Capital markets in the US have rallied around the fight to address environmental, social and governance issues, responding to the Biden administration’s increasing emphasis on climate change.

![]()

2021 looks set to go down in history as the year that the US and its financial industry finally got serious about environmental, social and governance finance.

During president Joe Biden’s first week in office, the world’s biggest economy and second-biggest polluter rejoined the Paris Agreement and created and filled new posts for national climate adviser and US special presidential envoy for climate. The year carried on with the Federal Reserve, Treasury Department and Securities and Exchange Commission appointing senior officials with pro-ESG records and the president launching his cornerstone Build Back Better spending plans, including funds for things like electric vehicles.

“The main argument for why ESG took off in 2021 is a combo of a change in Washington DC and Wall Street,” said Aniket Shah, global head of ESG and sustainable finance research at Jefferies. “There was a whole set of policy and regulation that started shifting the conversation on climate policy in the White House, on Capitol Hill and in places like the SEC.”

The connection between ESG concerns and those of finance had never been made so clear at the federal level. This essential endorsement encouraged a US private sector whose desire to develop more robust disclosure regimes, better data collection practices and wider ESG awareness was often ignored by the previous White House.

“The current administration is backing climate change,” said Marisa Drew, chief sustainability officer at Credit Suisse. “As soon as policymakers say things like, ‘We are going to invest in green infrastructure,’ or ‘We are going to put policies in place around electric vehicles', you’ve now just created enormous value in those sectors. And capital markets go where there’s going to be value creation.”

One trillion dollars

Signs of this shift showed throughout. EV trendsetter Tesla’s value reached US$1trn last year, more than twice the combined value of Ford Motor, General Motors and Stellantis (the 2021 merger of Fiat Chrysler and PSA). Novel ESG-flavoured IPOs from footwear maker Allbirds, oat drink maker Oatly and others tempted the equity markets for the first time. And previously unthinkable climate activist investor campaigns against corporate America’s biggest emitters notched important wins, aligning climate consciousness with return on capital.

“You saw American companies like Tesla just really take off, companies that are making products in the climate space in particular,” said Shah. “Tesla hit a trillion-dollar market cap, larger than all the other US car companies put together. So investors really made money on climate and all of this was validated.”

A vibrant bond market – though less flashy than its equity counterpart – underscored these changing tastes. Volume of ESG-labelled bonds in the US rose 64% year on year to US$236.7bn, Refinitiv data show, as bankers and executives responded to the signals from Washington and elsewhere.

Dealmaking records were broken, and the bond market fanned out into relatively new structures. Unheard of just a few of years ago, sustainability-linked bonds became popular, with volume in the US totalling US$27.8bn in 2021 – compared with just US$2.2bn the previous year.

Most notably, the emergence of the SLB helped usher in a new kind of ESG client. For the first time, companies from high-emitting sectors like transport, energy and mining were touting ESG credentials in front of investors.

Spreading the word

Whether any of these deals, with their emissions targets and step-up penalties, will help make a dent in the world’s environmental problems is anyone’s guess. Yet, if nothing else, they have helped spread the word about ESG in capital markets.

“For me, the most important feat of sustainable finance was bringing awareness of ESG concerns to the private sector and beyond,” said Herve Duteil, chief sustainability officer for the Americas at BNP Paribas. “This has been an amazing victory. A few years ago, almost no one in finance was talking about ESG. We went from niche to nearly universal. In the next few years, most financings will probably be a form of ESG financing.”

Driving a lot of this deal flow has been the banks. In April, US lenders announced major ESG financing targets for 2030 that align with the UN's Sustainable Development Goals. Bank of America, for example, came out with a US$1.5trn target over 10 years, which includes “deploying and mobilising” US$1trn by 2030 to accelerate the transition to a low-carbon economy. JP Morgan’s target over the same period is US$2.5trn; Citigroup’s is US$1trn.

“There aren’t any big banking transactions that don’t include at least some ESG consideration,” said Tom Eveson, director of corporate solutions at Sustainalytics, which provides ESG ratings and second-party opinions on new issues. “We deal with a lot of sustainability teams at investment banks, and they’ve grown in size over the years and have become very sophisticated.”

Second opinions

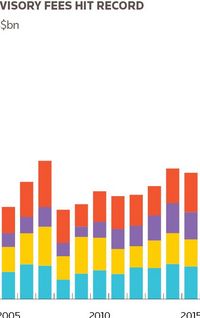

So too have the second-party opinion providers. On use-of-proceeds bonds and SLBs it has become almost a requirement to have an outside firm to vet a security’s ESG targets and the sustainability record of its issuer, similar to the role of a credit ratings agency. As bond volumes skyrocketed, second-party opinion providers had to staff up to meet all the demand for their services, which add a level of transparency and certainty to an industry rife with feel-good, hard-to-measure environmental claims.

So vital had second-party opinion providers become that one popular gripe among debt capital markets bankers in 2021 was that there weren’t enough of them to go around; deal flow was being restricted, as a result. True or not, ESG research firms have been pulled in new directions as this market has matured, whether providing opinions on bonds or ratings on entire companies’ environmental credentials.

“The ESG ratings world was initially really focused on mega-cap market leaders,” said Eveson. “This is now trickling down into smaller private companies and private equity portfolios.”

Market-leading buyout firms, meanwhile, expanded ESG capabilities last year with new hires, funds and/or initiatives. TPG announced the first close of an inaugural climate fund, TPG Rise Climate, in July at US$5.4bn. Blackstone hired Jean Rogers, founder of the Sustainability Accounting Standards Board, as global head of ESG in November, and Amisha Parekh as global head of ESG for private equity in October, while Apollo Global Management named Dave Stangis as chief sustainability officer.

The Carlyle Group and Blackstone were among the firms which last year created the ESG Data Convergence Project, with the aim of streamlining “the private equity industry’s historically fragmented approach to collecting and reporting ESG data”. General partners in the project will report metrics related to Scope 1 and 2 emissions, renewable energy, board diversity, work-related injuries, net new hires and “employee engagement”.

Ready for sale

“PE firms are responding to investor demand by increasingly asking the companies they own to report on ESG factors,” said Eveson. “PE firms also want to ensure that their holdings are ready for potential sale or IPO by getting ESG assessments completed well in advance.”

What’s more, all executives received stark warnings in 2021 that they are now being held accountable by an increasingly discriminating global market for the ESG claims they make (or don’t make). In August, the market cap of Deutsche Bank-controlled DWS fell more than €1bn in one day on news that US authorities were investigating the US$1trn asset manager after its former head of sustainability said it had misrepresented its ESG credentials. DWS denied the claims.

And in May, after buying a tiny stake in ExxonMobil, a virtually unknown investor named Engine No 1 forced something of a rebellion among the oil giant’s stockholders. Shareholders elected three of the activist investor’s four nominated directors, reflecting its concerns that ExxonMobil needed to better align its business with the global transition to net zero, lest returns continue to suffer.

“This was the year with big activist moves on companies like ExxonMobil,” Jefferies’ Shah said. “And Exxon made very clear shifts in their capex in the last six months [of the year]. Will this be enough to solve climate change? No. But it’s hard to argue that climate change is not driving real corporate executive decisions.”

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email leonie.welss@lseg.com