Deutsche Bank has materially increased its market share in trading of simpler “flow” fixed-income products over the past two years, marking a dramatic reversal for a part of the investment bank that Christian Sewing cut back shortly after he took over as chief executive in 2018.

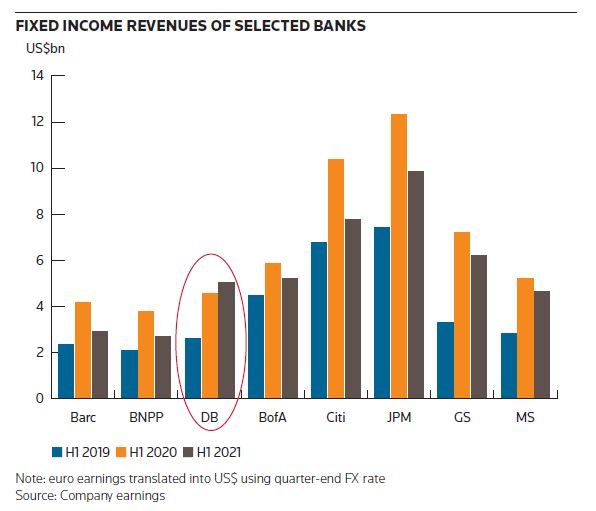

The German lender was the only major investment bank to grow its fixed income revenues on an annual basis in the first six months of the year following a bumper period for bond-trading businesses in 2020’s volatile markets.

Deutsche’s roughly US$5.1bn in H1 debt and currency trading revenues were nearly double the level it recorded over the same period in 2019 and gave the bank the third largest share of these markets in the first six months of the year, according to Coalition Greenwich.

Trading in flow products such as government bonds and derivatives has fuelled an important part of that growth, executives and analysts say, helping DB reassert itself as a major player in fixed income following several years of retrenchment.

“We want to run a really strong flow franchise driven by good leadership, good risk discipline, strong technology and a key client focus," said Ram Nayak, global head of fixed income and currencies at Deutsche.

“The bulk of the improvement was fundamentally intrinsic to what we do. We’ve taken huge market share in the past 12 months. I don’t expect that to continue at the same pace, but we believe these gains are sustainable.”

The bank's markets division has shrunk dramatically since its heyday around a decade ago, largely as a result of Sewing’s decision to pull out of equities in 2019. But the bank had also been losing market share in flow fixed income for a number of years when Sewing took over, prompting management to shift resources to other areas where it still saw DB as a market leader, such as foreign exchange trading and structured credit.

That has made the resurgence of the erstwhile “flow monster” (a moniker favoured under the leadership of former executives such as Anshu Jain, but since discarded) all the more surprising. It has also complicated the expansion plans of rivals such as Barclays, BNP Paribas and Morgan Stanley – all of which have designs on grabbing a larger share of these markets.

Tailwinds

DB has had some good fortune in its fixed-income rebuild coinciding with the best year for flow-trading businesses in a decade in 2020. There have been some tailwinds this year too, such as marking up credit writedowns from the pandemic and, more notably, a €300m gain from distressed debt and equity positions on Israel’s Zim Shipping Lines.

But Nayak says the revenue expansion extends beyond such one-off events and that a significant proportion of it is sustainable given the changes the bank has made, including significant cost reductions across the business. In that sense, DB has consigned the flow monster approach – trading as much as possible with scant regard for costs – to the history books.

“We’re expanding these businesses without using incremental capital or balance sheet – our cost base has continued to come down in fixed income," Nayak said.

DB has said it plans to grow overall fixed-income and currencies revenues to about €6.7bn in 2022, a 22% increase from 2019 that would see DB start to challenge the handful of US banks that dominate this space.

So far, its “focused approach is yielding results”, JP Morgan strategists wrote in a June report, while noting the “key debate” remains around the fixed-income revenue run-rate “in a normalised environment”.

The bank will also need to “defend [its] share from better-placed US peers” – and European banks such as Barclays and BNPP, they added.

"It’s true DB is bouncing back very quickly in fixed income,” said a senior banker at another firm. “But it’s difficult to see how [it] can become relevant as a global player without having an equities business.”

