BNP Paribas is doubling down on an ambitious growth strategy to bring greater balance to its equities division, breaking with a decades-old approach of focusing predominantly on the lucrative, but risky, structured derivatives business.

France’s largest investment bank is pushing ahead with its plans to expand in equity flow trading and financing, as it seeks to put last year’s substantial losses from its mainstay activity of structured equity derivatives firmly in the rear-view mirror.

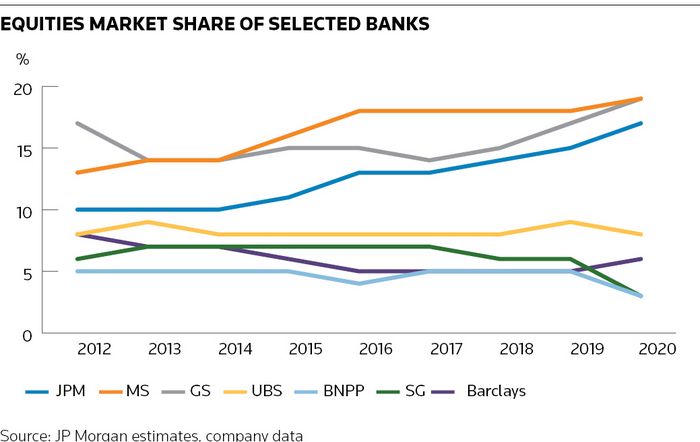

That gambit – which contrasts with cuts at local rivals Societe Generale and Natixis – forms part of a broader move from BNPP to establish itself as the dominant European investment bank in global markets, pitting it against European rivals such as Barclays as well as the US behemoths like JP Morgan and Goldman Sachs that have long dominated these activities.

“We don’t intend to reduce the structured business. We intend to grow the rest,” said Nicolas Marque, global head of equity derivatives at BNPP. “It’s a bold move for the bank. We used to be mostly recognised as an equity derivatives house. We want to maintain our investment and risk appetite there, building in products such as flow and corporate derivatives, while also expanding prime services and adding cash equities. This fully fledged equity ambition will also give us the ultimate opportunity to successfully develop the flow business."

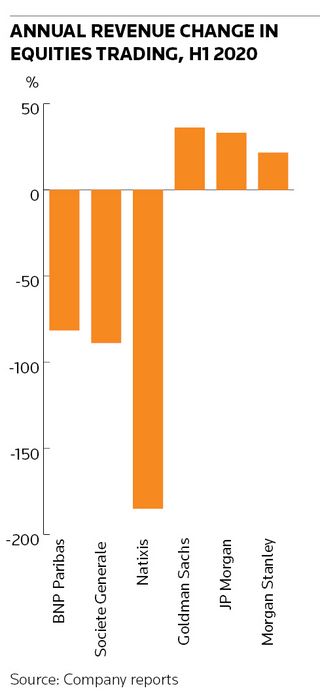

BNPP’s strategy provides a strikingly different solution to a problem facing BNPP, SG and Natixis after they all suffered eye-watering trading losses when stock markets swooned early last year. The trio haemorrhaged money as a result of complex derivative exposures from structured notes sold to wealthy retail investors, traditionally their main source of equities revenues.

In the soul-searching that followed, Natixis outlined plans to exit the most complex products and slash the number of clients it services, while SG said it would cut back its most complex exposures, giving up as much as €250m of annual revenues in the process. By contrast, BNPP is pushing ahead with an audacious strategy to build a full-service equities division.

The scale of the challenge BNPP faces is hard to overstate. Competition is fierce in flow trading and margins are razor-thin. The bank also lacks a natural outpost in the US, the largest market for these activities.

"The flow business is dilutive from a [return on equity] perspective to what they currently have," said Omar Fall, a banking analyst at Barclays. "The returns are lower. To make the economics work on the flow side, you need to be a player of scale."

BNPP has nonetheless deployed serious money to fill the gaps in its coverage and catapult itself up the ranks. In 2019, it agreed to buy Deutsche Bank’s prime services division, which provides financing as well as a gateway to financial markets for hedge funds and similar clients. This year it said it planned to acquire the remaining 50% stake that it does not own in Exane, which specialises in cash equities. It is also hiring senior traders and salespeople from the competition.

Still, acquisitions can take years to pay off and the bank has a lot of ground to make up. BNPP generated US$2.2bn in equities revenues in 2019 before the pandemic hit, compared with US$3.5bn at UBS and US$7.4bn at Goldman.

“BNP Paribas’s plans to develop a full-service equities franchise are ambitious,” said Michael Turner, head of competitor analytics at Greenwich Coalition. “However, this is a journey that should make them more rounded and improve RoE over the cycle. It’s also a very powerful message to clients that they’re the only EU bank at scale left in this business.”

