ESG derivatives once looked to be the next big thing in sustainable finance. Two years on and momentum has slowed in this famously innovative corner of investment banking, leaving a question mark over whether these markets are merely suffering from growing pains or face more fundamental issues that are hindering widespread adoption.

Companies announced a flurry of sustainability-linked derivatives trades in 2019 and 2020, which allowed them to make savings on interest rate and foreign exchange hedges provided they met certain ESG targets. Bankers say there has been a slow but steady trickle of such deals since then, while acknowledging they remain a niche product that is both time-consuming and complex to put together.

For that to change, experts agree on the need for greater standardisation in companies’ sustainability goals and the creation of suitably robust key performance indicators across different sectors – an issue that continues to hamper the development of ESG financial products more broadly. But despite the sluggish progress of late, many still expect sustainable derivatives will grow to complement the expected surge in sustainability-linked financing in the coming years.

“Derivatives can be an important part of the toolbox of financing solutions when they are all pointing in the same direction, complementing what is being done in sustainable bonds and loans,” said Constance Chalchat, chief sustainability officer for global markets at BNP Paribas.

“It’s a nascent product and there is a lot of heavy lifting; there is a lot of structuring. It took the industry three to four years for sustainability-linked loans and bonds to get industrialised. The great thing is we’re learning from those experiences as we look to industrialise the market and link it to a broader sustainable finance framework,” she said.

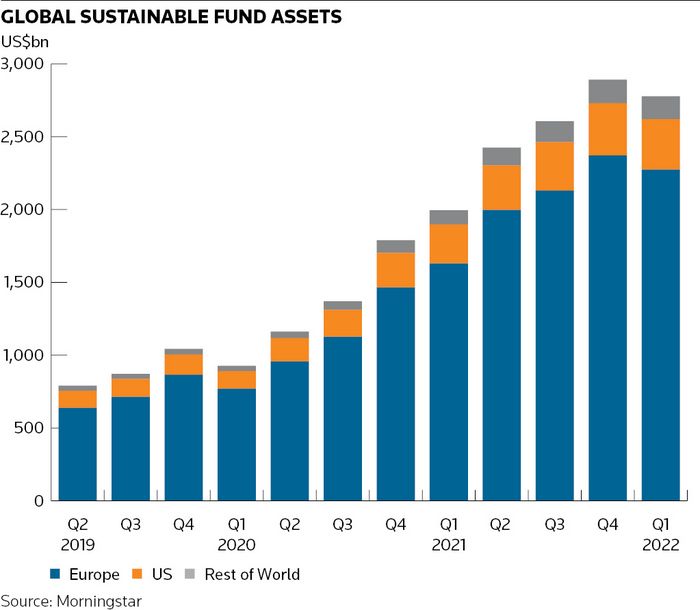

Sustainable finance has grown rapidly in recent years as investors and companies have looked to reshape their businesses in more ESG-friendly ways. Assets in global sustainable funds nearly quadrupled from mid-2019 to US$2.9trn at the end of last year, according to Morningstar, before dipping slightly in the first quarter of this year.

Mixed bag

ESG derivatives have grown too and now span a range of asset classes that have met with varying degrees of success. Products providing exposure to ESG-friendly equities have gained the greatest traction, with the market in Stoxx Europe 600 ESG-X Index futures now around a fifth the size of futures on the regular European benchmark, according to Refinitiv data, though the outstanding amount of these contracts has tumbled 46% since their peak in November.

In credit markets there have only been a handful of trades in IHS Markit’s flagship ESG credit default swap index since its 2020 launch, data from Depository Trust and Clearing Corporation show.

Sustainability-linked interest rate and FX hedges are more bespoke contracts that are looking to replicate the success of ESG bond and loan markets, where it’s becoming increasingly common for companies to link their borrowing costs to ESG targets. Standard Chartered expects green, social, sustainable and sustainability-linked bond issuance to increase to US$1.7trn this year, accounting for 18% of total debt sales compared with 11% in 2021 – and that share is forecast to grow to a third by 2025.

