Bastion of stability

In a year that decimated high-yield supply and saw bonds default just months after issuance, one bank managed to shift its business to not only survive but thrive. For its market savvy, Deutsche Bank is IFR Asia’s High-Yield Bond House of the Year.

![]()

After Covid-19 destabilised the market in 2020, conditions only became more difficult in 2021 as China’s deleveraging policies had a knock-on effect for heavily indebted property developers.

In the face of those challenges, Deutsche stepped up to hold the top league table spot for Asian G3 high-yield bond issuance, with US$3.67bn of league table credit and a 7.4% market share.

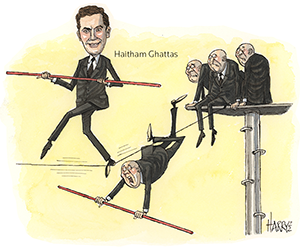

“It was one of our most impressive years to date,” said Haitham Ghattas, head of capital markets for Asia Pacific. “We have only extended our leadership in this market, and it was a year of many dynamics.”

For one, Deutsche leveraged its capabilities in India, leading transactions from the country during what was a booming year for Indian borrowers. Deutsche worked on the JSW Steel SLB, for instance, helping push the US$1bn dual tranche trade into the market.

In South-East Asia, Deutsche worked with investors from challenging sectors, balancing loan and bond financing in order to get the best possible outcome. For example, Deutsche encouraged Indonesian tyre maker Gajah Tunggal to finance through a loan before coming to the public bond market with a smaller deal than the company had initially wanted. Thanks to a more manageable size, the trade was a success, and showed the value of properly judging market dynamics.

While Chinese real estate borrowers have favoured short-dated bonds, some even marketing sub-one year tenors, Deutsche looked to push tenors longer. At the start of 2021, the bank advised its clients to reach for longer maturities while they were available – a prudent move for the issuers and for the market. Logan Group, for example, locked in a US$300m seven-year non-call four 4.5% bond in January, its longest tenor ever.

Most notably, Deutsche did not allow the decline of Chinese high-yield property developers and their drag on the wider market to damage business. In a year in which multiple high-yield offerings stumbled, Deutsche’s savvy in negotiating market gyrations meant it was the only one of the leading houses to end the year without pulling a deal.

“We started to feel the sands of change in the second quarter,” said Ghattas. In response, Deutsche shifted its business to capture more borrowers outside of China property. The move proved fortuitous as defaults began to unsettle the market, and Chinese high-yield primary issuance plummeted.

Away from real estate, Deutsche managed to bring high-yield issuers like eHi Car Services and Yanzhou Coal Mining to the market.

But Deutsche did not turn its back on its Chinese property clients. The bank conducted liability management exercises, helping credits like China Aoyuan Group, which completed an exchange offer.

The bank was a leader in the push into the 144A market in 2021, raising US$9.8bn for high-yield issuers from Asia ex-Japan in the format. The US investor base proved important in a year when many Asian investors were stretched financially or too nervous to add exposure because of market swings. These 144A trades included a handful of Indian deals, as well as the Macau gaming credits that Deutsche is known for. Deutsche has become the go-to DCM bank for Macau’s casinos, but raising funds for gaming companies remained challenging last year, as the pandemic took its toll on the sector. The bank’s forward-looking approach was evident when the bank led Studio City to sell a US$750m 5% eight-year non-call three bond in January 2021, the borrower’s longest tenor yet.

Deutsche has also contributed to the growth of green, social and sustainable bond issuance in the region, leading 32 high-yield G3 currency ESG deals for Asia ex-Japan in 2021, including a number of debut trades. The transactions included Pakistan Water & Power’s US$500m 7.5% 10-year green bond, the first from the country, and Continuum Energy’s US$561m six-year non-call three 4.5% green notes.

To see the digital version of this report, please click here

To purchase printed copies or a PDF, please email gloria.balbastro@lseg.com