European go-to

The equities expansion is part of a broader pitch from BNPP to become the go-to European investment bank in a world where erstwhile rivals such as Deutsche Bank have retrenched. Over the coming years it is aiming to become the top EU-based equities house, Marque says, and to close the gap with UBS and Barclays in the US.

BNPP has already expanded in fixed income, making gains in credit, interest-rate and foreign-exchange trading. Many of these activities can be capital-intensive, but they also complement BNPP’s broader corporate banking business in services such as debt underwriting. The cross-selling logic behind the equities move is similar, with management eyeing potential gains in mergers and acquisitions and equity underwriting.

To get to that position, though, the bank must shift the centre of gravity in equities away from structured products. That alone will involve a revolution in culture and mindset for a bank that has – until recently at least – focused the majority of its resources on being a leader in this one segment.

“We are very serious about growing flow to diversify our business. But we will do it slowly – it’s not going to be a big bang,” said Marque.

BNPP – like its French rivals – used to be comfortable avoiding the substantial costs involved in running a sprawling equity flow operation focused on trading simple, low-margin products such as stocks, exchange-traded funds, and standardised futures and options. Instead, it spent the past three decades molding its equities division around the business of packaging and selling structured notes to wealthy savers in Europe and Asia.

These activities can be hugely profitable for banks when stock markets are docile, producing returns of around 15% – roughly three times higher than flow trading in a typical year. Structured equity derivatives on average accounted for about 40% of equities revenues at BNPP and SG in 2019, according to Greenwich Coalition, compared with 20% at other large investment banks.

But the pandemic-fuelled equity sell-off in 2020 changed those calculations, laying bare how damaging it was to be heavily reliant on this one, complex business. While losses mounted in the exotics books at BNPP and others, the giant US banks were enjoying a flow bonanza as investors transacted colossal volumes to switch up equity positions. Morgan Stanley recorded nearly US$10bn in equities revenues last year, almost seven times more than BNPP.

“French banks that were exposed to structured products underperformed last year. That doesn’t mean they are bad products. It means you need to find the right balance between structured and flow,” said Olivier Osty, global head of markets at BNPP. “Maintaining structured products while developing flow gives us a stronger bank with a business mix that can perform both during volatile times and when markets are slower.”

Structured heritage

BNPP’s plan to keep the faith with exotic equity derivatives (although with some notable changes – see Box story) recalls its decision in the aftermath of the 2008 financial crisis when it lost nearly €2bn from such instruments. If anything, BNPP leaned more heavily into these activities in the following years, buying structured products books totalling tens of billions of euros as rivals such as Credit Agricole, ING, Macquarie and RBS headed for the exits.

The post-crisis regulatory framework – including beefed-up capital rules – made the high margins on offer in the structured business look even more appealing compared to flow. Heritage undoubtedly played a role too. BNPP had come to define itself as a structured house – and equity derivatives was the jewel in its crown. Yann Gerardin, head of corporate and institutional banking and a potential successor to chief executive Jean-Laurent Bonnafe, created BNPP’s equity derivatives business in 1987. Osty is also an equities veteran.

Still, it was the heft of BNPP’s far larger fixed-income unit that cushioned the blow of last year’s equities losses and enabled the bank to go all-in on its equities transformation. Global market revenues actually increased 23% to €3.6bn in the first half of 2020, despite equities contributing just €203m.

By contrast, SG’s markets revenues slumped 38% to €1.5bn, an indication of how skewed the bank’s trading unit had become towards structured products. That dynamic ultimately forced SG to cut back the most complex of these exposures and redesign its product set. Even so, there are already tentative signs of a turnaround in that business after SG reported a strong first quarter in equities. That came against the backdrop of favourable market conditions, which also allowed the bank to complete its de-risking ahead of schedule.

Flow time

BNPP currently derives around a quarter of its equities revenues from flow trading. That compares to about 45% at other banks, according to Greenwich Coalition. Meanwhile, the US accounted for about 10% of its equity derivatives revenues in 2018 and 2019, BNPP said. That compares to about 40% elsewhere.

Marque says BNPP wants to grow flow trading to about a third of its equities revenues over the coming years.

“We have been punching below our weight in flow,” said Emmanuel Dray, global head of equity derivative flow sales at the bank. "We know where we want to grow and how we want to do it.”

BNPP already specialises in some areas of flow such as dividend futures, along with activities where it can recycle risks from its structured products business like “dispersion”, when traders bet on stocks moving in different directions.

It has not always been smooth sailing, though, with poor management of some S&P 500 options positions causing heavy losses in late 2018. One-off incidents aside, BNPP has struggled to do enough business with some important segments of the client universe, including long-short equity hedge funds and asset managers.

Primed to go

That is why senior management believes the Deutsche prime services acquisition is so transformative, bringing along with it the electronic execution capabilities that fast-trading firms such as quant funds prioritise.

