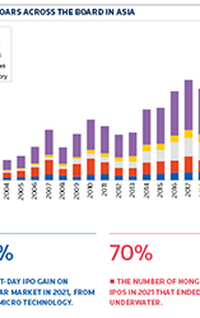

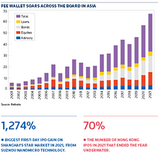

Western hedge funds eye big-ticket workouts from China as restructurings become more predictable elsewhere in Asia

![]()

Asia’s debt restructuring landscape in 2021 revealed its increasingly dual nature: China, and the rest of the region.

South and South-East Asian legal regimes remain challenging although reform is underway, led by India, Singapore, Malaysia and the Philippines and hope springs that greater transparency and predictability will emerge as markets develop.

“Undoubtedly China distressed is perceived as the new frontier for Asian debt restructurings,” said Jamie Mclaughlan, director at advisory firm PJT Partners in Hong Kong. “Over many, many years we will likely see the market evolve and change like the US and EMEA had to over many, many years of case law and successful or unsuccessful attempts at consensual holistic solvent restructurings.”

China has become the locus for the big Western restructuring advisory specialists such as Houlihan Lokey and PJT, who tend to focus on offshore debt and ply their trade against the home-grown competition which has traditionally been more DCM-focused.

New frontier

Big ticket restructurings from China’s real estate sector for the likes of developers China Evergrande Group, Kaisa Group Holdings and Fantasia Holdings, plus the ongoing stress across China’s highly leveraged real estate sector, help explain the idea that the country represents the new frontier for the industry.

But other industry segments are likely to form part of China’s restructuring pipeline in the coming years thanks in part to the Covid-19 pandemic, high levels of leverage and cyclical industry downturns. Manufacturing could be the next shoe to drop in the face of soaring energy prices in China.

“We’ve seen a meaningful increase in restructuring activity in the region in terms of new mandates and closed deals over the past twelve months. Covid-driven changes in the credit cycle and sector-specific developments such as those in Chinese real estate have been key catalysts for this increase in restructuring activity,” said Brandon Gale, Hong Kong-based head of Houlihan Lokey’s financial restructuring group in Asia.

Corporate debt restructuring in Asia has for years existed against an unpredictable legal backdrop, with unfit-for-purpose restructuring laws and often capricious courts. This is most notably the case in Indonesia, where long timelines are the norm, highly paid advisers engage in gamesmanship often involving outrageous tactics and restructurings of restructurings are commonplace.

But the ex-China landscape is changing with Singapore a standout benchmark exception in terms of predictable process. Meanwhile, Malaysia India and the Philippines have enacted legal reforms which should transport the region closer to that benchmark.

Still, the bad old ways die hard and the restructuring of national carrier Garuda Indonesia is a case in point. A US$10bn debt restructuring is in the works, having commenced on December 9, some 11 years after the company’s last such exercise which was completed in 2010 after five years of tortuous negotiations, and 18 months after the carrier restructured a sukuk.

Garuda entered the PKPU process, allowing it to suspend creditor payments as it works out a restructuring plan over a 45-day window or agrees to be wound up, amid accusations of gamesmanship after the first creditors meeting was scheduled on December 21, right before Christmas.

Western hedge funds

A phenomenon which has been notable over the past few years in Asia is the participation of large US and European funds, which are sitting on piles of cash due to quiet home markets and are willing to deploy them, largely in offshore distressed debt. China has been – and will continue to be – their main target.

“With the recent high profile, large cap Chinese real estate distressed names we have seen US and European hedge funds look to play in this space. Many are attracted by the low trading price, typically 20–30 cents and large notional sizes of the debt,” said PJT’s McLaughlan.

Underlying this is the hope that Asian restructurings will become less contentious, less time-consuming and less costly, much as they are in the US and Europe.

“Typical successful western restructurings are often consensual, holistic, solvent restructurings where all the balance sheet liabilities are restructured at the same time,” McLaughlan said.

The hope is that this is the direction of travel for Asian debt restructurings, and the signs are there, beginning in Singapore.

