Banks are ramping up efforts to provide new financial products and services in the nascent – and still controversial – market for offsetting carbon emissions amid rapid growth that could create billions of dollars in trading revenues while also helping lenders to reduce their own carbon footprint.

The market for voluntary carbon offsets is on track to double in size to around US$1bn this year, according to Standard Chartered, as a growing number of companies and investors choose to buy these products to help lower their own emissions. Bank of America, BNP Paribas and JP Morgan are among the banks jostling for position in this fledgling market amid expectations it could mushroom to around US$50bn by 2030.

But these activities are also fraught with risks for the banks and companies involved. The breakneck speed of expansion comes against the backdrop of a highly fragmented market lacking a common, robust set of standards for de-carbonisation projects. Accusations of greenwashing are rife – as are questions surrounding the effectiveness of many of the emissions-reducing products that banks are looking to package and sell.

“The voluntary market has the potential to grow exponentially – to multiply by five times next year and probably more in the upcoming few years,” said Constance Chalchat, chief sustainability officer in BNP Paribas’s global markets group. “What's going to be extremely important is to be careful that the projects are real projects that have been carefully vetted.”

“There's a fine line between projects having a real impact on the market and incentivising low-carbon and carbon-positive projects versus greenwashing."

Energy companies and other high-polluting sectors have had to use regulated (or mandatory) markets, such as the European Union’s Emissions Trading System, to reduce their carbon footprint for years. But regulated markets and carbon taxes cover less than a quarter of global greenhouse gas emissions, according to BofA research, leaving significant room for the voluntary offset market to expand as more companies look to reduce emissions of their own accord.

Nearly 60% of S&P 500 companies have now committed to reduce carbon emissions, including 11% with a net-zero target, according to BofA.

Voluntary offsets allow companies to do that through buying credits generated by projects that reduce or remove carbon emissions, such as planting new trees, developing wetlands or technological innovations involving carbon capture. Once purchased, the company must “retire” the credit to reduce its emissions so the offset can’t be reused.

Licence to pollute?

But offsetting remains controversial. Environmental activists argue it discourages companies from taking meaningful steps to reduce their own emissions and raise questions over the effectiveness of individual carbon-reduction projects in the context of global efforts to lower emissions. Many companies are still wary.

"We consider that the best offsetting of carbon is not to issue carbon,” said Nicolas Dutreuil, deputy CEO in charge of finance at French real estate company Gecina.

“So our goal today is to continue to invest in our portfolio in order to reduce the emissions. We think that we have to be much more efficient on initial emissions rather than trying to do some offsetting.”

And some banks emphasise that carbon offsets should be a last resort after companies have done everything else they can to reduce emissions.

"We look at where we can make the most impact, so it needs to involve a change or transition in our clients' activities and if it's only to buy carbon credits, but not to make a change that is so needed, that is something that would not fit our position,” said Leonie Schreve, ING's global head of sustainable finance.

Mark Carney, the UN special envoy for climate action and finance (and former governor of the Bank of England), has nonetheless defended carbon offsetting markets, which he argues will play an important role in the world’s transition to net carbon neutrality. Last year, Carney launched the private sector-led Taskforce on Scaling Voluntary Carbon Markets and has called for the voluntary market to grow to as much as US$100bn in size.

