Rising interest rates and a dimming economic outlook have created a challenging backdrop for banks’ credit trading divisions this year, with desks handling everything from investment-grade bonds to distressed and structured credit all reporting a fall in revenues.

One notable area is bucking the trend: private credit.

Revenues at the top investment banks are up about 35% in private credit over the past two years, according to data firm Coalition Greenwich. That has helped cushion the decline in more traditional bank activities such as trading corporate bonds, with “flow” credit trading revenues plunging about 50% over that period.

“We’ve seen significant expansion in the private credit markets over the last two years as banks have become much more adept at providing financing and servicing these needs,” said Michael Turner, head of competitor analytics at Coalition Greenwich.

“Banks want to grow steady, accrual-like revenues in a rising rate environment, but they also need to be wary of credit deterioration and ensure that they have sufficient margins to protect against a downturn," he added.

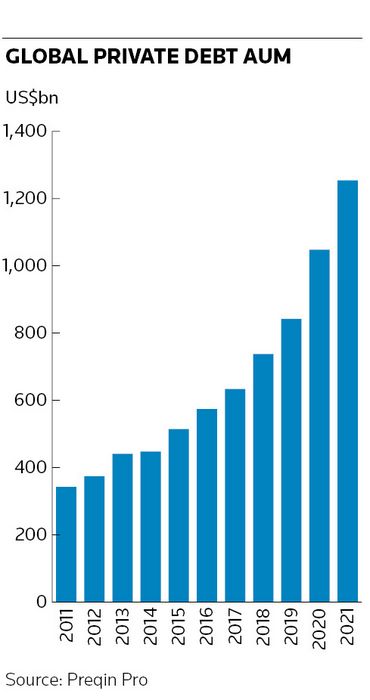

There is more than a whiff of irony about banks’ expansion into private credit, a part of the capital markets that has grown rapidly in recent years in response to a curtailment in bank lending. Private debt fund assets roughly doubled to US$1.25trn at the end of 2021 from four years previously, according to data provider Preqin, with the largest investors now able to deploy enough capital to rival banks’ syndicated loan desks on many deals.

Private credit funds have been able to flex their muscles even more this year, deploying some of their US$400bn in dry powder. Volatile credit markets have seen banks sitting on stuck exposure to leveraged buyouts, leaving underwriting desks with a hangover of deals to shift – along with some hefty losses – and private credit shops have proved willing to take on that exposure, although only at large (and potentially lucrative) discounts.

If you can’t beat ‘em

Despite the narrative of private credit funds eating their lunch, though, many of the top investment banks have steadily increased their presence in these markets in recent years, often through providing bridge funding or leverage to private credit funds from the financing desks housed within their fixed-income trading units.

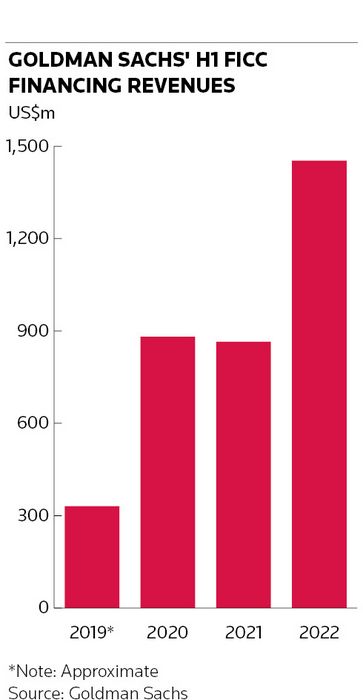

Take Goldman Sachs. Its fixed-income, currencies and commodities financing revenues (which bundle together a range of financing activities including those related to mortgages and repo as well as private credit) were US$1.5bn in the first half of the year, an increase of well over four times from the same period in 2019.

"The emergence of the private credit market presents both a fascinating challenge and also an opportunity for banks. The question is how individual banks respond," said Chris Skinner, head of UK debt and capital advisory at Deloitte, noting the range of approaches banks have tried, including the establishment of lending partnerships, in-house funds and offering investors leverage.

The appeal of such activity is clear for bank executives. While it may be prone to one-off blow ups, this financing generally provides a more stable source of revenues than volatile trading businesses.

“We like having a wide array of businesses within credit to have a portfolio effect, so that when some are underperforming, others are performing more strongly,” said a senior credit trader at a major bank. “Growth within the credit complex has been skewed towards private credit as alternative financing has opened up. Capital markets have had a significant hangover to deal with, which has benefited the growth of this space.”

Direct competition

This year's turbulence has helped foster a more collaborative attitude between banks' underwriting desks and private credit funds, as bankers have looked for help to offload some of their deal overhang. But that chummier dynamic won't stop many banks from forming their own direct lending groups internally, either within their asset management divisions or their investment banks.

Mitsubishi Financial Group was the latest to join the fray when it announced earlier in August it had formed a direct lending group. Barclays and Deutsche Bank are also eyeing an expansion in direct lending, while JP Morgan recently said it would dedicate more resources towards this space.

In short, both banks and investors are betting on these markets swelling further in the years ahead – and will continue to jostle for position.

“The direction of travel continues to be growth in the private credit market,” said Paul Simcock, a partner at law firm Alston & Bird in London. “Private credit is much more mature in the US, but the European market is going from strength to strength and we expect assets under management to keep growing.”

Additional reporting by Eleanor Duncan