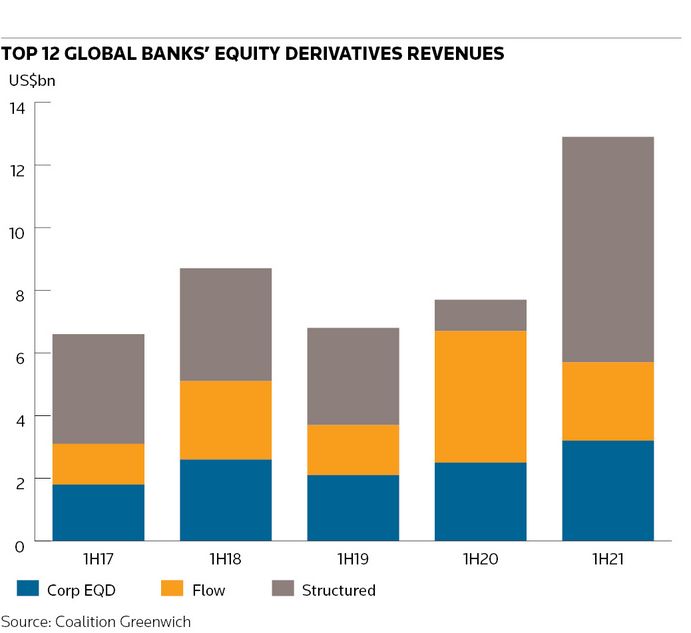

Structured products desks are driving a surge in bank equity derivatives trading revenues this year, marking an extraordinary turnaround for a business that suffered eye-watering losses when markets swooned at the start of the pandemic.

Structured equity derivatives revenues at the top 12 global banks are on track to reach a record of about US$12bn in 2021 after jumping sevenfold in the first half of the year, according to analytics firm Coalition Greenwich. That would represent about a doubling in annual revenues compared with the years leading up to the pandemic.

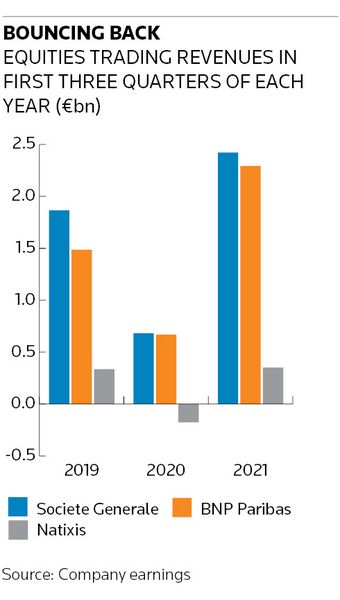

The combination of rising stock markets and low bond yields are fuelling demand among wealthy retail investors for structured notes that pay out chunky coupons dependent on the performance of equities. That has helped to revive banks such as BNP Paribas, Societe Generale and Natixis that disclosed nearly US$1bn in structured losses between them last year – while also fuelling competition among rival firms manufacturing these products.

Banks say they are more resilient to shocks in these markets after revamping their operations over the past 18 months, shifting risks that had previously been on their books to end-investors, among other measures. But the mixed track record of these activities inevitably raises questions over whether the current boom could come back to haunt banks – or their clients – in future downturns.

“Rising equity markets create a virtuous circle for investors, distributors and banks, which mechanically feeds the growth of the structured products market,” said Renaud Meary, head of structured equity at BNP Paribas.

“Banks have been reassessing their risk policies to reduce the magnitude and type of risk that they're taking with these products. It can be beneficial to investors if they can access products with more interesting yields, but we as an industry need to pay proper attention to the appropriateness aspect of products. There is a risk of damage to this whole business if the industry doesn’t manage this with the due level of care we owe to investors."

Good times, bad times

The tendency of stock markets to move higher, and bond yields to remain low, has helped establish structured products as a staple investment for many wealthy investors in Asia, Europe and even the US over the past decade. A typical trade might see an investor buying a note that will return them their money along with a hefty interest payment provided an equity index reaches a certain level in a year’s time. Most products automatically redeem at that point, a feature that gives them their “autocallable” moniker.

