Consumer lender Santander on Wednesday priced the biggest-ever dollar sub-prime auto loan securitization, signaling continued investor demand for this type of ABS paper even with historic tight spreads.

The US$2.5bn transaction, Santander Drive Auto Receivables Trust 2021-3, was upsized from US$1.75bn to accommodate heavy early orders, market sources said. Barclays, Deutsche Bank and Wells Fargo were the joint lead underwriters.

The six offered tranches were oversubscribed, with some roughly twice oversubscribed, even after the offering was enlarged, a source familiar with the deal said.

The money market and Triple A rated tranches priced at the tight end or inside their price guidance, while the lower-rated notes cleared 5bp inside their guided ranges. Their spreads were in line with the two SDART issues priced earlier this year.

SDART 2021-3's biggest tranche was a US$746.94m Triple A rated Class "A-2" note, which carried a 0.65 year weighted-average life. It priced at 15bp over EDSF, which was tighter than the 16bp-18bp guided range.

Robust car demand and near record high used-vehicle prices have kept sub-prime auto delinquencies and defaults near record lows. Sub-prime auto ABS have relatively wider spreads versus prime auto paper and that has buttressed demand, analysts and investors said.

Sub-prime auto delinquencies ticked up to 2.78% in June from 2.54% in May, but down from 3.74% a year earlier. Sub-prime auto losses grew to 2.56% in June from 2.28% the month before, but they were down from 6.49% a year ago, according to Barclays.

While vehicle sales and used car prices have cooled from their recent peaks, they are still running much higher than their pandemic lows last year. The widely-followed Manheim used vehicle index dipped to 200.4 at the end of June, which is down 1.3% from its record high, but is still up 34% from a year-ago.

"We expect used vehicle prices to level off somewhat through year-end, but remain at a high level due to the lack of supply of late model used vehicles and the ongoing global semiconductor shortage impacting new vehicle production," Deutsche Bank analysts wrote in a research note on Tuesday.

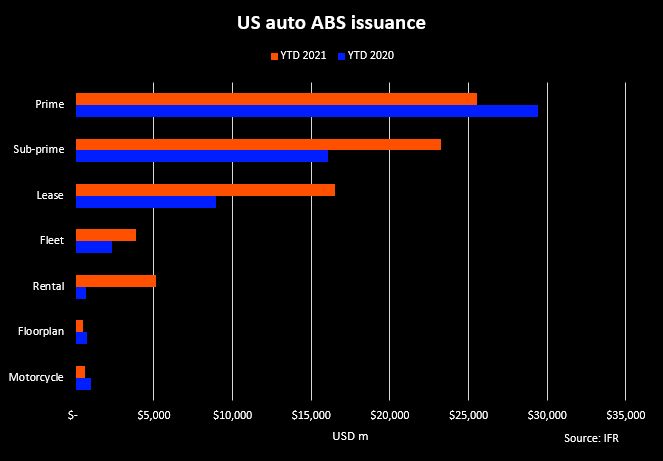

The Santander deal pushed this week's auto issuance to nearly US$6.3bn. It also increased year-to-date sub-prime auto issuance to over US$23bn, surpassing the US$16bn during the same period in 2020, according to IFR.