.

“If you take India or Indonesia, for example, a number of the capital markets financings in those countries have assisted in recycling assets from the banking sector and distributing them more globally into institutional investors. That’s created more and more room for banks to continue financing greenfield projects and supporting new capacity addition in terms of renewal energy.”

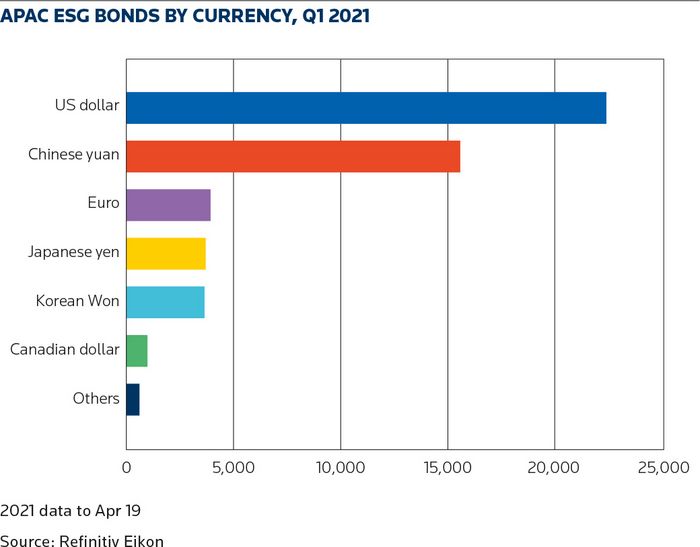

According to Refinitiv data, sustainable finance bonds totalled US$286.5bn during the first quarter of 2021, more than double the first quarter of 2020 and an all-time quarterly record – up 48% on the previous quarter.

That includes US$10.2bn in Japan and US$43.9bn in the rest of Asia Pacific, with China leading the way.

Globally, 11.5% of all bonds sold in the first quarter had an ESG component, up from 9.5% during fourth quarter 2020.

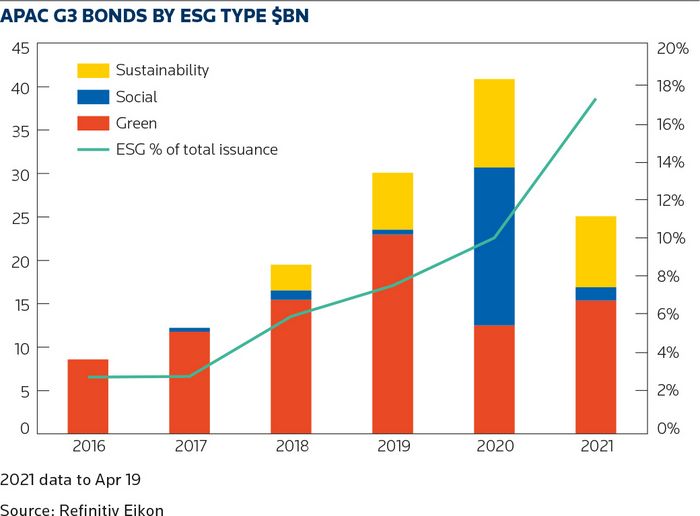

That trend is even more pronounced in Asia Pacific’s international bond market, with 17.2% of all G3 bond issuance in the first quarter carrying a green, social or sustainable label, up from 10.0% in the previous three months.

During the first quarter of 2021, Green bond issuance totalled US$131.3bn, an increase of more than four times first quarter 2020 levels and all-time quarterly record.

SLB push

One of the most significant new developments in ESG finance is the introduction of performance-linked instruments, which link funding costs with specific targets – such as emissions reductions or green building scores.

The concept first took root in Europe, where Italian energy giant Enel was an early pioneer, but has begun to catch on in Asia, first with bilateral bank loans and more recently in fully distributed capital markets deals.

Hong Kong-based New World Development raised US$200m in January from a 10-year bond that requires it to purchase carbon offsets if it misses a target of using renewable energy across its portfolio.

