The promise of greater efficiency – and cost savings – from the automation of debt capital markets appears to be getting closer, given the rising number of platforms or applications being marketed to syndicate desks. We’re not there yet but we might just see evidence of progress this year – at least in some parts of the new issue continuum.

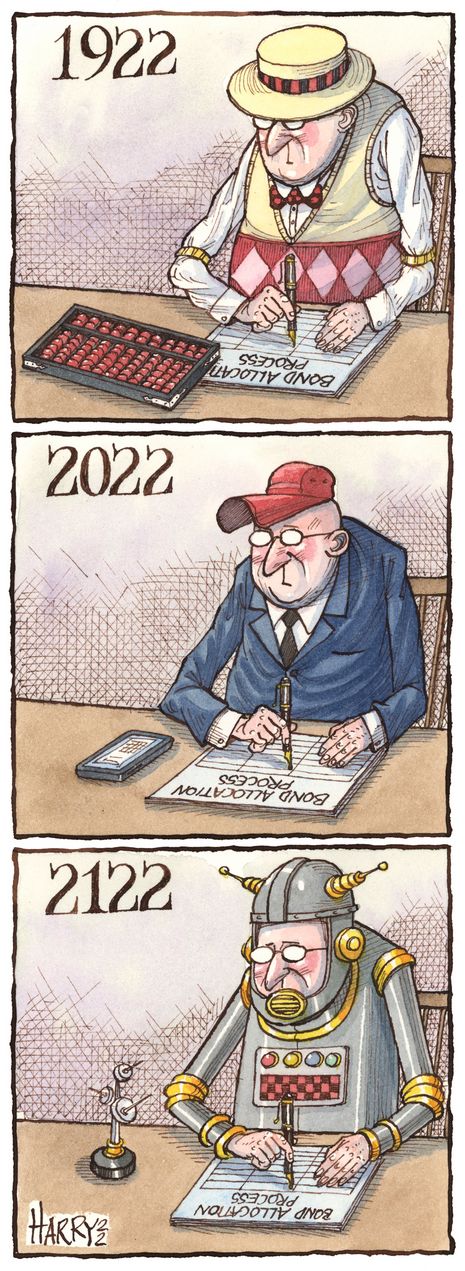

Barriers to automating or digitising workflow in primary bond markets are well known to anyone in the business, where the standing joke is that the biggest change over the past 30 years has been the introduction of email. Yet things are changing. Slowly.

“There is progress. The challenge is that the process of launching a new bond consists of many different parts, and we’re seeing different players looking to address and automate some of the issues that arise during the different stages of that process,” said Gabriel Callsen, secretary to the International Capital Market Association’s FinTech Advisory Committee and the person leading ICMA's work on fintech in international debt capital markets. “It's fair to say that there isn't a single one-stop shop that automates the entire process.”

It's also fair to say there are good reasons for that.

“There are risks involved in raising capital by issuing debt – underwriting risks and legal risks, for instance,” said Maud Le Moine, head of SSA DCM at Goldman Sachs. “So even with automation, we still need to double-check manually. Right now, it's impossible to have a truly automated workflow.”

Some aspects of the bond syndication process lend themselves better to automation than others: in particular, ensuring a transaction is processed as efficiently as possible and that data flow between different parties without the need for human intervention when entering or copying details into systems. They are the natural targets for a technology solution.

“The primary markets work well already but there are radical improvements that can now be made all along the new issue process that will seamlessly flow into the post-trade/secondary phase and persist for the full life of the security,” said Charlie Berman, co-founder and CEO of agora digital capital markets, which is applying distributed ledger technology and smart contracts to create what he says is the world's first end-to-end digital platform for the full life cycle of bonds.

“There are many areas where things could just be done so much better with the technologies that we and the key market stakeholders are developing. It's an incredibly exciting and pivotal period."

Pain points

The potential for technology to address the pain points in primary debt markets is attracting new providers with new ideas. The marketplace for solutions is getting busier.

In January 2022, ICMA released the latest update of its primary markets technology directory. This shows that the number of services available to automate all or part of the process of issuing debt securities had increased by 10 to 45 between the fourth quarter of 2020 the fourth quarter of 2021, and had more than doubled since the directory was first launched in 2018.

Some solutions have already gained a degree of traction, others are still at the development stage and there are those that could be in operation later this year.

And while each product addresses an area of the new issue market worthy of resolution, the vision of a straight-through process comprising a series of applications bolted and patched together in Heath Robinson fashion raises issues of interoperability – and fatigue.

“There are lots of good ideas out there,” said Sotiris Manderis, founder and CEO at finsmart, a provider of digital applications for primary capital markets. “But ideally, you’d want someone to own the process end to end. I’m sure that will happen at some point in the future, but we’re not there yet.”

