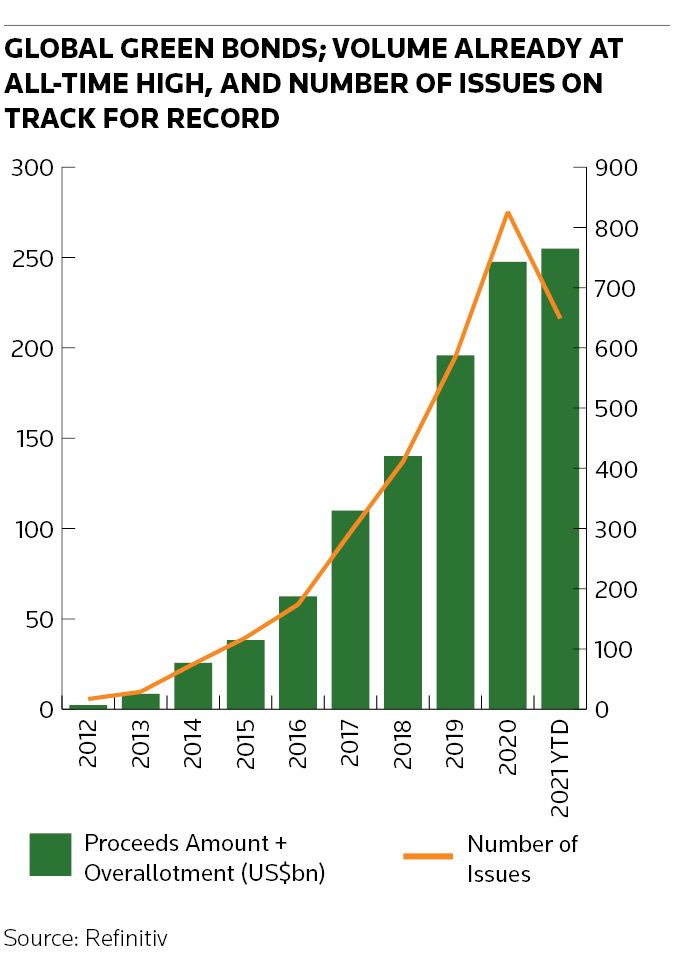

Global green bond issuance this year has passed 2020’s full-year volume of US$247.5bn to set a new annual record before the first half ends, according to Refinitiv data, as China and the US compete for the title of most active market.

Volume of US$255bn for 2021 is more than three times higher than US$83.2bn at the same point last year when green bonds took a back seat to a wave of social bond issuance as the world responded to the Covid-19 pandemic.

Green bond volume has rebounded strongly in the first six months of 2021 as governments and companies continue to focus on a green recovery, and investor demand remains strong, supported by Europe’s new Sustainable Finance Disclosure Regulation that aims to redirect capital flows to sustainable finance.

The number of green bonds issued has more than doubled to 650 in 2021 so far, compared with 301 in H1 2020, and accounts for just over half (50.4%) of the US$506.86bn of ESG bonds issued this year, up from 43.9% a year earlier.

“We see an unprecedented momentum in global sustainable finance,” said Joerg Eigendorf, head of communications, social responsibility and sustainability at Deutsche Bank. “After a record year in 2020, we are on track to set a new record in 2021. Green financing continues to be the largest share.”

This acceleration is most pronounced in Europe, where US$154bn of green bonds has been issued, nearly three times higher than the US$52.9bn at the same point last year – even before green bond issuance starts under the €800bn NextGenerationEU programme.

Around €250bn of green bonds will be issued in 2021–2026 under the NGEU programme, which is designed to manage Europe’s recovery through green and digital transition. A conventional €20bn bond was issued on June 15 and green issuance is expected to start in late summer or early autumn when a financing framework has been completed.

The level of issuance could require forecasts to be revised, as investor demand shows no sign of slowing despite the rise in volume, which is creating a more attractive green premium over conventional debt.

ESG specialist NN Investment Partners revised its green bond forecast after a busy first quarter. The firm said in March that green bond issuance could increase by 50% to €400bn in 2021 from last year. That would put total outstanding green bonds at more than €1trn, and set the market on track to grow to €2trn by the end of 2023.

“Overall the trend is clear, the demand and supply of ESG financing are fundamentally changing and reaching unprecedented levels,” Eigendorf said. “I think it will go faster than we all think and that ESG will be the new normal.”

China vs US

While Europe continues to dominate regionally, China and the US are vying for dominance as the most active market and are outpacing Germany and France as the end of the second quarter looms.

China is marginally ahead of the US with US$33.78bn of transactions and 136 deals giving a 13.2% market share, compared with the US volume of US$32.76bn and 53 deals, which gives it a 12.8% market share.

Germany is in third place with US$31.09bn, 49 deals and a 12.2% market share, followed by France with US$27.92bn and 26 deals, giving a 10.9% market share. France has dropped from first position at this point last year, when it had US$11.14bn of volume.

Year-to-date green bond volume in Asia of US$56.7bn is more than three times higher than the US$15.04bn in 2020, and US$38.95bn of green bond issuance this year in the Americas is nearly three times higher than US$15.25bn last year.

Despite its ambition to be a green leader in the run up to the UN’s COP 26 climate conference in Glasgow in November, the UK is in 13th place with volume of US$6.58bn and 11 deals, down from ninth at the same time last year with volume of US$3.4bn.

Updates throughout