Designing and selling these notes is generally very profitable for banks compared to the low-margin “flow” activities of trading stocks and other standardised products. But the start of the pandemic last year flipped that calculus on its head, as mass dividend cancellations and soaring volatility proved a toxic combination for banks housing large autocallable exposures on their books.

French banks that had historically relied heavily on structured products to generate equities revenues were the highest-profile casualties, prompting BNPP, Natixis and SG to review (and in the case of the latter two scale back) their businesses. But all three opted to stay in these markets, while others that were less affected – such as Barclays and Citigroup – doubled down on expansion plans.

Those decisions have paid off – at least so far. Structured derivatives accounted for 56% of banks’ equity derivatives revenues in the first half of the year compared to just 13% in 2020 and an average of about 45% prior to the pandemic, according to Coalition Greenwich.

“Our ambition is to make a sustainable, long-term business,” said Michael Haize, head of global markets at Natixis corporate and investment banking. “The good news is that there has been a lot of demand this year and we’ve been able to shift to ... less risky products, which have still performed well for clients. It’s a win-win: less risk for us and strong performance for investors.”

Back with a bang

There is no doubt that 2021's heady equity markets have shown the structured products business in its best light and fuelled its stunning comeback, just as plunging markets at the start of the pandemic exposed the risks these desks can harbour.

Rising equities have ensured these products perform as advertised for clients, encouraging them to reinvest their money in another note when the autocall feature kicks in and they receive their payout. That presents the banks selling these products with another revenue-making opportunity, while the redemption of old notes has the additional benefit of mechanically removing risk from banks' books, including some of the diciest exposures originating from before the pandemic.

Fred Despagne, head of cross-asset distribution sales for Europe at SG, said the first nine months of 2021 represented the bank’s best ever such period for structured products. That comes despite SG saying last year that risk reductions it was making would lower annual trading revenues by as much as €250m.

“Investors appreciated our capacity to extend our product mix very quickly for new underlyings, new payoffs and new product types,” said Despagne.

The benign market backdrop has certainly made it easier for banks to prod clients towards products designed to be less hard to handle when turbulence increases – perhaps the most significant change the industry has embraced in response to the events of last year.

“The key consideration for us has been how to shift the distribution client segment towards solutions bringing less illiquid risk to the books … and to fortify the other side of our client base that helps us to recycle the remaining risks as these volumes keep growing," said Alexandre Isaaz, global head of equity and hybrids payoff structuring at Citigroup.

Shifting the risk

There has been a notable effort to shift clients to “decrement” indices in particular, which Isaaz said had accounted for over a third of index volumes in Europe in 2021 compared to about 5%–10% a couple of years ago.

Banks originally conceived decrement products to offer higher coupons for investors than those based on standard equity benchmarks. They did this by building custom indices of shares that historically had paid chunkier dividends. These dividends are reinvested in the performance of the index as they are distributed. Meanwhile, the bank subtracts a fixed decrement (essentially a fee, or synthetic dividend) from the index performance on a daily basis, which is calculated at the outset using historical dividend levels.

This design ensures the dividend risk rests with the end-investor: if companies pay dividends that are either higher or lower than history had suggested, the performance of the index underlying their product will improve or suffer. That differs from traditional autocallables, where the dividend exposure sits with the banks and can become extremely costly when markets plunge or companies abruptly cancel shareholder payouts as they did last year.

"There is a global need to change this product. The advantage of the decrement feature is that the performance is fairly easy to understand. It’s an education process that started a couple of years ago and is now bearing fruit," said Isaaz.

Whether the shift to such products – along with more concerted efforts to hedge and recycle other risks from structured books – succeeds in revolutionising this notoriously volatile business will ultimately be determined by how the industry weathers the next downturn.

In the meantime, some say banks should proceed with caution. BNPP’s Meary said decrement products can inflate other risks for banks such as on equity repo and volatility. He also voiced concern about the increasing use of these structures for single-stock products.

“We think the whole industry should be careful,” he said. “Investors are taking extra risk on these products in exchange for a higher coupon. We as issuers have a responsibility to ensure our clients understand these risks.”