Plunging stock indices, soaring volatility and a dimming economic outlook: today’s markets form the kind of deadly cocktail that has frequently spelled disaster for banks’ structured products books.

But two years on from trading desks suffering hefty losses from these complex equity derivative exposures, executives say they are weathering the current bout of volatility far better, even as global stocks slide into bear market territory. That raises an intriguing question: have banks fixed their structured products problem for good?

Traders point to a range of factors to explain this apparent resilience. The worst-affected firms in 2020 have revamped their businesses, often cutting back riskier activities, bolstering defences and encouraging clients to buy products that are easier to handle when equities whipsaw.

Still, when hard pressed, few are willing to consign structured product blow-ups to the history books. For one, this year’s market moves haven’t been as treacherous as those seen in more systemic crises such as 2020 or 2008. And many believe a repeat of those types of crashes will inevitably spark losses for banks heavily involved in this often lucrative – but always risky – business.

“In a large systemic crisis like in 2008 or 2020, these structured products books will definitely lose money,” said Arie Boleslawski, deputy head of global markets and global head of equities at Natixis CIB.

“What made the difference, however, to bank results [this year] is the risk management. Compared to 2020, this year the crisis was not as sudden, not as dislocated and didn’t last as long as in 2020, when we had been in a bull market for many years with very low volatility and no-one expected a downturn.

"In 2022 it [has been] different: we were carrying much less risk than we used to have and at much higher breakeven levels – in particular through very steep skew – with positions hedged on the downside."

Structured products have become a staple investment among many retail investors over the past decade, their appeal aided by a combination of rising stock markets and low bond yields. In a typical trade, an investor buys a note that returns them their money along with a chunky interest payment provided an equity index reaches a certain level in a year’s time. Most products automatically redeem at that point, giving them their “autocallable” name.

Designing and selling these notes is normally very profitable for banks compared to flow activities such as trading stocks and other standardised products. But these products also leave banks with exotic exposures that become fiendishly hard to handle during stressed market environments such as the start of the coronavirus pandemic.

Business revamp

In the first half of 2020, BNP Paribas, Natixis and Societe Generale, disclosed nearly US$1bn of losses between them on structured products, forcing the trio to rethink their businesses. All three reviewed how best to manage and hedge exposures, while Natixis and SG decided to cut back their riskiest positions.

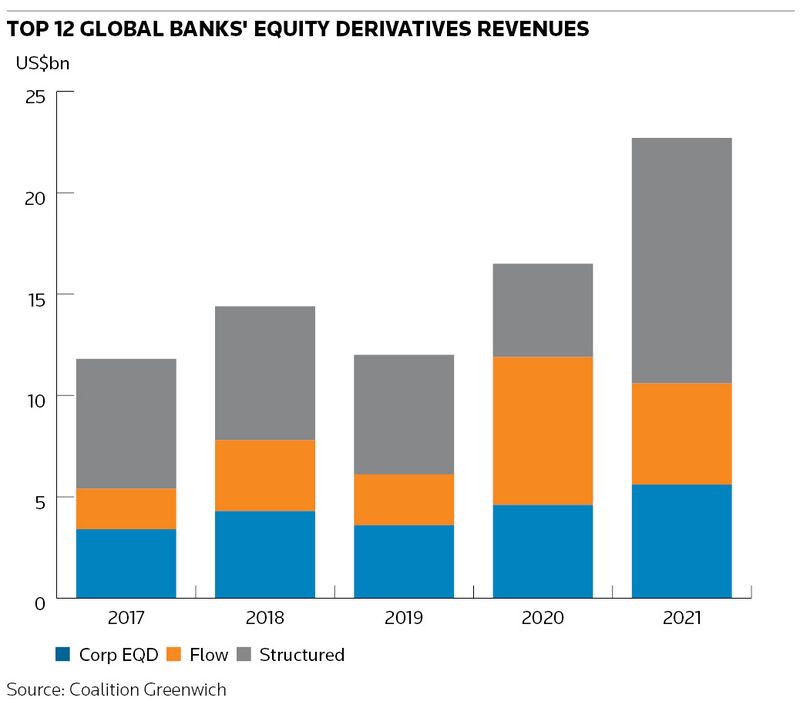

Then, in an unexpected twist, the structured products market rebounded sharply in 2021 as equities rallied, providing a record payday for banks active in this space. The top 12 global banks made over US$12bn in revenues from structured equity derivatives, according to analytics provider Coalition Greenwich, roughly twice as much as in 2019.