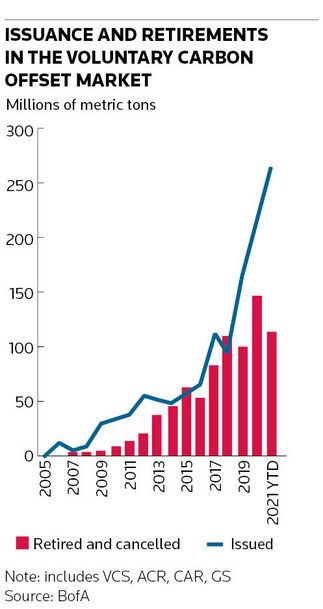

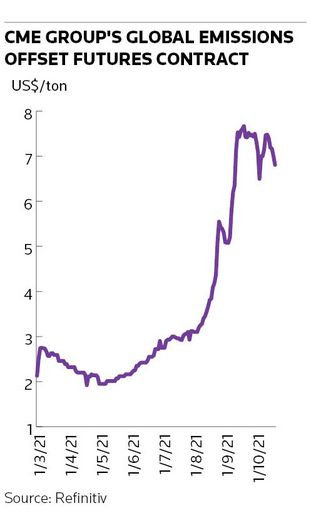

Issuance of voluntary carbon offsets is currently on track to surpass 300m tonnes this year, according to BofA, which would represent a nearly 50% annual increase. Prices have also skyrocketed. CME Group futures contracts on global voluntary emissions reductions have more than tripled in value since early May to a recent high of nearly US$8 a ton in September, according to Refinitiv data.

“The EU voluntary market is much smaller than the regulated market, but it’s increasing at a much faster pace as there is more and more interest from participants to trade,” said Francois Carre, carbon portfolio manager at BNPP. “Traditionally this market was almost exclusively trading on a spot basis, but we’re seeing more and more clients looking for forward transactions to cover their future carbon footprint.”

Big business

Banks certainly see huge opportunities in emissions trading and products built off the back of it. Barclays and Standard Chartered are among the banks looking to increase their presence in these markets, alongside others such as Citigroup and Goldman Sachs.

Carbon credit trading across regulated and voluntary markets, along with notes and exchange-traded funds linked to ESG and carbon credits, are on track to make banks active in these activities US$500m in revenues between them this year, according to projections from data firm Vali Analytics, which expects the annual industry revenue pool to increase to US$1bn by the end of the decade.

Some banks are already repackaging carbon credits from regulated markets into structured notes to provide access to a wider range of investors – while also reducing the capital costs they have for holding these positions on their books. Others are exploring capital markets products that include embedding voluntary carbon credits in sustainability-linked loans, bonds and derivatives.

“We have been seeing lots of repacks of carbon credits,” said Leanne Banfield, counsel at law firm Linklaters. “The price of carbon is going up, but it is difficult for investors to purchase it directly, so they are looking to financial institutions to provide them with exposure through repack notes.”

Developing the voluntary offset markets further will provide other notable benefits for banks, such as allowing them to buy credits to lower their own carbon footprint. Meanwhile, encouraging their corporate clients to buy voluntary credits could provide a further benefit: helping to reduce banks’ financed Scope 3 emissions, a measure of an organisation’s indirect carbon footprint, which are notoriously hard to manage.

"We want companies to buy carbon credits to compensate for their emissions and we want them to be recognised for that,” said Chris Leeds, head of carbon markets development at Standard Chartered. “At the moment that's not possible, so we're working with bodies to help enable that recognition. We're going to encourage all of our clients to buy high-quality carbon credits that meet the core carbon principles when they are finalised. And we ourselves will also do that."

Big risks

Many believe the success of voluntary carbon offsetting rests on the implementation of robust, common standards to dispel concerns over greenwashing and allow the development of a deep, thriving market. That will be no mean feat given the considerable disparities in global environmental policies and governance standards at present, as well as huge regional and geographical variations in projects.

Average carbon prices among major economies range from US$67 per tonne of CO2 emissions in Italy to US$3 per tonne in Japan, according to Barclays research. Several large emerging economies such as Brazil and India still have no carbon price.

Regulated emissions trading markets are fragmented across a number of different regions, while the voluntary offset market is currently split between four main standards for certifying carbon reductions or removals.

The TSVCM is looking to tackle the problem head on through formulating standards for voluntary offsets that will bring greater harmonisation and integrity to these markets. It recently announced a governance body to set a global benchmark for carbon credit quality.

“One of the first jobs of the governance body is to agree core carbon principles that will underpin high-quality carbon credits. They have to be additional, [they] have to be permanent and they must avoid leakage,” said Leeds, who sits on TSVCM's board of directors.

“In financial markets we’re all very familiar with KYC [know your client]. This is something that really needs to be developed within the voluntary carbon markets,” he added.

Many banks are already working furiously behind the scenes to develop their own compliance standards, while also sourcing new offset projects for clients. The breathless pace at which these markets are expanding has only raised the stakes further.

"We're currently spending a lot of time finding new sources of projects. But we need to ensure that from all angles those projects are correct and material," said BNPP's Chalchat.