Combined ESG-labelled bond and loan issuance in 2021 is rapidly approaching the major milestone of US$1trn and its percentage share of the overall market is rising as investors take a tougher line with companies that are not yet raising sustainable debt.

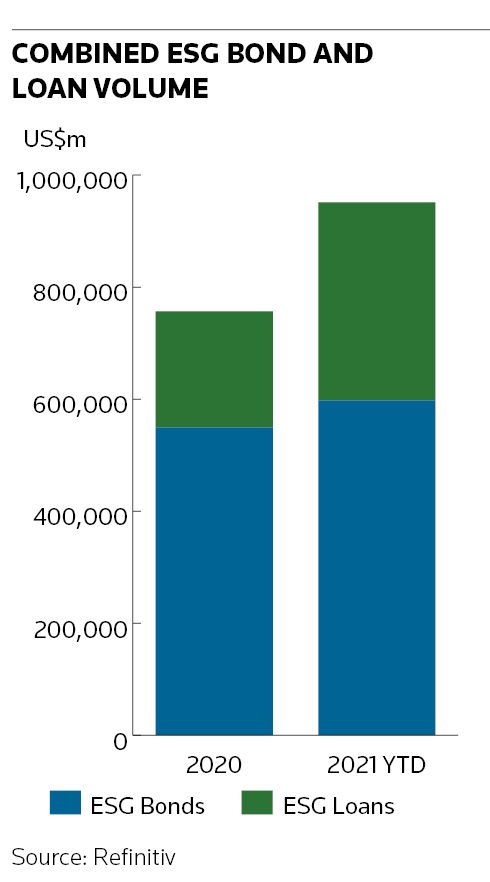

Year-to-date ESG bond and loan issuance totals US$951.5bn (US$598bn of bonds and US$353.5bn of loans) after comfortably exceeding full-year 2020 totals of US$756.6bn at the half-year point, according to Refinitiv data.

Combined ESG volume is expected to pass the US$1trn landmark in August.

"US$1trn of combined ESG bond and loan issuance is very significant. If you are not participating in the ESG capital markets in some way, your absence begins to make a statement," said Marilyn Ceci, global head of ESG DCM at JP Morgan.

ESG bond and loan issuance now accounts for 10.6% of all issuance and has nearly doubled from 5.4% in 2020 amid a change in tone from investors who are taking a dim view of companies that are not at least exploring ESG financing.

"The question of ‘why should I participate?’ has now shifted to investors asking ‘why are you not?'," Ceci said.

ESG bonds account for 9.7% of all bond issuance, up from 5.3% last year, and ESG loans now make up 12.5% of all loan volume, up from 5.7% last year.

Just the start

Bankers feel there is much more to come. "In the scheme of things, US$1trn seems to be just a start, which might indicate a structural change of the market," said Armin Peter, global head of debt syndicate at UBS.

The scene is also set for a blockbusting end to the year with an anticipated surge in volume timed to coincide with the UN’s COP26 climate meeting in Glasgow in November as corporates vie to bag the limelight amid a flurry of ESG announcements.

Ceci believes ESG bond issuance on its own could top US$1trn by the end of the year. "US$1trn is eye-catching without a doubt and optically a very important number for loans and bonds, but combined ESG-labelled bonds will hit a trillion dollars alone by the end of the year," she said.

Moody's is similarly bullish. It is forecasting around US$850bn of issuance in green, social and sustainability bonds this year, excluding sustainability-linked bonds.

Investor appetite shows no signs of slowing, although leading ESG investors are wary about possible quality issues amid the surge in volume.

"There will be a lot more growth in labelled bonds, but investors really have to dig into the detail," said Scott Freedman, a fixed-income portfolio manager at Newton Investment Management.

Busy year-end

Sustainability-linked debt in both loan and bond formats is the key driver of volume as "hard-to-abate" sectors tap the market to maintain or establish a presence and demonstrate the credibility of their transition plans to stakeholders. The sustainability-linked loan market has seen a sharp increase in issuance in 2021 as a result, while the SLB format continues to take centre stage.

"The sharpest increase in volume is now coming from the SLB format. 2020 was the year of social bonds from agencies and supranationals, it looks like 2021 is more the year of the SLB," said Thibaut Cuilliere, head of real asset research at Natixis.

Since the end of the first half, the ESG loan and bond markets are seeing more ESG-labelled high-yield deals in both green and sustainability-linked formats and that is expected to continue.

Sovereign issuance outside Europe is increasing, too. ESG securitised products are also picking up from a relatively low base and are expected to accelerate in the fourth quarter.

Much of the increase in ESG debt markets is due to an upturn in activity in the US, including from the influential tech sector. Some participants describe the market as being at "fever pitch" as it awaits the results of the SEC’s consultation on increased ESG disclosure for US companies.

"There's no question, the US has had a sea change in the ESG capital markets. Engagement has been robust in Europe for quite some time, we're now at that tipping point in the US," Ceci said.

Many US companies view SLLs as an entry-level instrument before tapping the ESG bond markets, and some are in such a hurry that they are asking lenders to sign “agree to agree” deals where KPI targets will be added later via ESG amendments as they buy time to get broader corporate-level targets in place.

"One can certainly say that ESG is not a niche product or trend, the question is more whether this is the new normal," Peter said.