JP Morgan and Barclays dialed back their projections on commercial real estate bond issuance this year, prompted by rising interest rates and continued market volatility.

A slowdown in property appreciation will likely result in a decline in primary activity in the second half of the year following a relatively healthy first half, the two banks said. Before the slowdown, the banks had anticipated CMBS supply would exceed last year's total of US$350bn on expectations of steady rates and market conditions.

CMBS borrowers have raised US$68.4bn so far this year, compared with US$62.3bn for the same period in 2021, Refinitiv data show.

JP Morgan analysts now see CMBS issuance totaling US$337bn for 2022, split between US$145bn from the private-label sector and US$192bn from US mortgage finance agencies Fannie Mae, Freddie Mac and Ginnie Mae. Earlier forecasts called for a total of US$360bn, comprising US$165bn from private-label issuance and US$195bn from the mortgage agencies.

"With market volatility presumably here to stay a while longer, we think our prior targets will be challenging to reach," JP Morgan analysts wrote in a research note on Friday.

The surprisingly high 1% increase in the May consumer price index spooked financial markets last week, sending the major stock indexes plummeting. It also reinforced the view that the Federal Reserve would increase key interest rates by half a percentage point at its policy meeting this week and signaled more rate hikes were on the way to reduce upward price pressure.

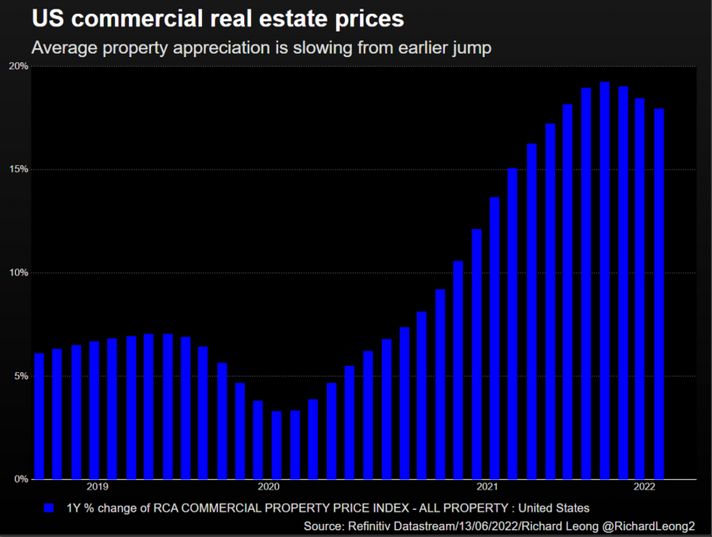

"Commercial real estate market participants are only slowly adapting to this new environment, with transaction volume starting to decline and price appreciation plateauing," Barclays analysts wrote in a research note on Friday.

The average year-over-year increase on property prices slowed to 17.8% in April after peaking at 19.2% in January, according to Real Capital Analytics.

Barclays analysts reduced their forecast on total CMBS for this year to US$300bn-US$330bn from their earlier projection of US$335bn-US$365bn. They now see private-label issuance reaching only US$135bn-US$150bn this year, which would be lower than their previous view of US$155bn-US$170bn.

They revised their agency CMBS supply for 2022 to US$165bn-US$180bn, down from their prior forecast of US$180bn-US$195bn.