In a bit of ingenious financing, Royal Caribbean Cruises (RCL) tackled a portion of its pandemic-era debt by raising US$1.15bn from the sale of a three-year convertible bond and using that money to simultaneously repurchase an equivalent amount of CBs maturing in 2023.

While such rollover financings are commonplace, RCL has differentiated itself from sector peer Carnival which, a few weeks earlier, opted to raise US$1bn through straight equity. Where Carnival concluded it had to dilute its shareholders yet again – to the point where outstanding shares have increased by 80% during the pandemic – RCL believes it can sustain a high-debt position, for now at least.

One factor in RCL's favour is an agreement in place with Morgan Stanley to backstop the sale of US$3.15bn of new debt in 2023, a commitment typical on leveraged acquisitions but novel to a high-yield company like RCL seeking to manage heavy debt loads.

“The expectation is that RCL will be back in the market again in the next 12 months,” said one equity-linked banker involved in the CB offering. “Royal Caribbean has a lot of debt maturing in the short term. The reason they didn’t do more now is they are hoping for market conditions to improve.”

Morgan Stanley, sole counterparty to the backstop, and Bank of America were joint bookrunners on Monday's sale of the new US$1.15bn three-year CB priced at 6% coupon and 40% conversion premium, the midpoint of the 5.75%–6.25% and 37.5%–42.5% price talk.

The banks launched at a US$900m base, upsized to US$1bn at pricing, and US$1.15bn once the greenshoe was exercised later in the week.

As part of the financing, RCL bought back US$800m and US$350m of its 4.25% and 2.875% CBs maturing in June and November 2023, reducing the outstanding on those bonds to US$350m and US$225m. The refinancing – US$1.15bn of new debt to buy US$1.15bn of old debt – was net-neutral to shares outstanding and represented 60%–70% of the outstanding bonds.

“To avoid triggering tender rules, the general view was that the size of the repurchase should be limited to 80% of outstanding,” said the banker. “The repurchase benefits execution of the new deal because hedge funds are able to roll over delta hedges they have in place.”

Cruise control

RCL’s shares closed on Monday at US$35.79, after falling 7.5% while the CB was marketed, and traded late in the week at US$39.45, elevating prices on the new CB to 110.

The 4.25% and 2.875% CBs being repurchased, which RCL issued at the height of the pandemic in 2020, are convertible at share prices above US$72.11 and US$82.50, so are deeply out of the money.

RCL has been more reluctant to sell stock than other cruise ship operators, relying more heavily on term debt and other sources of credit with a goal to limit earnings dilution.

RCL CEO Jason Liberty appeared to take a swipe at Carnival’s decision to raise US$1bn by selling stock last month. “I know that there is focus around the balance sheet and especially in the current state of the capital markets,” he said on the company's second-quarter earnings call on July 28. “I think we have clearly shown [throughout the pandemic] we have been very thoughtful and very methodical about capital raising, balancing liquidity and minimising dilution, especially relative to others.”

RCL did raise US$2bn from pandemic-era stock sales, at US$60 a share in October 2020 and again at US$93 in March 2021, but has increased shares outstanding by only about 20%.

2023 debt tower

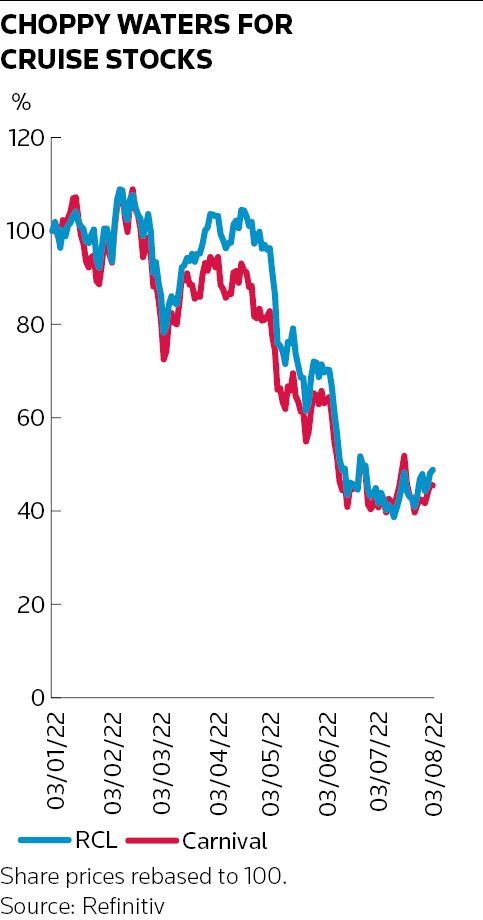

While RCL’s equity-light strategy may benefit shareholders in the long term – assuming it can be maintained – a debt-laden balance sheet won't help it ride choppier waters in the near term.

In addition to US$575m now remaining of earlier CB debt, RCL has US$2.575bn of term debt coming due by the end of 2023.

It was able to smooth near-term maturities by selling US$1bn of 5.5-year senior unsecured high-yield debt at a 5.5% coupon in January, and put the backstop agreement with Morgan Stanley in place a month later.

The meteoric rise in interest rates and near-closed capital markets since have made things more challenging – the 5.5% HY notes RCL issued in January now trade at 82, bumping their yield to maturity to 11%, and RCL five-year CDS has ballooned above 1,000bp, from 400bp entering the year.

The backstop agreement allows RCL to sell to Morgan Stanley up to US$3.15bn of five-year senior unsecured debt at any time between April 1 and June 29 that year, subject to the “satisfaction of certain conditions”, to repay debt maturing in 2023.

RCL could not be reached for comment. Morgan Stanley declined to comment.

Backstop commitments typically obligate for a specific size but allow for flexibility on pricing. The bonds may allow for a discounted price to subsidise economics at a specific coupon, said bankers away from the RCL situation.

RCL is recovering, having just reported its first cashflow positive quarter since the onset of the pandemic. In the second quarter, the company generated adjusted Ebitda of US$123m on revenue of US$2.2bn.

The results are a major reversal from the US$729.8m Ebitda loss RCL posted in the second quarter of 2021, when it generated just US$50.9m of revenue.

Reinstated earnings guidance has RCL management guiding toward third-quarter Ebitda and revenue of US$700m–$750m and US$2.9bn–$3bn.

Operating cruise ships has been an amazingly lucrative business in good times. In 2019, before the pandemic, RCL churned out US$3.4bn of Ebitda.