Raiffeisen Bank International showcased its ability to tap capital markets despite being one of the European banks most exposed to Russia, although the issuer had to compensate investors handsomely to get the deal away.

It garnered more than twofold demand for a €500m five-year covered bond on Monday, having forked out the juiciest new issue premium seen in the Austrian covered space in over three years.

"It's a great outcome for RBI and if you consider that Luminor Bank didn't perform really well last week, it's an encouraging result even if we paid a lot compared to other Austrian names," said a lead manager.

"Their credit standing was affected by Russia and Ukraine, but the fact that Austrian supply was so heavy also had an impact. We heard that there are starting to be fewer lines for Austrian covered bonds."

Credit Agricole, DZ Bank, Natixis, RBI and UniCredit held a roadshow early last week but delayed execution as the market tone deteriorated in the latter part of the week.

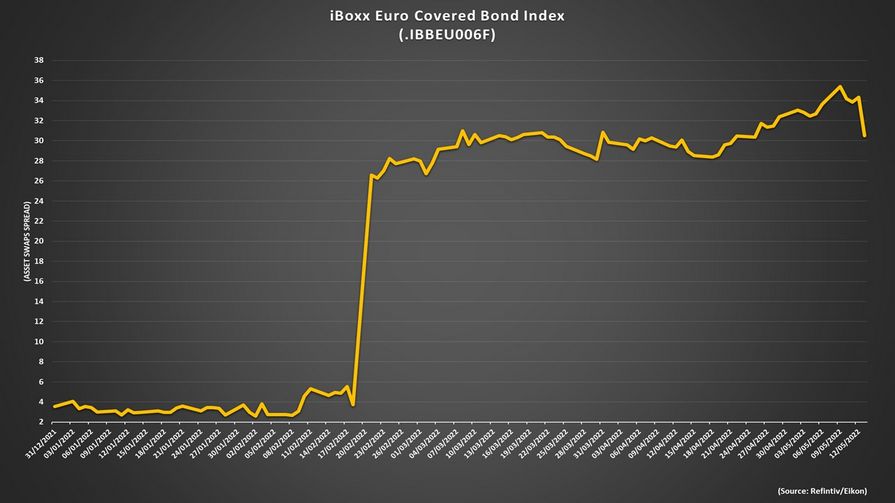

"The end of the week, especially for covereds, was not that good. We have seen a widening of 2bp or 3bp which also would have had an effect on new issue premiums," one banker away from the trade said.

Following investor feedback last week which pointed towards pricing in the mid-swaps plus high 10s to 20bp, books opened on Monday at mid-swaps plus 25bp area for the no-grow trade.

The bond landed at plus 23bp after orders passed the €1bn mark (ex JLM). The order book closed around €1.3bn (including €75m of lead interest) and was of good quality, the leads said.

"They started a bit wider than I thought they would when they first announced the trade last Tuesday but covered bonds have worked a bit less well since then," said a second banker away. "And maybe they could have tightened by 1bp more, but all-in-all it is in line with expectations."

Market participants said RBI left 8bp-10bp of new issue premium on the table. For comparison, since the onset of the war in Ukraine, five-year Austrian covered supply has priced within a mid-swaps plus 7bp-10bp range and with NIPs of around 2bp.

"The new issue concession for them was higher than other more established names due to the war in Ukraine, but generally you can get trades done if you are willing to pay up," said the second away banker, adding that RBI moved early in a week that is shaping up to be heavy in covered supply.

"I don't think you will see trades this week with no or minimal new issue premiums; it's going to be more in the context of 3bp-4bp for the majority of trades," he said.

UniCredit Bank Austria and Raiffeisenverband Salzburg will keep the Austrian momentum going this week; the first is readying a €500m no-grow six-year debut green covered bond for Tuesday while the latter is marketing an inaugural euro five-year sub-benchmark mortgage-backed transaction for Wednesday or Thursday.

Equitable Bank, HSBC Canada, and Hamburg Commercial Bank are also queuing up, providing a range of issues which will offer a detailed picture of the state of the covered bond market.