Italy's Banca Monte dei Paschi di Siena plans to raise €2.5bn through a rights issue by the end of this year to underpin a major restructuring and new strategic plan, which includes 4,000 job cuts and branch closures.

The world’s oldest bank said last Thursday the Italian government, which owns a 64% stake after a 2017 bailout, will support the rights issue pro rata to its shareholding, meaning Rome will pump in another €1.6bn.

BMPS said it had secured a pre-underwriting agreement with Bank of America, Citigroup, Credit Suisse and Mediobanca as joint global coordinators of the new share issue. The rights issue is subject to shareholder approval at a meeting to be held by the end of September, and approval from European competition authorities.

The fundraising dwarfs the bank's current market capitalisation of less than €700m so non-participating shareholders will in effect be wiped out, as has been the case with the multiple recapitalisations of the bank since the financial crisis.

“These deals are tough and it is not easy to underwrite these transactions in this market," said a banker at one of the underwriting banks, "but there is a lot of wood to chop before we get to this transaction”.

The Tuscan bank has spent years struggling to survive and launched a business plan for 2022–2026 aiming to make it “a clear and simple commercial bank".

BMPS said its common equity Tier 1 ratio should improve to 14.2% by 2024 and 15.4% by 2026 after the rights issue and restructuring, giving it “significant buffers” to regulatory capital requirements.

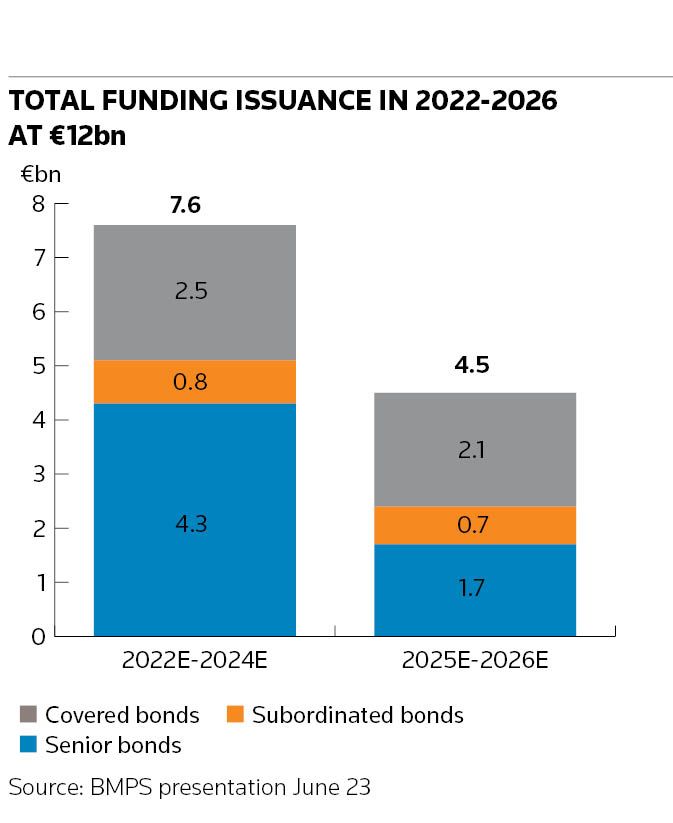

It also plans to implement a more stable and sustainable funding strategy by rebalancing towards customer deposits and institutional funding. It includes a reduction in funding from central banks and €12bn of cumulative bond issues in the 2022–26 timeframe.

That will include €7.6bn by the end of 2024, of which €4.3bn will be senior bonds, €800m will be subordinated bonds and €2.5bn will be covered bonds, according to a presentation to investors and analysts. Another €4.5bn is expected to be issued in 2025–26, comprising €1.7bn of senior bonds, €700m of subordinated bonds and €2.1bn of covered bonds.

"New chapter"

BMPS said it expects non-performing loan exposures to decrease by €1.3bn to €2.8bn by 2026, including €800m from a disposal in progress and expected to complete this year.

“Today our bank starts a new chapter, revamping its development path and aiming to reach a robust capital level, while keeping its own identity and leveraging its unique history,” said chairperson Patrizia Grieco.

CEO Luigi Lovaglio, a veteran Italian banker who took the helm at BMPS in February, said the bank’s value had been hidden “for too long” by its legacy problems.

“The simplification of the group structure is the first important step to achieve the plan’s targets, to streamline and speed up processes on the basis of a simple and agile organisation,” he said.

The plan includes about 4,000 job cuts from a voluntary redundancy scheme, which should save €270m per year from 2023, after restructuring costs of about €800m.

BMPS plans to cut about 150 branches, including 100 by 2024, reducing its network to 1,218 branches.

It expects pre-tax profit to rise to €909m by 2026 from €263m in 2021. Operating income is forecast to rise to €3.29bn in 2026 from €2.98bn in 2021, while costs are expected to decline to €1.89bn from €2.11bn.

The bank will restructure into three business divisions: retail and SME; large corporate; and investment banking. The latter will be called MPS Capital Services, and include corporate finance, investment banking and capital markets activities, and will be positioned as a hub for structuring and project finance, the presentation showed.