“Retail structured products were the main driver of revenues in [equity derivative] exotics last year,” said Youssef Intabli, head of equities competitor analysis at Coalition Greenwich. “Wealth managers and retail investors were searching for yield and there was strong demand from Asia clients in particular.”

Trading conditions became trickier this year, providing banks with the first proper stress test of their revamped structured products desks. Equity markets slumped in late February following Russia’s invasion of Ukraine and any hopes of a relief rally soon faded as concerns grew over the need for central banks to raise interest rates to tame stubbornly high inflation. The FTSE All World Index is now down over 20% from its record high in early January.

So far at least, banks have appeared equal to the task. SG and Natixis both highlighted “good risk management” when reporting equity trading revenue increases of 20% and 11% respectively in the first quarter, while BNPP highlighted strong momentum in structured products early in the year when reporting a 61% rise.

These books have continued to hold up in the second quarter, bankers say, though the recent central bank-inspired fireworks in financial markets look set to test their risk management prowess even further.

"It's been a good year in what’s been a volatile environment,” said Emmanuel Dray, head of hedge fund and asset management sales for global equities at BNP Paribas. “Our structured products books are much leaner in terms of risk and much better protected than in the past. The margins on these trades are better too. We took decisions to better protect the franchise after what happened in 2020.”

Better foundations

Last year’s booming equity markets provided the ideal backdrop for banks to lay the foundations for a more sustainable structured products business. Autocallables redeemed as stock indices climbed, mechanically removing some of the diciest risks from banks’ books such as so-called worst-of baskets.

The buoyant environment made it easier for banks to prod clients towards products that are less problematic to handle when markets go haywire. Those include so-called fixed decrement indices, where banks pass dividend risks onto the investor in the note. That matters in scenarios like March and April 2020 when a wave of companies cancelling dividends inflicted hundreds of millions of dollars of losses on banks’ exotics books.

“We have more diversification in terms of underlyings, such as far more positions in decrement indices where dividends are not embedded,” said Guillaume Flamarion, co-head of the multi-asset group for the Americas at Citigroup.

Flamarion noted the higher level of interest rates has allowed banks to manufacture shorter-dated products and some with fixed maturities (rather than the extendable autocallable feature), which carry less risk. There are also what he described as “more defensive products” that have a higher chance of being called rather than having to wait until a yearly observation date.

“The market wasn't concentrated on one single product, bringing greater diversity to our risk and making it easier for exotics books,” Flamarion said.

Risk management

Banks with large structured products books have also made a greater effort to hedge these positions. That can involve off-loading various exposures to sophisticated investors like hedge funds through so-called risk-recycling trades. On top of that, many are placing large macro hedges such as buying vanilla put options, which should make money when markets slide.

"Banks have continued to have a defensive profile since the Covid crisis," said Jean-Francois Mastrangelo, global head of structuring for products and solutions at Societe Generale.

"After a good year like 2021, you could’ve expected banks to be more aggressive but it was not the case – I believe they were generally defensive going into the start of the year. Equity markets were high and people felt volatility would rise as the year wore on, so they were cautious," he said.

Bankers agree this year's market conditions – while febrile at times – have not been as distressed as in 2020 or 2008, when it became punitively expensive to roll hedges, and exotic book losses inevitably spiralled. Few are discounting that happening again in future crises, particularly if they are preceded by a long period of low volatility. In the past, that backdrop has tended to spark fierce competition among banks in structured products, compressing the margins they make on these trades and so discouraging them from paying for costly hedges.

Mindful of these dangers, many have looked to the example of US banks, whose sprawling flow-trading operations minted huge profits in 2020, more than offsetting any losses elsewhere in their businesses. BNPP has acquired Deutsche Bank's prime services unit and bought the remaining stake in cash equities specialist Exane with an eye on expanding in flow, while SG and Natixis have also looked to bring greater balance to their equities divisions.

"The solution remains in the diversification of your business mix," said Boleslawski, who said Natixis CIB was trying to expand its footprint to other regions and products to be less dependent on retail structured products, with a goal of making less than half of its revenue from this business.

"That will take time, but we are managing to make some good increases in corporate activity," he said.