Ultratech, an Indian cement maker, followed a month later with a US$400m that binds it to reducing carbon emissions by 22.2% from 2017 to 2030. The 2.8% coupon will increase by 75bp if it misses that target.

“JP Morgan helped create the idea of sustainability-linked bonds, because it allows us to help companies link their specific corporate targets to financing costs,” said Tan.

“It puts some skin in the game for a lot of these companies, demonstrating that they are willing to step up and meet the targets that they have committed to.”

Dropkin at Fidelity welcomes the format – with some caveats.

“The capital markets and investors would be very supportive of companies who commit to green transition and are willing to put targets and risk their cost of capital behind that,” he said.

“We need to make sure that there’s some bite… There have been some bonds which have been issued with very minor step up in coupons if companies don’t achieve their objectives.”

Proponents of the SLB format believe the financial incentives – or penalties – can encourage companies in carbon-intensive sectors to adopt a meaningful climate strategy.

Green deals from these so-called brown industries remain a polarising topic. Airports, for example, are off-limits for some sustainability-focused money managers, but others are keen to engage with companies that show a real commitment to make changes.

“In a lot of the so-called brown or carbon-intensive sectors I think it’s going to eventually require technological changes, but certainly setting up the right financing structures can help set a pathway towards that,” said Jhavar.

The challenge in growing the market lies in convincing issuers and investors to accept variable funding costs. Tan at JP Morgan, however, believes that more participants will see the benefits as data on funding costs emerges.

“Because of the demand from the investor side, we have seen them price tighter compared to traditional bond financings. The savings could be as low as 5bp but up to 10bp–20bp,” said Tan.

“If people are willing to put skin in the game, they are being rewarded upfront with an initial lower cost of funding.”

Consistent standards

The growth of performance-linked instruments may also accelerate the drive for more comprehensive disclosure and standardised reporting.

“We’re at the stage now where investors and asset owners are a little bit confused. There is such a proliferation of ratings out there. There’s such a proliferation of standards out there,” said Dropkin.

“That’s a pretty normal part of the cycle, since sustainability and ESG is such on an upswing right now. Let’s face it, lots of companies and lots of organisations are seeing opportunity out there. No doubt that will resolve itself. I think both regulators and governments are going to drive consistency and drive standardisation over time.”

Peng at CICC said the growing acceptance of ESG in international financial institutions may trigger a fundamental change in the global financial system.

“Financial institutions in China should seize the opportunity to raise their competitiveness in ESG and help achieve the goal of carbon neutrality,” he said.

“This requires us to formulate unified green standards that are in line with international standards, strengthen the establishment of environmental information disclosure mechanisms for corporates, promote the concept of green living, and exert ESG guidelines for long-term funds such as pensions and insurance companies in China.”

Li Zhiming identified three major areas for development: policy incentives for low-carbon industries; measures to stimulate investors’ demand for sustainable assets; and enhancement to China’s market infrastructure.

“We need to vigorously develop innovative green bond indexes, ETFs and other products, formulate green information disclosure systems and standards for issuers and investors with strict regulatory requirements onside,” he said.

Other panellists agreed that central banks and governments have a critical role to play in deepening the market for sustainable finance.

“Singapore is a great example, where the government recently passed regulation around the 2030 green plan,” said Jhavar. “It specifically creates the parameters around which the government will start issuing green bonds. That will then lead to the development of capital market products in the quasi-public sector and the private sector as well.”

“We have seen a very rapid shift in focus over the past two years ago in Singapore and now it’s now one of the most important discussions that we are having in the Singapore capital markets.”

More government-level commitments can be expected ahead of the COP26 climate summit in Glasgow in November.

The panel left no doubt that this growing focus on climate change has moved beyond the policy level. Global banks and asset managers have also ramped up their efforts to green the financial system, mobilise funds for low-carbon initiatives and exit polluting industries, and the corporate sector is catching up.

“Investing has become more than just financial returns. It’s social returns. It’s linking companies and issuers with making the world a better place,” said Dropkin.

“That might sound a little cliché, but investors are really looking for this now.”

Watch a replay of the event here, or download a digital version of this report here

To purchase printed copies or a PDF, please email gloria.balbastro@lseg.com