Bank of America is making a material increase to its fixed income, currency and commodities trading division in Europe as the lender looks to close the gap to US rivals in the region.

A spokesperson for BofA declined to comment on the exact growth in headcount beyond saying it was "meaningful", but sources familiar with the matter said it involved an increase of 20%–25% in FICC sales and trading in EMEA across a range of asset classes and locations, with a large chunk in the European Union. The bank has already completed 60 external hires in EMEA FICC sales and trading this year, the sources said.

The expansion follows BofA opening its Paris trading hub in 2019 in response to the UK’s departure from the EU, as the bank significantly increased its presence in mainland Europe.

It also comes at a watershed moment for global financial markets as government bond yields spiral higher, a dynamic that executives say should encourage greater inflows of investor money to Europe after years of negative interest rates acting as a deterrent.

"EMEA has always been an important part of the global markets ecosystem and an important part of our franchise. Brexit was an impetus for us to review our profile and increase our intensity on the Continent," said James DeMare, president, global markets at BofA. "We are excited. Our clients are excited."

BofA was the fourth-largest bank in global FICC trading by revenue in 2021, having slipped behind Goldman Sachs over the previous two years as its US rival grew rapidly in the high-volatility environment. BofA's senior management has identified Europe as an area where it can gain ground.

Many European banks have scythed back fixed income trading divisions over the past decade. And while a number of local banks still compete fiercely, the opportunity remains substantial thanks to the diversity of currency and bond markets in the region.

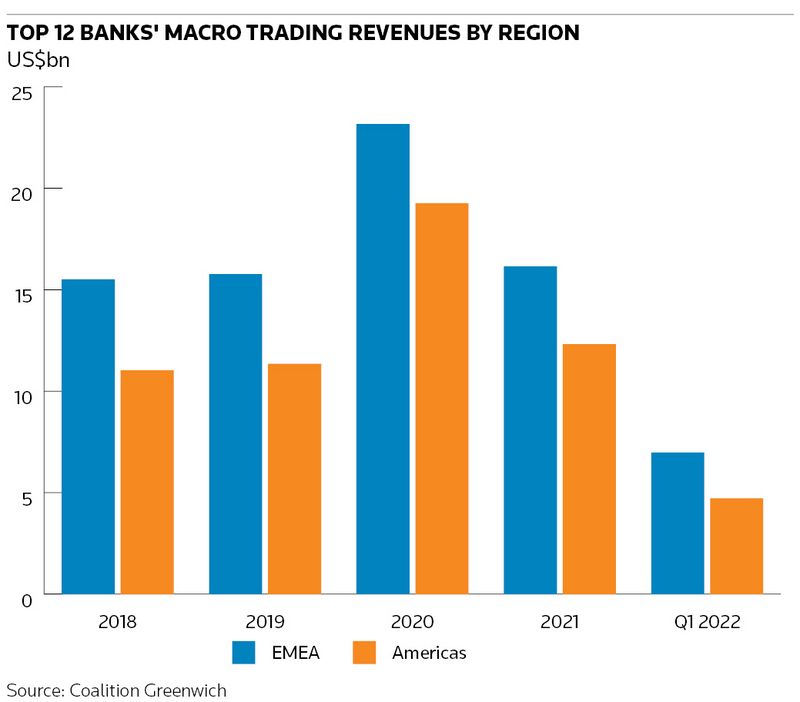

Macro trading revenues in products linked to interest rates and currencies have been more than 30% higher on average in EMEA than the Americas in recent years, according to analytics firm Coalition Greenwich, while broader FICC revenues were roughly equal between the two regions at about US$12bn in the first quarter.

European revival

Executives believe the industry revenue pool has further to grow as European fixed income markets start to look more appealing again to investors. The yield on 30-year German government debt recently rose to almost 2% from below zero in December, as traders reacted to the prospect of the European Central Bank ending its years-long experiment with negative interest rates. The yield on 30-year Italian bonds topped 4%.

"Europe is back," said Snigdha Singh, co-head of EMEA FICC trading at BofA, who predicted the region is on the edge of a "massive take-off".

It's the "first time in a decade rates are priced to turn non-negative. Our view is this is a regime change: we'll see a lot of money coming back to the region", she said. "Clients are under-allocated to Europe, so the pie is going to grow a lot."

BofA was an early mover following the Brexit vote, shifting material amounts of sales people and traders to Continental Europe, including a number of senior bankers. That was a reverse of its strategy following the bank’s merger with Merrill Lynch during the financial crisis of 2008 when staff were pulled out of Europe and concentrated in London.

The new hires are broad-based across different products and countries. Some are in London, such as several senior traders and salespeople in sterling credit, foreign exchange and low-carbon trading. But a large chunk of the new additions will be in mainland Europe spread across Paris, Frankfurt, Madrid and Milan. Those moves come alongside an initiative to increase the number of primary dealerships in Europe.

"Historically the largest gap was in Continental Europe," said Othman Kabbaj, head of EMEA FICC sales, arguing BofA has "significant upside in the EMEA region".

Kabbaj said the bank has been investing in people, products and platforms across sales and trading to expand its local footprint. "We’re now starting to see that investment yield results.”

Balanced portfolio

The European expansion is part of a broader push within BofA's global markets division, with the bank recently announcing it had expanded its global FX and emerging market businesses by more than 30 trading professionals since 2020. Singh emphasised BofA's plans to run a diversified FICC business on the assumption that asset classes will perform differently depending on the environment.

"To be relevant in these spaces you need to have scale. Markets are so interconnected and clients want that large global footprint that we have," Singh said. "We’re plugging the gaps with the aim of becoming top three across asset classes."

Commodities is one area where the bank is investing across sales, trading and structuring, according to Kabbaj, who said it "is currently one of the biggest opportunity sets given the structural themes around energy transition, energy security and inflation".

Macro products also present "significant opportunities given higher rates, market volatility and client demand for higher yields", he said, while ESG is another area of focus given investor interest is "growing exponentially".

“It’s an incredible environment for macro," Singh said. "We’re coming off a regime where volatility has been suppressed for 14 years because there was so much liquidity in the system. Now the environment is extremely rich. The market knows how to price where terminal rates should be – it’s been doing it for years – but it doesn’t know how to price quantitative tightening.”