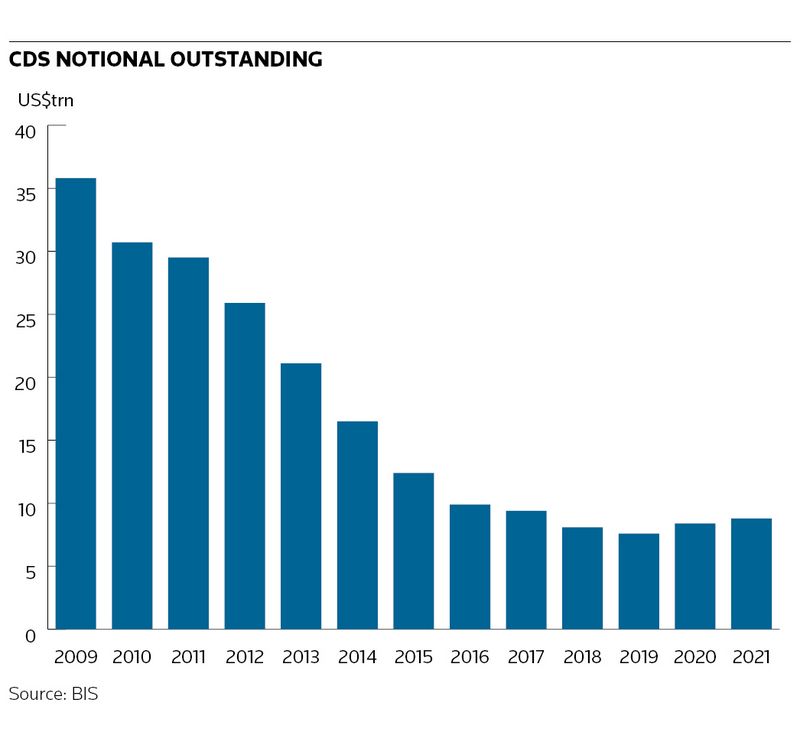

A crucial part of infrastructure underpinning the US$9trn credit default swap market has become shakier this year as the industry body that rules on CDS events has shrunk further in size, raising questions over whether it remains fit for purpose at a pivotal juncture for the market.

The Credit Derivatives Determinations Committee has not found a replacement for Cyrus Capital Partners following the New York-based hedge fund’s departure in April, leaving the decision-making panel of banks and investors two firms short of its required quota of 15.

It comes at a time when defaults are poised to pick up amid a deteriorating economic outlook. The Committee has already fielded a flurry of questions this year, including over Russia CDS – its most high-profile ruling since Greece’s sovereign debt default over a decade ago.

CDS veterans believe the Committee’s dwindling membership shouldn’t pose an immediate threat to the smooth operation of the market, although John Williams, a partner with law firm Milbank, said there was "definitely a certain point at which it becomes a problem".

"I personally think this should be fixed as it’s not good for things to operate differently from what the rules say,” Williams said.

Others are concerned that further departures could undermine safeguards built into the Committee to maintain its integrity.

“In practice, it will become increasingly difficult to function if more institutions decide not to participate,” said Chris Arnold, a partner at law firm Mayer Brown, who, like Williams, has been heavily involved in the development of CDS markets over the past two decades.

The Committee rules on a range of crucial matters for the everyday functioning of the CDS market. Those include deciding when credit events that trigger payouts to protection holders have occurred. Created in the aftermath of the 2008 crisis, the Committee is supposed to comprise 10 banks and five investment managers. (See box story.)

That mix aims to encourage a diversity of views on the panel, while an 80% “supermajority” threshold for votes to be carried is designed to prod it towards a broad-based consensus on rulings. The rare decisions that don’t meet that threshold are referred to a group of independent legal experts for review.

Keeping the balance

Such a process is unique in financial markets and has drawn a fair amount of criticism over the years, not least because those sitting on the Committee can stand to gain or lose economically from the decisions it makes. There are various mechanisms that look to shield the Committee from manipulation. Chief among those is maintaining the correct balance of firms, as well as the supermajority requirement.

