A growing number of investors and economists are convinced the Bank of England should delay sales of its Gilts portfolio that are currently scheduled to begin at the end of the month amid ongoing volatility in UK government bond markets.

Such a move would mark a climb down for the BoE, which has so far appeared determined to proceed with its plans to start selling Gilts on October 31. The central bank has already had to postpone the start of this “active quantitative tightening” from its original start date of early October, after it announced emergency Gilt purchases on September 28 in an effort to calm bond markets upended by the UK's so-called mini-budget.

That emergency purchase programme was due to stop on Friday, but many analysts doubted that it would with bond markets remaining febrile. Analysts are even less convinced that the BoE will be able to start to sell Gilts at the end of the month. They note the market outlook remains hugely uncertain amid fast-moving political events.

Gilts had staged a rally in the latter half of a roller-coaster week following media reports that the government was set to make an extraordinary U-turn over its fiscal plans. That culminated in prime minister Liz Truss sacking chancellor Kwasi Kwarteng on Friday and scrapping a cut in corporation tax that the government had pledged in the mini-budget.

But the rally faded on Friday afternoon, when the BoE completed the last of its scheduled Gilt purchases, raising questions over how stable markets would remain even after the government's partial policy reversal.

A fiscal U-turn is "helpful to the market and could also lessen pressure on the BoE to support Gilts", said Antoine Bouvet, senior rates strategist at ING. "We aren't out of the woods yet, however, and now isn't a time for complacency. It will take time to restore trading conditions in the Gilt market that look even remotely normal. The BoE has a chance to get the situation under control; let's hope they seize it."

Orla Garvey, senior fixed-income portfolio manager at Federated Hermes, said "the market focus should firmly shift from the BoE to the government". Still, she believes it's "highly unlikely" that active QT will begin at the end of October "given the fragility of the market and the upcoming risk events" including a series of important central bank meetings around the turn of the month.

Crazy week

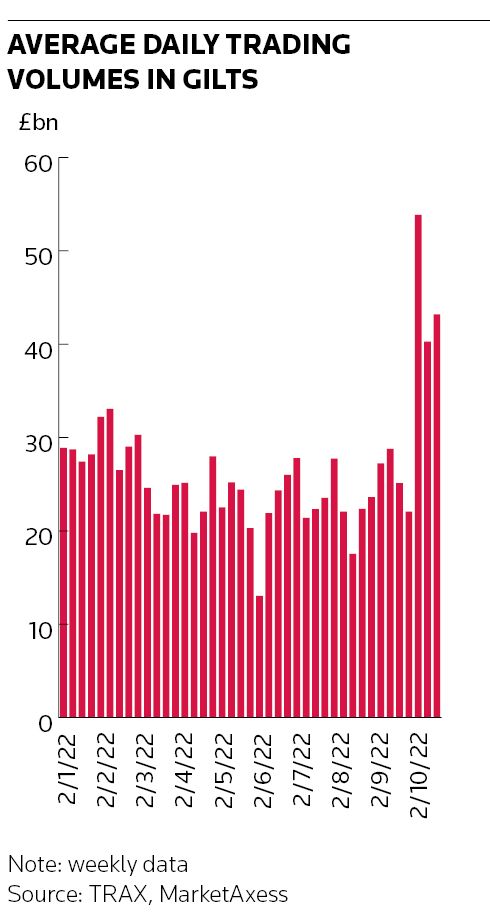

It was certainly another topsy-turvy week in Gilt markets amid a flurry of news from both the BoE and the government.

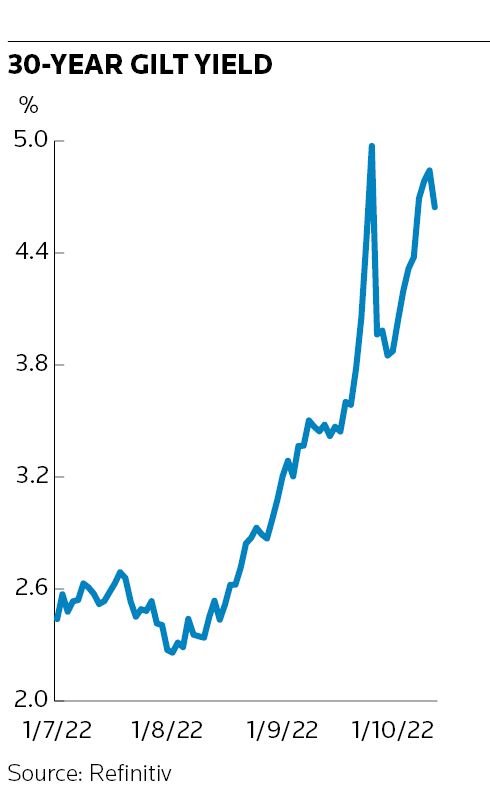

Long-dated yields jumped earlier in the week despite the BoE unveiling a series of new measures aimed at alleviating market stress. The 30-year yield rose above 5% on Wednesday – perilously close to the level at which the BoE originally announced its emergency purchases – as many doubted markets could cope with the BoE ending its emergency purchases on Friday.