Prime services form a crucial pillar in US banks’ equity units, accounting for roughly 40% of revenues. The returns can be impressive too – around 20%, BNPP has said. Crucially, financing hedge funds also tends to give banks an edge in securing a greater share of their trading volumes.

“Buying Deutsche’s prime business and the technology that comes with it really upgrades the bank’s capabilities in this space,” said Ashley Wilson, global head of prime services at BNPP. “It’s a scalable, stable platform that can handle extremely high volume. When you add in all the clients that come along with it and the ‘halo’ effect on trading, then you have a highly attractive business.”

Of course, prime brokerage comes with risks too, as the collapse of Archegos Capital Management in late March showed after it inflicted losses of over US$10bn across a number of banks. Some analysts suggest that episode could dampen appetite for this business.

“The jury is still out from investors on the benefits of the Deutsche Bank acquisition [for BNPP],” said Barclays' Fall. “Management initially said it would add €400m in revenues, but when they will get there is unclear. We also don’t know how many of the original clients stayed, or how the Archegos event plays into that in terms of broader risk appetite for prime brokerage or market share gains.”

Kieron Smith, deputy head of prime solutions and financing at BNPP, said the bank was on track to bring over the remaining client balances from Deutsche by the end of 2021. He also said BNPP had already seen strong benefits of the “halo” effect on increasing business elsewhere even earlier than first envisaged. Clients see BNPP "is clearly very committed to this space," he added.

Certainly, some clients like what they see so far. “BNP’s balance sheet combined with Deutsche Bank’s global financing expertise and platform technology complement one another well,” said Louis Messina, head of portfolio finance at Sculptor Capital Management, the New York-based hedge fund with US$37bn in assets under management. “The combination should create a stronger participant in the prime brokerage ecosystem, which is beneficial for all participants.”

Meanwhile, BNPP executives say the fact that both BNPP and Deutsche escaped unscathed from the Archegos debacle has put the bank in a good position to take advantage of competitors pulling back.

“We have not lost a client in the transition. In fact, because we came out of [Archegos] with zero losses, we’ve seen a significant move in client balances to the business we’re building,” said Wilson. “People value a bank with strong risk management. Once the transition is completed, we expect to be bigger than BNPP and DB were combined, historically.”

Slowly does it

BNPP’s move to purchase the remaining 50% stake in Exane is targeting another crucial client segment – asset managers – while also helping with long-short equity hedge funds. Management sees Exane’s extensive research coverage of stocks in key markets such as the UK, US and EU as a vital way to engage with clients.

“Today, we are not publishing equity derivatives research on single stocks. With Exane we will be able to leverage their analysis and enrich our equity derivatives strategy. It will also help our traders facilitate the flow business on a fundamental story," said Dray.

That is because Exane’s research should arm BNPP’s own traders with company-specific information to trade these shares more aggressively.

Building credibility as a full-service equities house is already helping BNPP recruit senior traders and salespeople to help grow these operations, BNPP people say.

Elsewhere, BNPP is also making a concerted push in corporate equity derivatives – a business centred around providing financing and hedges on large, concentrated equity stakes.

Still, the structured products business was instrumental in helping BNPP produce its best first-quarter results in equities since 2015, with growth in prime services also contributing. Marque emphasises BNPP’s equities expansion will be gradual, not least because it lacks a homegrown platform in the US.

“We want to be seen as the number one European bank in equities," said Marque. "We won’t be as strong as the US banks on pure flow, but we will be credible in this business while having this flavour of being a structured house. That could be a fantastic combination and a door-opener to many clients."

Structured review

BNP Paribas announced a €184m loss last year after many companies cancelled dividends in response to the pandemic. But the hit to BNPP’s equities division was in reality far larger, as soaring volatility and correlation devastated structured products books. BNPP’s equities revenues clocked in at €203m in the first half of 2020, roughly a seventh the size of the €1.4bn it pulled in during the same period in 2018.

Executives have maintained they have no plans to pull back here. But behind the scenes, BNPP has made some notable changes, bringing in Olivier Renart (formerly the bank’s head of credit trading) to lead equity derivatives trading.

It has become more conservative, opting to place rolling hedges for its structured products book in the form of equity put-options to counteract volatile markets. This lowers the level of returns in this business, but it would have reduced BNPP’s losses in market sell-offs, such as the one that occurred in March 2020, by up to 50%.

BNPP is also pushing to diversify its mix of structured products. That will mean fewer based on the performance of heavily favoured sectors such as European bank stocks – a popular strategy that proved particularly costly when lenders slashed dividends in 2020. Instead, it is looking to do more products based on US companies as well as custom-built indices that can remove the risk around dividends.

“We’ve adapted our set-up to draw lessons from the crisis,” said Marque. “We have enhanced our risk management framework and have pushed to diversify the underlyings”.