Peru sovereign bonds recovered in secondary trading on Monday following the confirmation of former World Bank economist Pedro Francke as the country's new finance minister, but expected tensions between the moderate left minister and the country's far left executive continue to drive concerns.

There was turbulence in the bond market on the first days of President Pedro Castillo's new administration after his appointment last Thursday of Guido Bellido, a far-left member of his Peru Libre party, as prime minister.

Peruvian bonds slumped on Friday after Bellido was named. There was further pressure on the bonds when Francke, who was widely expected to be sworn in as finance minister last Thursday along with other ministers, abruptly left the swearing-in ceremony, sparking concerns among investors he had rejected the post and that Castillo was backpedaling the moderate stance he had adopted in recent weeks.

However, the moderate left Francke was confirmed as the country's new finance minister late on Friday evening, sparking a recovery in bond prices on Monday.

The country's 2.392% 2026 bond traded at a price of 103.22 on Monday afternoon, up from Friday afternoon's 102.40 price, according to MarketAxess.

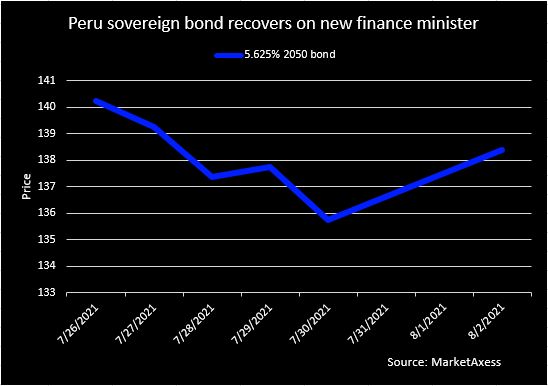

Similarly, its sovereign 5.625% 2050 changed hands at a price of 138.40 Monday afternoon, around three points higher than levels of 135.76 on Friday. Its 8.75% 2033 was also up Monday by nearly two points at 157.11 from 155.75 on Friday, the MarketAxess data showed.

The 2026, 2050 and 2033 dollar bonds had traded as much as two points lower on Friday from the previous trading day.

Secondary pressure

While Peru's bonds recovered from Friday's sell-off, they are still trading lower compared to mid-July, before President Pedro Castillo was inaugurated on July 28.

Some market participants remain wary that Francke, considered a moderate left appointment, will run into tensions with the new president, who ran on a far left economic platform.

Castillo's Peru Libre party outlined plans to redraft the country's constitution, including economic sections that protect free market principles and macroeconomics policy. Castillo has also said that he will increase the state's role in business, changing or annulling concessions, and nationalize strategic sectors.

"My view is the fireworks aren’t over yet. You have a very radical left wing government, surrounded by very radical people," said Aaron Gifford, an emerging market sovereign credit analyst at T. Rowe Price.

Bellido is currently being investigated by local authorities after he made comments defending the Shining Path terrorist group in an interview with local media. Members of the Peruvian Congress have also said they would not back Bellido's appointment.

"The alternative [to Francke] would’ve been much [worse], i.e someone closer to Bellido and Cerron. So the relief rally is what you would expect," said a UK-based investor.

Francke, who was President Castillo's economic advisor in the past few months, has adopted a more moderate tone with investors in recent weeks.

Shamaila Khan, director of emerging market strategies at AllianceBernstein, described Francke's conversations with investors as "constructive" and "very reasonable".

"Our view has been that it’s going to be very difficult to make radical changes, regardless of ideology given the fact that the president doesn’t have majority in congress," said Khan. "There are going to be institutional constraints to making any kind of important change to the laws of the country."

Still, tensions are expected between Francke and Castillo, said Gifford.

"I’m not convinced that Francke has a full mandate to govern right now on the economic and fiscal front," he said.

"I think its worth reducing underweight positions, not necessarily going into overweight territory because I do think there are a lot of unanswered questions. This is going to be a long, volatile political process with clashes between the legislature and the executive," he added.

Peru's economy has been deeply impacted by the Covid-19 pandemic, contracting by as much as 11.1%, according to the World Bank with unemployment and poverty levels rising last year.

Despite the head winds, Peru is considered one of the region's more stable economies with low leverage levels and strong reserves.

The Peruvian ministry of economy and finance did not respond to a request for comment.

Updated story: Adds graph, recasts headline