The forced selling by UK pension funds has sent a shudder not just through the Gilt market but has also embroiled UK corporates.

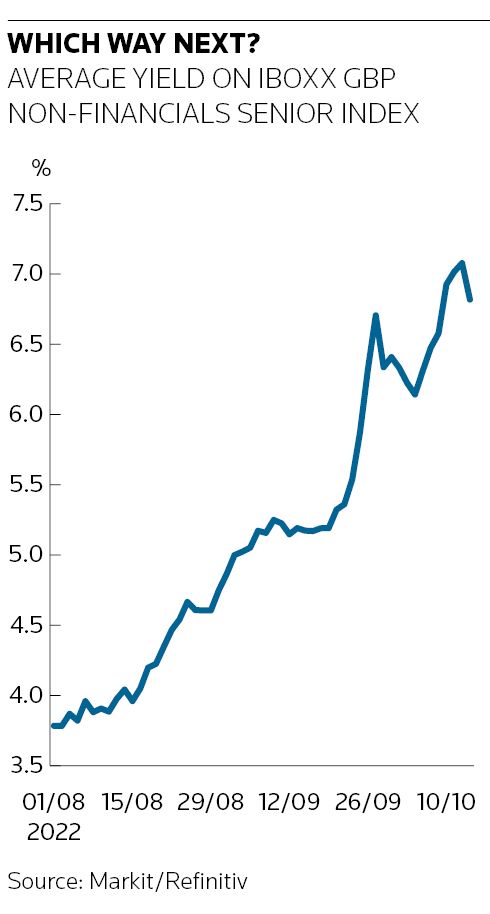

Even the best credits have seen their yields soar. In one example of how rampant selling has swept up liquid names, a £500m 1.5% July 2026 bond issued by consumer goods company Unilever (A1/A+/A) was trading at 6% at one stage last week, according to Refinitiv, before recovering to 5.64% by Thursday – though that's still 100bp higher than where it was quoted before the UK's mini-budget on September 23.

“If you get a margin call, then you sell what’s most liquid first, which after Gilts is corporates," said David Zahn, head of European fixed income at Franklin Templeton. "For companies that need to refinance, that will be expensive. Having said that, a lot of corporates have spent the last decade extending out maturities, so they don’t have a huge need for new debt in the near future."

The sterling investment-grade corporate primary market has been shut for over a month, with nothing printed since Danish utility Orsted sold two sterling notes as part of a dual-currency triple-tranche trade in early September. Those notes are now trading 10–15 points below reoffer.

Who's first?

Bankers still hope there will be more supply in the coming weeks, though that would require a company to get over first-mover fears. "We have five deals in the pipeline and you need one to go to open up that supply, but nobody wants to be the first," said one DCM banker. "Unless that one goes, there might be zero deals this year."

Yet at the same time, he was hopeful that a "constructive" sterling market "will offer access if issuers are willing to be pragmatic about absolute levels".

"We feel at these levels and with the liquidity that’s built up there will be a meeting of minds," he said. "Things could be worse in January and February. Issuers may say ‘I hate 7% but the direction of travel is not in my favour’."

Higher yields could tempt cash-rich investors into activity. "We have had such a dearth of primary activity in sterling these last few months, I would expect a new deal, priced attractively from a well-liked credit, would actually do quite well," said James Vokins, global head of investment-grade credit at Aviva Investors.

"It may even add some stability to the market and demonstrate the depth of the demand. Having said that, there would need to be a high level of spread compensation to tempt investors to part with their cash and this would likely push the secondary curve wider."

Paola Binns, head of sterling credit at Royal London Asset Management, said market stability was needed before any further issuance could be contemplated, despite the attractive yields for investors. She said, though, with so much up in the air, such as the Bank of England's strategy, "it looks unlikely to happen in the short term".

The Bank of England's efforts to stabilise markets in recent days have included a temporary pause on sales of its corporate bond portfolio, which had started last month. It has also put in place a repo facility aimed at allowing pension funds to borrow money against assets including Gilts and corporate bonds, though the effect on the corporate market has been limited because of the cost involved to access it.

In the meantime, certain UK corporates are considering other funding avenues, including other currency markets or private placements. Private markets, in particular, have offered diversification and a less volatile arena for corporates seeking to lock down some immediate liquidity. For example, Anglian Water, which has been sitting on a nine-year sterling sustainability-linked bond since holding calls on September 6, is also exploring a £150m 15-year private placement.

Playing away

The picture is less clear for corporates lower down the ratings spectrum. Two UK-related issuers, energy firm EnQuest and entertainment company Odeon Cinemas via Odeon Finco, did announce deals last week but in the US dollar market – a natural home for both, given their particular characteristics.

UK-domiciled EnQuest, which sold a US$305m five-year non-call two note at 12%, is an oil and gas company with a highly international business, while UK brand Odeon Cinemas is a subsidiary of US outfit AMC Entertainment. Odeon's US$400m five-year non-call two note was due to price on Friday (see Top News for more).

For most UK high-yield issuers, however, market access appears a more difficult prospect, particularly in sterling. There have only been four high-yield deals executed in the currency since the start of the year, three of them in January.

Still, high-yield investors are relatively sanguine. "From a public market or bond perspective, I'm less concerned because the big issuers are all pretty much okay from a liquidity perspective and don’t really have any maturities coming due in the next two years," said one high-yield investor.

UK-domiciled high-yield corporates have £2.4bn-equivalent of fixed-rate debt maturing before the end of the year, according to IFR data, with roughly £15bn-equivalent maturing in 2023 and £12bn-equivalent in 2024.

More concerning could be issuers with large floating-rate debt exposure like Morrisons, given servicing costs will become more expensive as interest rates rise.

Over half of the supermarket's funded debt is floating-rate and it has no interest hedging in place, according to Moody's. With the Sonia rate up by 100bp and three-month Euribor by 120bp since August 1, the ratings agency said Morrisons' interest expense would increase to about £335m a year from around £300m, excluding lease interest.

But even with interest rates ramping up, and a deep recession in the UK a possibility, a second high-yield investor thought most issuers will muddle through. "A lot of UK names have hedged and mix fixed and floating-rate debt," he said. "Unless they have a near-term maturity, I don’t see a rising rate environment pushing them into defaults."

Additional reporting by Eleanor Duncan, Helene Durand, Jihye Hwang and Lorena Ruibal

Refiled story: Corrects spelling of Zahn in third paragraph