“We understood that participants would take biases into the Committee, so we wanted to design it in such a way that those biases would not affect the outcome. That’s why we erred towards the supermajority structure,” said Athanassios Diplas, a former Deutsche Bank executive who helped design the Committee.

Cracks in that structure first appeared in 2019 when Societe Generale left the Committee, following the likes of Royal Bank of Scotland and UBS out the door after cutting back in CDS trading. No bank replacement has since been appointed – a reflection of the shrinking population of major dealers active in CDS.

Cyrus’s departure has now exposed the lack of fund managers willing or able to join the Committee.

Insiders point to the Committee's considerable workload as one reason for the absence of those willing to step into the breach. That's particularly onerous for buyside firms, where relatively smaller staff numbers mean they often employ external lawyers to sit in on their behalf. There have been over 30 meetings on Russia CDS alone this year.

Noisy business

Committee members also have to contend with the inevitable noise and scrutiny around high-profile events such as the defaults of Russia or Greece. Pimco, for instance, sits on the Committee and is known to have been one of the largest sellers of Russia CDS protection. Pimco declined to comment. The investment manager was one of 12 firms that voted to trigger Russia CDS nearly three months ago.

“It’s quite an administrative burden for those that do participate and it also attracts some attention from time to time,” said Arnold. “The Determinations Committee is essentially a utility. No one who serves on it gets any kind of remuneration; it’s purely voluntary. Institutions do it essentially for the good of the market. They recognise it needs to exist.”

Declining interest from CDS users to join the Committee may force it to evolve. Williams suggests the rules could be adjusted so there are eight dealers and four fund managers, with a 75% supermajority.

"Below that [number of members] I think it becomes a problem," he said.

So far, the Committee has survived 13 years of intense regulatory and media scrutiny. Now it's reliant on the readiness of CDS users to get involved if it is to continue to endure.

“It’s a commitment to be involved – there’s no question,” said Diplas. “But it’s something that’s a necessity for these markets – they won’t work properly if people don’t participate. It’s important people realise they are making a living out of these markets and therefore they need to maintain its important functions."

The birth of the modern CDS market

The credit default swap market expanded at breakneck pace from virtually nothing in 2003 to a peak of over US$60trn in 2007, before falling back to earth. That explosive growth also came with a worrying lack of standards governing how these contracts should behave.

Trading counterparties had to agree among themselves such fundamental issues as whether CDS had triggered and what constituted a fair payout. Discussions became heated as defaults increased in those years. “It was not an ideal situation to have these decisions being made on the hoof,” said Chris Arnold at Mayer Brown.

The 2008 financial crisis accelerated a regulatory push from the New York Federal Reserve under Timothy Geithner to modernise the market so that contracts could be funnelled through central clearing houses to reduce systemic risk. The result was the “Big Bang” in 2009, which hardwired the Determinations Committee and the CDS auction process into all CDS contracts.

“The biggest hurdles to setting up a CDS clearing house was creating a mechanism to, one, determine for the market as a whole whether or not a credit event had occurred and, two, settle all trades in the market at the same level,” said Tom Benison, a former JP Morgan executive.

Benison and Diplas led the project under the auspices of the International Swaps and Derivatives Association with help from lawyers at Allen & Overy including Arnold and John Williams, as well as oversight from regulators led by the New York Federal Reserve.

“We wanted to make sure that the decisions of the Committee would be broadly accepted. If people didn’t like the mechanism, they wouldn’t sign up for it,” Benison recalls.

They inserted various safeguards into both the Committee and auction processes to prevent manipulation. As well as the supermajority rule, votes are publicised and there are compliance requirements for managing internal conflicts of interest on the Committee.

For the auction, using real trades and including an option for physical settlement looked to address some of the concerns that arose around the Libor fixing scandal. Still, such measures haven’t stopped criticism of the CDS market, particularly when it produces unexpected results.

“CDS as a product is imperfect. That was part of the reason for setting up a process for this,” said Benison. “Overall, it’s a robust process that was built with oversight from the regulators. That doesn’t mean it couldn’t be improved upon. But I’ve never heard anyone suggest a better alternative."