Sustained selling of long-dated UK government bonds from investors including UK pension funds looks to have been the main reason the Bank of England was forced to announce plans to intervene in the Gilt market to bring a measure of calm on Wednesday after an extraordinary few sessions in these markets.

The yield on the 30-year Gilt plunged to under 4% from as high as 5.1% earlier in the day following the BoE’s announcement that it would temporarily buy long-dated Gilts. UK government bond markets had become increasingly dysfunctional since the country’s chancellor of the exchequer, Kwasi Kwarteng, announced a series of large, unfunded tax cuts the previous Friday.

Strategists at HSBC dubbed the BoE's intervention its own "whatever it takes" moment, a reference to the famous comment from former European Central Bank president Mario Draghi, which many credit with bringing an end to the eurozone sovereign debt crisis a decade ago.

Traders had reported heavy selling of long-dated Gilts as so-called liability-driven investment strategies managing defined benefit pension schemes have been forced to raise money to fund margin calls on their portfolios. Those margin calls had threatened to create a self-reinforcing feedback loop, where rising yields precipitate more calls for collateral and further selling, pushing up yields once more.

In one example of the extremity of market moves, the yield on 30-year UK inflation-linked bonds (which have historically been popular with LDI investors) jumped from below 0% the previous week to above 2.5% on Wednesday prior to the BoE’s announcement, before falling back to 0.7% on Thursday.

"We've been hearing that LDI investors have had to raise collateral by selling bonds and that's a big reason why long-dated Gilts – and inflation-linked bonds in particular – have been under so much pressure," said Mike Riddell, a senior portfolio manager at Allianz Global Investors.

Long-dated UK government bond yields have been rising for some months now, but the speed of the moves accelerated sharply after the UK government outlined sweeping tax cuts in its so-called mini-budget. The yield on the 30-year Gilt jumped about 150bp from its pre-budget levels to an intraday high of 5.1% on Wednesday before the BoE intervened – an unprecedented leap for a benchmark that had yielded less than 1% in late 2021.

That created a major problem for LDI investors, who implement investment strategies aimed at managing defined benefit pension schemes. These schemes, which promise pensioners a defined payout in retirement, held about £1.6trn in assets at the end of August, according to the Pension Protection Fund.

LDI strategies have become increasingly popular in recent years as pension funds have looked for ways to meet these obligations. Those strategies usually involve entering derivatives contracts linked to long-term interest rates and inflation, as well as leveraging their Gilt holdings in repo markets. That leaves LDI managers vulnerable to a liquidity squeeze if government bond yields jerk higher, forcing them to meet margin calls to reflect changes in the value of their positions.

Although pension funds tend to hold some cash buffers to meet margin calls, these have been run down in recent months amid a relentless rise in Gilt yields. As well as selling Gilts to raise money to post as collateral, investors say LDI managers have also been selling equity and credit fund holdings.

“The LDI story … has been playing out for a little while. They’ve been getting these collateral calls as rates have been moving higher [even] before we had the budget,” said Orla Garvey, senior portfolio manager at Federated Hermes.

“We’ve been seeing outflows from our credit funds for a number of weeks pre-Budget. It’s not a new idea, but obviously everything is ratcheted up with the move higher in rates," she added.

Stepping in

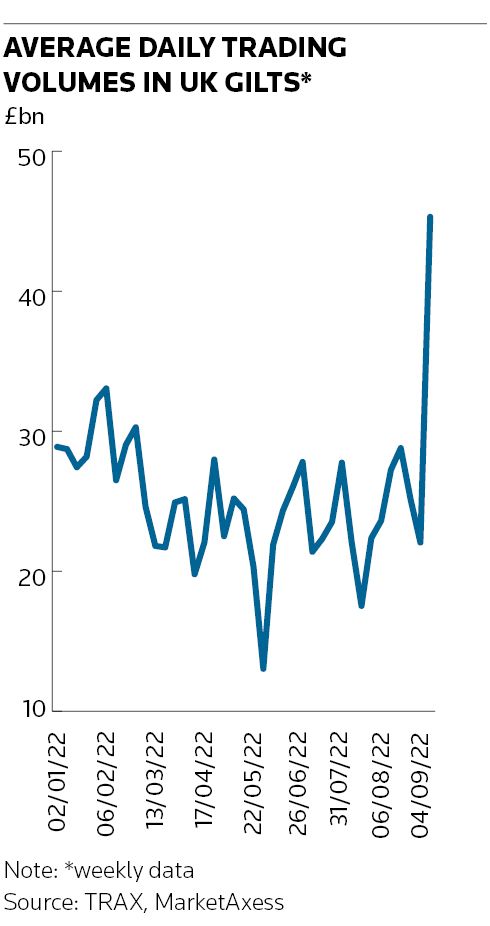

This dynamic may have made the BoE’s move to shore up Gilts inevitable. Markets had become frenzied, with average daily trading volumes in Gilts more than doubling from the previous week to £45bn, according to market-wide data from bond trading platform MarketAxess, as investors scrambled to adjust positions. Bid-ask spreads had also widened sharply, reflecting the heightened level of volatility.

Daniela Russell, head of UK rates strategy at HSBC, wrote in a note on Tuesday before the BoE’s intervention that the central bank might have to step in to restore market functioning. “What we are witnessing appears to be a disorderly move in yields, which could yet get worse in the near term. The more the selloff continues, the more stop-outs there will be,” she wrote, noting that the speed and scale of the selloff had been "highly problematic".

Russell and colleague Song Jin Lee said in a follow-up note on Wednesday the BoE's announcement should provide a backstop for long-dated Gilts and offer relief for pension funds facing "severe strain" on their collateral pools.

"By preventing a further uncontrolled selloff, it will take the strain off pension schemes and allow them to address their liquidity issues and top up their collateral pools," they said.

Experts note the rise in Gilt yields isn’t all bad news for UK pension funds, as it has also decreased the value of their defined benefit liabilities at the same time. Some funds that haven't used so many derivatives to hedge their liabilities, or leveraged their Gilt holdings in repo markets, may also see the rise in yields as a buying opportunity.

“If you’re an LDI fund your overall funding level has improved because of the fall in the value of your liabilities, but it’s the cash that needs to be posted against your hedges – that’s the issue. And it’s unclear how the dynamic plays out to be honest because all LDI funds are very different," said Garvey.