Singapore overhauled its restructuring laws in 2017 and in 2020 enacted the 2018 Insolvency, Restructuring and Dissolution Act (IRDA), which builds on the earlier moves to align the city state with a Chapter 11 regime and introduces a straightforward process for the establishment of jurisdiction over foreign companies, flexible moratoriums and the availability of “roll up” rescue financing. These moves underpin Singapore’s bid to position itself as Asia’s premier restructuring hub.

A clear case underpinning Singapore’s ambitions and its aim to streamline restructurings was the “pre-packaged” approach taken under IRDA in November 2020 to the US$231m of bonds issued by Indonesian media and financial services conglomerate MNC Investama under which the company was able to cut time and cost by avoiding the need to apply for court approval to hold a statutory meeting and replace the paper with new notes and shares.

Malaysia and the Philippines have entered Singapore’s slipstream, with the former having last year introduced judicial management and corporate voluntary arrangements and the latter with the Personal Property Security Act which will enhance the enforcement of security.

Meanwhile the UNCITRAL Model Law on Cross-Border Insolvency has been implemented in the Philippines. Japan and South Korea have also adopted the UNCITRAL framework.

Red tape culture

While there were hopes that India’s Insolvency and Bankruptcy Code, introduced at the end of 2016, would pave the way for a restructuring boom, the country remains constrained by its red tape culture and there have been teething problems.

“In India, the IBC has been transformational in consolidating prior laws, reducing the time for debt resolution and improving creditor recoveries. At the same time, IBC has faced growing pains and a number of amendments have been made to the code to address investor and practitioner feedback. One of the biggest challenges has been in relation to case timeline delays, mostly driven by judiciary bandwidth,” said Houlihan Lokey’s Gale.

The IBC was regarded when first drafted as creditor friendly and less so towards India’s ubiquitous equity promoters, who had to cede ownership to a resolution professional if insolvency proceedings began. But, in an about-face, an amendment in April restored promoter ownership during restructurings and with it the prospect of contentious and drawn-out proceedings.

Meanwhile hopes are rising that a solid Indian restructuring deal pipeline will emerge when banks are able to start fully reporting non-performing loans following the debt moratorium introduced in 2020 to ease pandemic-induced debt service stress.

“There are few interesting opportunities on the public secondary market side in India,” said Michel Lowy, Hong Kong-based founder and CEO of global banking and asset management group SC Lowy. “In India generally it’s a case of wait and see for what 2022 holds when banks can become more proactive about their NPLs.”

The troubled Chinese real estate sector had what appeared to be a fillip in late November when Kaisa – second only to Evergrande in terms of outstanding offshore US dollar debt – announced a restructuring plan for its US$400m 6.5% 2021 senior notes under a consent solicitation and exchange offer involving a par-to-par swap for new 2023 bonds.

That fillip proved short-lived, as the 95% voting threshold required from holders of the 2021s for the terming out to go through was not met.

“No one would want to extend on a par for par basis with the same 6.5% coupon in this environment,” said Lowy. “Maybe if the company paid you 20% upfront and the same every three months with a 10% coupon, otherwise forget it. The 95% acceptance threshold was wishful thinking and the whole proposal seemed designed to indicate a hardball strategy from the get-go.”

The behemoth in this regard is Evergrande, which has US$300bn of liabilities and 1,300 active real estate projects. After a period of debt service stress beginning in September amid heightened levels of market speculation it finally defaulted when it failed to pay an overdue US$82.5m coupon on December 6.

This was its first default on a public offshore bond following the expiry of a 30-day grace period. The coupon miss triggered cross-default on US$19bn of the company’s offshore debt (which totals around US$100bn).

A developer the size of Evergrande defaulting has prompted talk of systemic risk to China’s economy, but observers expect the Chinese government to focus on ensuring the company’s ongoing residential property pipeline is completed to avoid civil unrest. As for the debt, the workout process is expected to drag on for many years.

The key question is how foreign creditors will be treated compared to those onshore.

“The typical Chinese restructuring approach is akin to a ‘lock step’ – restructure onshore creditors then offshore afterwards – which can introduce significant challenges in terms of perceived parity of treatment of creditors with similar legal or security rights but who have separate financing arrangements or different perceived temporal seniority,” said McLaughlan.

To see the digital version of this report, please click here

To purchase printed copies or a PDF, please email gloria.balbastro@lseg.com