US swap execution facilities increased their share of euro swaps trading volumes in the second quarter of the year in a further confirmation of how the US has become the main beneficiary of a post-Brexit regulatory impasse between Brussels and London.

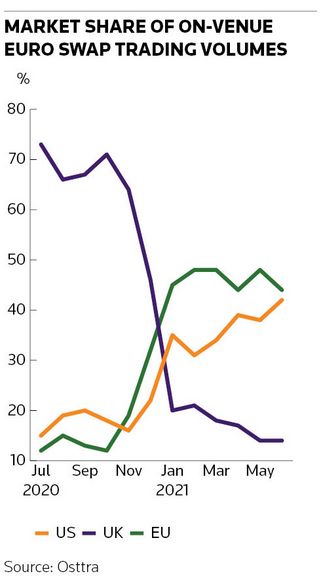

US SEFs accounted for 42% of on-venue euro interest-rate swap volumes at the end of June, according to post-trade firm Osttra, up from 34% at the end of March and now rivalling EU venues as the top trading hub for such activity.

That came amid a continued slump in euro swap volumes on UK venues to 14% – down from 73% in mid-2020 – as well as a small second-quarter decline in market share for EU venues to 44%.

“After the dramatic moves in late 2020 and early 2021, we have seen additional movement of euro swap trading activity from the UK to US venues in the second quarter of the year,” said Kirston Winters, head of legal, risk, compliance and government and regulatory affairs at Osttra, which is jointly owned by CME Group and IHS Markit.

The post-Brexit “shifts in market share have created a more geographically fragmented market in [euro and sterling interest-rate swaps] and a more geographically concentrated market in [US dollar swaps] on SEFs,” he added.

The EU’s refusal to recognise the UK’s financial regulatory regime for swaps trading as equivalent, even though it is largely identical in practice, has triggered what may well be the largest migration of derivatives trading in history as trillions of dollars worth of swaps activity has left London.

EU-based firms haven’t been able to transact standardised swaps subject to the so-called derivatives trading obligation on UK venues, and vice versa, since the start of the year. Instead, EU and UK-based firms can only trade on local venues or in countries with which equivalence agreements have been struck, such as the US.

EU venues have subsequently grabbed a substantial share of the euro swaps trading activity that previously resided in the UK – a long-held goal of EU leaders.

US gains

But the US looks to have gained the most from the regulatory standoff, increasing its market share significantly in euro, sterling and US dollar interest-rate swaps. In euros alone, the US has nearly tripled its market share of on-venue activity since mid-2020, Osttra data show.

A migration of interdealer trading has driven the majority of that shift, with the UK’s share of such euro swap activity collapsing from 50% in mid-2020 to below 10% in June. But the US has also grown dealer-to-client euro swap activity and has even risen above the EU in this part of the market with a 17% share in June.

Elsewhere, the latest Osttra data laid bare once more how the standoff over regulatory equivalence has cut off EU banks from a meaningful portion of trading activity still occurring on UK venues. That is because regulators on both sides of the English Channel require foreign banks to establish fully capitalised subsidiaries in their jurisdictions if they want to connect to local trading venues.

Those – like BNP Paribas, Deutsche Bank and Societe Generale – that don't have fully capitalised UK subsidiaries haven't been able to access UK derivatives venues this year. By contrast, most major UK banks have established EU subsidiaries, allowing them to trade on local venues.

As a result, the 14% of on-venue euro swaps trading still occurring in the UK is currently out of reach of EU banks – as is the meaningful portion of sterling and (to a lesser extent) US dollar swap trading that resides there.

“Market share is one aspect of this story, market access is the other,” said Winters.