But Gilts rallied as the week wore on, bringing much-needed breathing room for pension funds, which have found themselves at the centre of the market turmoil. A rebound that began on Wednesday afternoon accelerated on Thursday following the reports of the coming tax U-turn, pushing the 30-year yield down to as low as 4.2% on Friday morning before it rose back to 4.8% in choppy afternoon trading.

Communication issue

Despite what had briefly appeared to be a more positive tone in the markets towards the end of the week, investors remained unimpressed by the BoE's plans to finish Gilt purchases on October 14 only to start Gilt sales on October 31.

“The Bank of England has a communication issue. It makes no sense to say you'll buy bonds one week and sell them the next,” said David Zahn, head of European fixed income at Franklin Templeton.

“They need to stabilise the market, remove the stress that’s there, get it working again and then talk about QT. They should wait several months, maybe until early next year. The market is getting confused by [their mixed messages]. As a result, we are going to get more volatility.

"They need to get the Gilt market working properly given that the Gilt market is how they transmit their monetary policy," he added.

Bouvet said the BoE had made a mistake in committing to active sales of Gilts. “We’ve seen from the second quarter that the Gilt market was buckling under the prospect of QT. The end of the month is way too short, they need to postpone until at least 2023. They need to reduce uncertainty and buy some time,” he added.

Balancing act

There is no denying that the BoE has been forced into a difficult balancing act in recent weeks, caught between the need to shore up febrile UK bond markets (without looking like it is financing the government's fiscal largesse) and remaining credible in its battle to tame inflation that has been running at multi-decade highs.

The Gilt market had become dysfunctional following the UK government’s mini-budget on September 23, which promised large, unfunded tax cuts along with a huge energy bailout for consumers and businesses. Bond yields jerked higher in response, triggering unmanageable margin calls for pension funds that had deployed “liability-driven investment” strategies using derivatives.

The announcement of the BoE’s emergency purchase programme on September 28 sent long-dated Gilt yields tumbling lower, creating some much-needed breathing room for pension schemes to replenish liquidity reserves. The danger for the BoE was that a more prolonged commitment to underpin Gilt markets could lessen the pressure both on pension funds to delever – and on the UK government to reassess its proposed tax cuts.

Neil Shearing, group chief economist at Capital Economics, said markets needed reassuring over the government's fiscal plans and that the BoE's policy would be guided by that.

"In every conceivable scenario, the BoE will have to backstop the market for a long time, if not through outright asset purchases then through other means such as an increased use of its repo facility," said Shearing. "It has a torturous path ahead."

Paul Dales, chief UK economist at Capital Economics, said that having already delayed the start of active QT, it would make sense for the BoE to wait a little bit longer. "As we shift to a higher rate environment, that creates more uncertainty so it will be harder for the BoE to shrink its balance sheet as quickly as it wants," he said.

Stepping back?

The BoE has unveiled other measures aimed at stabilising markets in recent days, including a temporary pause on sales of its corporate bond portfolio, which had already started. It also added inflation-linked bonds to its temporary buying programme on Tuesday and has put in place a repo facility aimed at allowing pension funds to borrow money against assets including Gilts and corporate bonds.

The BoE may yet win credit for standing its ground and refusing to backstop Gilts indefinitely if markets end up stabilising without further support from the central bank, not least because its stance may have encouraged the government to reverse its tax-cutting plans.

But many believe muddled messaging out of Threadneedle Street has been damaging to the BoE’s credibility and risks backing it into a corner. BoE governor Andrew Bailey said on Tuesday that the support would end this week, while the Financial Times reported the BoE had told bankers privately that the purchases could be extended.

Luke Bartholomew, senior economist at abrdn, said the BoE was trying to dispel concerns around fiscal dominance, where it would be forced into more permanent operations to support Gilt yields in response to the volatility and the repricing of Gilts caused by the government’s fiscal policy. But he suggested recent statements from the BoE risked damaging its credibility given how vulnerable Gilt markets have been.

“Having to reverse course after such an explicit statement of intent is likely to end up further damaging the Bank’s standing with markets and efficacy of its communication,” Bartholomew said.

The Bank of England declined to comment.