ING traded the first known sustainability-linked swap in 2019 when it structured a deal for Dutch firm SBM Offshore that allowed it to hedge the interest rate risk on a revolving credit facility. While the designs of subsequent trades have differed, these structures tend to allow a company to save money on the cost of interest rate or FX hedges provided they meet certain sustainability goals outlined in key performance indicators, or pay a penalty if they miss those targets. Many of these trades have accompanied sustainable bond or loan financings, though some hedging programmes, particularly in FX markets, have stood alone.

"When it comes to KPI-linked, corporates tend to align their financing with their hedging. If we see the financing part of the spectrum growing, it might have an impact on the derivatives side," said Neven Graillat, head of JP Morgan's global markets sustainability centre.

"On the derivatives side, what the market wants is standardisation around KPIs which are material, audited and with targets that are ambitious. We’re spending a lot of time working on that."

Slow but steady

Geraud Redor, head of EMEA private side structuring for global markets at BNP Paribas, said the market for sustainability-linked derivatives has expanded beyond Europe to include Asia, the US and Latin America. He also pointed to smaller companies considering ESG derivatives, as well as the development of a wider range of asset classes and products such as options. “The market is much broader than it was a few years ago,” he said. “It’s still a niche product – the market is not doubling in size every year, but we see it expanding steadily.”

Jonathan Gilmour, head of derivatives and structured products at law firm Travers Smith, highlighted three areas holding back growth. A lack of standardisation makes it very difficult for banks to offset their trades with other participants in a liquid market. Some banks, meanwhile, are waiting to see if regulators will relax capital rules for sustainability-linked instruments.

There are also "concerns around whether the sustainability KPIs are sufficiently robust to guard against accusations of greenwashing", he said.

Those concerns have created an inherent tension in ESG finance more broadly that has plagued the development of these markets since their infancy: how to establish standards that can be applied industry-wide, while ensuring that individual companies are committing to suitably tough targets in exchange for better financing terms. Sustainability-linked derivatives are no different: a copy-and-paste approach to designing trades simply doesn’t work for most companies.

“There is no market standard right now,” said Vanessa Battaglia, senior counsel at Travers Smith. “The KPIs that we have seen for these products are very bespoke. They can vary depending on a number of factors, including the counterparties' specific requirements and objectives, as well as the sectors and jurisdictions where they operate. This means that it is hard to come up with standardisation of KPIs in the derivatives space."

Developing standards

That has made crafting these trades extremely labour-intensive for all concerned, particularly for companies having to develop KPIs from scratch. These can vary hugely depending on the type of company and the markets where it's active – not to mention how far it has already progressed in its transition to a more sustainable footing.

“It’s a structured product with only flow revenues,” said one senior trader at an ESG-minded investment bank. “I think it’s worthwhile for the branding and moving the industry forward, but a lot of work goes into it.”

Some are just plain sceptical of the whole business. "It seems to be a little bit of a flag-waving exercise rather than anything systemic,” said one senior executive at an international bank.

Proponents of ESG derivatives remain undeterred, while mindful of the challenges ahead. The International Swaps and Derivatives Association is working on developing best practices for trading sustainability-linked derivatives and is examining how KPI frameworks used in bond and loan markets can be included in these contracts. ISDA has also launched a survey to determine if there is sufficient appetite to consider standardising certain contractual terms.

At the company level, it will inevitably take time for individual firms to develop appropriate targets for their financing or hedging transactions. Associated British Ports completed its first sustainability-linked derivative last year in what group treasurer Shaun Kennedy described as something of a “trial”.

The company is now doing a lot of work on its sustainability strategy. Once completed, ABP will examine how it can incorporate that into its financing plans. “It makes sense for us to align all aspects of our financing to our sustainability goals,” said Kennedy.

Kristell Herbault, a sustainable finance specialist at Societe Generale, noted that the sustainability-linked derivatives market is still very new. “One of the most challenging barriers to market growth is the difficulty for clients to build credible sustainability strategies: define relevant KPIs and ambitious targets,” she said.