Eni brought its much-awaited inaugural sustainability-linked bond on Monday, becoming the first oil major to raise debt in the format.

Despite the scrutiny that it was under, Eni (Baa1/A–/A–) had no problems generating demand for the landmark €1bn seven-year deal.

A book in excess of €3.1bn enabled bookrunners BNP Paribas, Bank of America, Credit Agricole, Goldman Sachs, JP Morgan, Morgan Stanley and UniCredit to print the bond at 50bp over swaps from IPTs of 75bp area.

That represented a premium of 3bp–5bp based on bankers' estimates. However, according to one lead banker, the emphasis was more on size rather than very tight pricing.

The starting point was described as generous by two bankers away from the deal.

“Starting about 30bp back for a trade like this, which should be getting a lot of attention, is bit cheap,” said one.

The deal was well flagged, with investor meetings beginning on June 2.

The bond incorporates two KPIs and if one or both are missed, the issuer will incur a 25bp coupon step-up.

To avoid the penalty Eni must have 5GW of installed renewable capacity by the end of 2025, from around 300MW at the end of 2020.

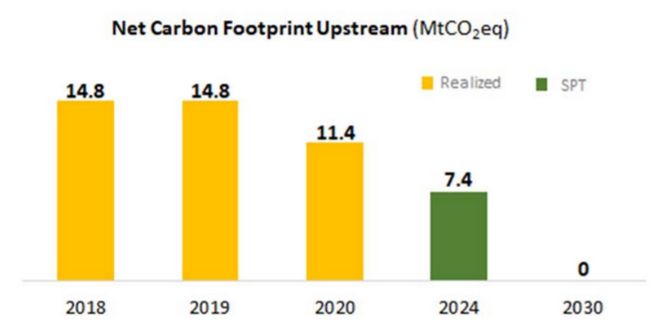

The other KPI requires Eni to reduce the Scope 1 and 2 emissions – those that the company is directly responsible for – in its net carbon footprint of its upstream operations to 7.4m tonnes of CO2-equivalent by the end of 2024 as its sustainability performance target. The company uses 2018 as its baseline, when the figure was 14.8 MMtCO2eq.

The figure for 2019 was the same, but for 2020 it was 11.4 MMtCO2eq. However, several bankers said that SLB issuers have avoided using 2020 as a baseline because emissions figures are often artificially low because of the impact of the Covid-19 pandemic on operations.

When Eni announced its framework it received praise for including Scope 3 emissions which, although indirect, typically account for the majority of a company’s CO2 emissions, in two of its four KPIs. However, it decided not to use these for the new issue. This is at least partially a reflection of the new issue’s maturity, said a second banker involved in the deal.

The observation date for those Scope 3-linked targets is not until 2030, while the new issue matures in 2028.

Investors and bankers away from the transactions have been broadly supportive of Eni’s proactive approach to sustainability and sustainable finance.

“We have had our ESG analysts look over the framework and to us it looks robust,” said a second banker away from the trade. “It goes back to having a good corporate and industrial strategy and it is interesting and impressive that these guys have decided to be the first movers.”

It’s not the company’s first foray into sustainability-linked finance. By the end of 2020 Eni had more than €5bn of sustainability-linked loans and interest rate swaps in place, according to an investor presentation.

Source: Eni