Adoption rate

Multiple obstacles need to be overcome before the primary debt markets accept, wholesale, the benefits offered by automation – not least a general reticence at the best of times to adopt new technology.

“The market is handicapped by a reliance on legacy systems,” said Mark Leahy, chief operating officer at Trumid XT, an electronic bond trading platform. “It’s a punchy call for anyone to go through the expense of upgrading. And there’s also the question of who owns the budget.”

The counterargument is that doing nothing can leave you behind the curve.

“In any digital cycle, you have innovators and then you have early adopters, then everybody else follows. It’s the same with financial technology,” said Manderis.

“We’ve had discussions with many banks and we've seen people who are very technologically open, who want to push forward, digitalise the process and make a difference. And there's others who even though they accept the fact that a solution is needed, they don’t want to be the first but will join in the second wave.”

Banks at the vanguard of adoption are not defined by size or geography but represent a cross-section of the community.

“This year will be the year of implementation and we’ll see more ideas going live,” said Manderis. “It’s going to be a testing ground where banks judge which solutions make sense to support.”

Breakthrough

The number of solutions coming to market is set to increase again.

“We are frequently contacted by firms trying to solve some of the inefficiencies in the DCM syndication process,” said Le Moine. “Over the last few years, the only real change we've seen has been on the order book side. What is missing are all the other layers of the process: pre-trade input, data gathering and processing, term sheet drafting, pricing, information tracking and all the downstream processes, documentation and settlements.”

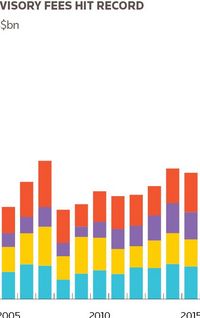

Bookbuilding systems, such as DirectBooks, IHS Ipreo, and Deal Pool are already used daily and are tipped to see more business in 2022.

Other sectors await a breakthrough.

Some providers focus on legal aspects – enhancing the drafting process and the coordination between the bankers, issuers and lawyers involved, and something essential across the new issue workflow.

“I don't think there is yet a mainstream application for automating documentation. It is an area that offers scope for further automation, but I wouldn't say the breakthrough is there just yet,” said Callsen. “As soon as there are different stakeholders involved, it becomes more complex.”

There is promise that the documentation impasse can be resolved, however, as it has in other sectors of the market. ISDA Create, for example, allows firms to negotiate and execute derivatives documentation online.

“The ability to structure unstructured data is now proven in different use cases across financial markets and DCM is clearly following this same trend,” said Mark Bennewith, head of EMEA at Arteria AI, a company that applies artificial intelligence to the drafting and analysis of contracts for the financial services sector.

If adjustments to documentation are minimal, any changes to terms should not take long. It is something that has worked with medium-term notes for decades. Doing something similar in the syndicated bond world makes sense, especially for repeat issuance from frequent borrowers.

And it is in the high-frequency issuer space that more automated business will first emerge.

“Market innovation typically starts with the big frequent issuers. It rarely occurs with an issuer that comes to the market once a year,” said Berman. “Those that are in the markets every day are naturally the first ones seeking greater efficiency."

Agora is already live with the first phase of its structured products software and will go live with version 1 of its syndicated bond platform during the first months of 2022, according to Berman.

Rip it up and start again

Most of the solutions address inefficiencies in the established processing of a new issue, rather than reinventing the infrastructure underlying the practice.

“They are really an efficiency play,” said Callsen. “Increasing efficiency in the process. Not changing the process and not disintermediating any party: agent, CSD or other party, or underwriter."

But there is a more radical approach where the central securities depository is replaced by the blockchain recording the data.

There are fiercely held views on either side of the camp as to the merits of blockchain and distributed ledger technology in the DCM space, but there will be further tests of its application to bond markets in 2022 following deals for the European Investment Bank and on SIX Digital Exchange in 2021.

“To see further acceptance of this technology you need a greater presence of investors in digital assets and the development of secondary trading using digital currency,” said Mathew McDermott, head of digital assets at Goldman. “We will see more deals this year – maybe even some sovereign issuances. They are very interested in this technology and can be a real enabler for increased adoption given their issuance profiles.”

Primary bond markets are set to become more efficient, whether it is through using a series of targeted apps, artificial intelligence, a move to use DLT and a revolution in the new issue process. Which technology will win out and how quickly it makes an impact remains to be seen. Everything depends on adoption.

“Adoption is critical,” said Bennewith. “The solutions that will get traction will ultimately need to work in both commoditised and complex use cases, as banks are increasingly looking for software that can play in more than one niche.”

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email leonie.welss@lseg.com