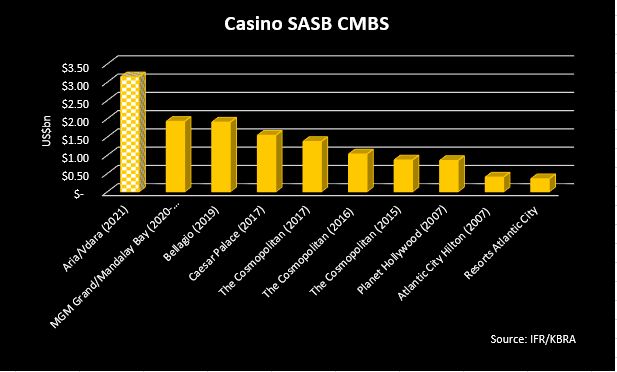

A group of banks is arranging the sale of the largest-ever casino CMBS, which is backed by a loan to fund Blackstone's US$3.89bn acquisition of the Aria and Vdara hotels in Las Vegas from MGM Resorts in July.

The US$3.15bn BX Trust 2021-ARIA is being led by JP Morgan, Citigroup, Morgan Stanley and Wells Fargo and is expected to price on October 13. The offering is being shown to investors at the SFVegas 2021 conference, which is taking place at the Aria through Wednesday, market sources said.

The multi-part blockbuster CMBS surpasses two other securitizations that involved the private equity giant acquiring three properties on the Vegas Strip from MGM and leasing them back to the casino operator.

Blackstone raised US$1.91bn from BX Trust 2019-OC11, that funded its US$3.10bn transaction on the Bellagio Las Vegas hotel and casino in December 2019. It has also been securitizing a US$3bn loan for its US$4.6bn acquisition of MGM Grand and Mandalay Bay. Just last month, a bank syndicate priced a US$107.7m chunk of that loan, BX Commercial Mortgage Trust 2021-VIV5. The rest of the MGM-Mandalay loan, about US$968m, is expected to be divided into collateral pools for future conduit deals, according to Moody's.

Blackstone may bring possibly an even bigger Vegas casino deal by year-end. Last week, a Blackstone real estate arm sold The Cosmopolitan to a group comprised of Blackstone's REIT, private equity firm Stonepeak Partners and the Cherng Family Trust – the family office of Andrew Cherng who co-founded restaurant chain Panda Express, for US$5.65bn.

A major difference between the Aria-Vdara deal and the Bellagio and MGM-Mandalay issues is the first one has a floating-rate structure and the other two are longer-dated fixed-rate bonds, which CMBS investors have been hesitant to buy amid concerns about rising inflation.

Early price talk on the biggest tranche, a US$832.3m Triple A rated "A" note, is in the 90bp area over one-month Libor based on an initial weighted-average life of 1.96 years and in the 95bp area based on an extended WAL of 4.96 years.

The mega casino issue arrives in the wake of several successful hotel CMBS in recent days, signaling increased investor willingness to fund lodging properties that are slowly recovering from the pandemic.

On Monday, Goldman Sachs and Bank of America priced a US$1.8bn SASB, LUXE Trust 2021-TRIP, which refinanced nine luxury hotels in North America owned by Strategic Hotels & Resorts. A US$652.6m Triple A rated "A" tranche with a 2.99-year initial WAL and 4.99-year maximum WAL of 4.99 years cleared at Libor plus 105bp.

"The hotel recovery post Covid has been robust but uneven," Deutsche Bank analysts wrote in a research note on Monday. Budget and resort properties including high-end casinos have done the best, outperforming hotels in big cities which are struggling due to the lack of business travelers, they added.

Still, delinquencies on hotels have remained the highest among major commercial property types. The 30-plus day delinquency rate on hotel loans was 11.45% in September, down from 12.05% in August. In contrast, the 30-plus day delinquency rate on industrial properties was 0.59% last month, down fro 0.63% the month before, according to Trepp.