Calling card

Flow trading used to be a calling card for Deutsche Bank, helping to propel it into the top-tier of fixed-income trading houses in the world behind only JP Morgan in 2011, according to Coalition Greenwich. Jain, who ran the investment bank and became co-CEO in 2012, seemed determined to maintain the bank’s flow monster model despite a costly post-crisis regulatory framework that had prompted rethinks at European rivals such as Credit Suisse and UBS.

But the business lost ground over the coming years as those costs came to bite, while creaking technology and a series of missteps – including some large regulatory fines – further hampered the bank's progress.

By mid-2018, around the time Sewing took over, DB had slipped below Bank of America, Citi and Goldman Sachs in fixed-income revenues, Coalition Greenwich said. Return-sapping flow businesses seemed ripe to cut back and Sewing duly singled out the US rates business as one high-profile casualty.

The markets unit became heavily slanted towards trading and financing complex and illiquid credit, a business that accounted for well over half of its markets revenues in 2019.

“As a firm, we were a bit distracted and took our eyes off the ball in the flow business, while remaining extremely solid in the structured business,” said Nayak. “The flow business model had moved on and we hadn’t.”

Cost-cutter

A drastic reduction in costs played an important role in boosting profitability across the division. That included a more than 10% reduction in front-office headcount from mid-2019 to late 2020.

There was a root-and-branch overhaul of DB’s clunky technology systems to bring rates, credit and FX all onto the same trading and risk management platform. Technology and infrastructure changes alone will yield €450m in annual savings, the bank has said.

“Moving everything onto a common, shared platform is much cheaper because you’re running just one platform instead of four. You can put the resources back into the businesses and your P&L growth is then exponential," Nayak said.

That comes on top of annual savings that are expected to reach €320m stemming from improvements to its funding model, a significant expense for the long-dated rates business in particular.

Elsewhere, DB worked on increasing its client-led business, driving revenues with its top 100 institutional clients 42% higher, Nayak said last December. It also revamped its trading and sales teams with a number of important hires. Taken together, these moves were pivotal to reinvigorating the flow rates business in particular, a former cash cow that had become a serious drag on returns in the Basel III era.

The once-in-a-decade trading bonanza of 2020 – when bond yields whipsawed and trading volumes ballooned as investors reacted to the pandemic – served to turbo-charge these expansion plans.

But even outside of such one-offs, DB believes it has made lasting inroads in businesses such as European government bond trading (where it had previously fallen out of the top 10 firms) following a coordinated push with its debt underwriting unit. Nayak said last December that DB's improved market share had added €200m in annual European rates trading revenues compared with 2019.

Notable hires of late include Alok Modi from Morgan Stanley as a senior rates trader in Europe and Chris Leonard from Barclays to continue to rebuild US rates sales and trading – an apparent reversal of Sewing's 2018 announcement. DB is also preparing to shift its US swaps business, which had been run from Europe, back to the US.

Credit flow

The build-out in flow credit has been slower, but the intent seems to be the same. Manav Gupta joined from Goldman in mid-2019 to lead those efforts and has since brought on board 23 traders and salespeople to beef up its presence across a range of areas, starting with euro investment-grade bonds, sterling, high-yield and more recently derivatives and the US flow business.

“DB has long been the best place to underwrite credit risk to maturity, but previously was not so good at underwriting credit risk for the short term – we didn’t have that flow mentality," said Gupta, who heads credit flow trading. "We needed to get in the flows with the big clients to get good at market technicals rather than just fundamentals.”

The bank has already recommenced trading in products that it dropped several years ago, such as single-name credit default swaps, and is looking to add total return swaps on iBoxx indices, CDS tranches and build out fixed-income ETFs. It is also looking to catch up in algorithmic execution and portfolio trading – an area that was hugely profitable last year for some banks.

“We have been building out in a very systematic way over the past two years to get all the products in place. We’re already hitting our return hurdles," said Gupta. "The commitment and risk appetite from the firm to continue investing and rebuild the flow business is there.”