Investment firm Castlelake rounded up US$1.6bn from institutional investors at the final closing on its biggest fund yet that targets aviation assets.

Castlelake Aviation IV Stable Yield Opportunities LP, the firm's fourth aviation fund, attracted repeat and first-time commitments from a range of investors including pensions, sovereign funds and endowments from around the world. It focuses investments in high-quality, younger mid-life aircraft and related aviation assets. The fund has already spent US$830m across 13 deals that involved 65 aircraft and multiple financings, the Minneapolis-based firm said.

Castlelake also securitizes the leases on planes that its funds invest in. Since 2014, it has raised more than US$6bn in the ABS market. Last year, it priced two ABS issues with most recent one sold in July, the US$450m Castlelake Aircraft Securitization Trust 2017-1R. Total aircraft ABS issuance totaled US$8.5bn last year, up from US$2.6bn for all of 2022, according to IFR.

In addition to raising more capital, Castlelake expanded its lending team by adding five structured credit specialists late last year.

Castlelake could not immediately be reached about its next ABS transaction.

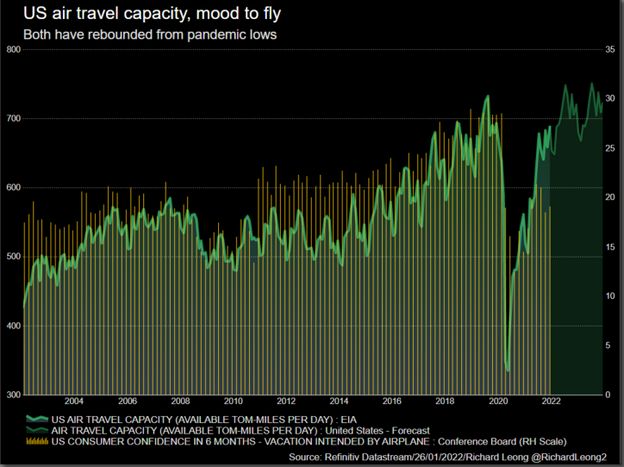

The capital raise came at a time as air travel is slowly recovering from its plunge in the initial stage of the pandemic. "We believe the current aviation market provides many compelling opportunities in which our exceptional team will be able to deploy capital," said Rory O'Neill, Castlelake's managing partner and chief executive officer, in a statement on Tuesday.

While financing through aviation ABS has improved, many of the deals are backed by younger, narrow-body planes which are typically used for domestic travel. Investors have shied from older wide-body jets because international flights have remained depressed due to Covid restrictions between countries.

"While recovery of domestic markets began in mid-2020, recovery in international traffic did not begin in earnest until early 2021, but has grown significantly in virtually every month over the course of 2021," said Deutsche Bank's head of aviation debt research Douglas Runte said in a note on Tuesday. "We expect that international traffic will continue to recover in 2022, but is unlikely to reach levels of domestic recovery until 2023," he said.