The extreme volatility gripping financial markets has proved to be a mixed bag for banks this year. Corporate financiers have struggled amid a drought in dealmaking, while trading desks have thrived as investors shuffle positions.

In this sales and trading bonanza, now stretching into its third year, JP Morgan is on track to equal its record haul of nearly US$30bn in annual markets revenues registered in 2020. That will cement its place as the pre-eminent bank in global markets, a position it has held for more than a decade after weathering the 2008 financial crisis better than its peers, and vindicate its decision to maintain a beefed-up trading unit during the leaner spell that preceded the pandemic.

But staying on top of the pack looks set to become tougher than ever in the years ahead as US rivals along with a clutch of resurgent European banks battle to grab a larger slice of the revenue pool. The likes of Goldman Sachs, Morgan Stanley and Barclays have grown at an even faster pace in this high-volatility environment, underlining the difficulties of maintaining a lead.

“The competition has never been this tough," Marc Badrichani, JP Morgan’s head of global sales and research, told IFR in an interview at the bank’s Canary Wharf office in London.

“Our focus has always been on staying close to large financial institutions so we can be their bank of choice and benefit from them growing. We believe that through doing that and being well positioned to capture some trends in markets, such as the growth of private assets, we will reinforce our leading position.”

Market share

The previous decade saw US banks increase their market share in sales and trading as many European firms such as UBS and RBS/NatWest beat a retreat. That helped cushion the decline in industry-wide markets revenues for US lenders, as the prolonged era of low interest rates depressed volatility and trading volumes.

But the market backdrop has changed hugely over the past few years, bringing trading desks to the fore once again. Asset prices have been far choppier since the pandemic, prompting a flurry of client activity and providing a tailwind to the handful of banks determined to expand their trading divisions.

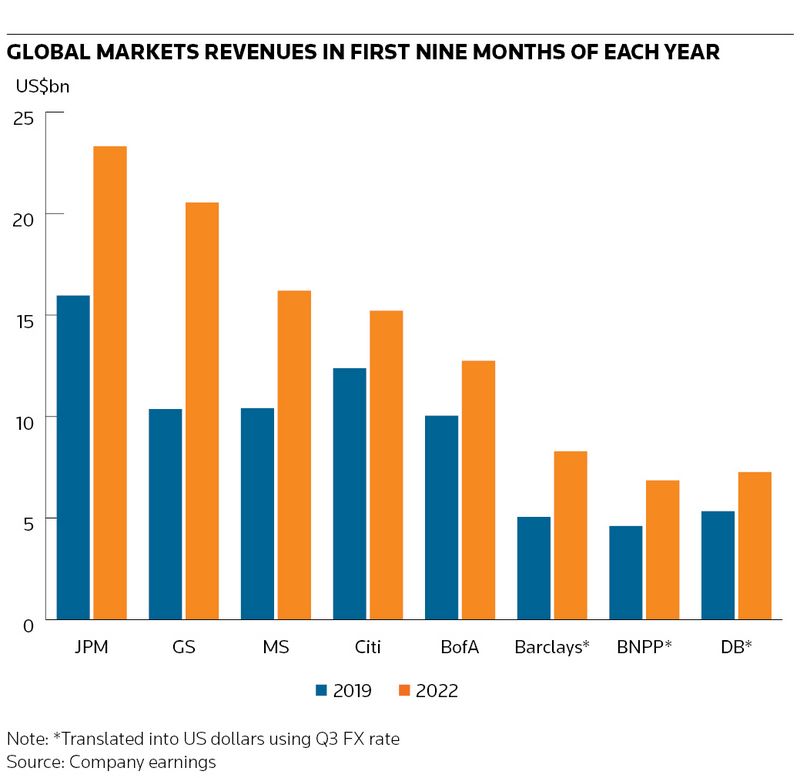

JP Morgan still remains out in front with US$23.3bn of revenue from trading in the first nine months of the year, a 46% increase compared with the same period in 2019, the last pre-pandemic year (and 5% above 2021). That has seen it increase revenues at a faster clip than Citigroup and Bank of America, but more slowly than the likes of Goldman, Morgan Stanley, Barclays, BNP Paribas and Deutsche Bank.

Goldman has been the standout performer in this period, roughly doubling its trading revenues to US$20.5bn so far in 2022 from its 2019 levels. Observers suggest increased risk appetite (particularly in fixed income) has been partly responsible for propelling these rivals up the ranks.

So is JP Morgan missing a trick by not growing trading revenues even more?

“You can always do better,” Badrichani said, highlighting some areas where JP Morgan has been investing. One of those is in electronic trading of corporate bonds, which has taken off in recent years.

“We want to be top three in all products,” he said. “There are times when you have some areas of weakness and you need to double down on those areas and correct them.”

One area JP Morgan has made notable headway in recent years is equities trading, where it is now going toe to toe with Morgan Stanley and Goldman. And what about trading in physical commodities, a space that many banks exited, but has been hugely profitable for those like Goldman that remain in a year dominated by swings in natural resource prices? JP Morgan is prominent in metals trading, but has a reduced presence in other markets after selling its physical business to Mercuria in 2014.

“We didn’t like the risk-reward of a lot of that business,” said Badrichani. “We are investing in new markets like renewables and at some point I think there’ll be an efficient carbon credit market. But we’re not going to change our footprint in energy just because energy is hot right now. Some of our competitors may have had a more profitable business mix this year, but our main objective remains serving our clients.”

An orderly correction

A concurrent slump in bond and equity prices has marked 2022 as a watershed year for financial markets as central banks have increased interest rates aggressively to tame inflation. Banks' ability to thrive in this environment stands in stark contrast to the 2008 financial crisis, when many teetered on the brink of collapse.

“Every time central banks tighten, that is going to create some stress in the system somewhere. But apart from the LDI situation in the UK, the market has corrected with no major dislocation – it’s been quite orderly,” he said, referring to liability-driven investment strategies that led to a fire-sale in Gilts by UK pension funds that prompted the Bank of England to intervene.

So what is the biggest risk facing markets today?

“The China-US relationship, because you have these two superpowers with tensions escalating between them, almost more by accident than design,” he said. “That’s the biggest risk in the system because that’s a risk to the globalisation model.”

More specifically for banks, the last two years has been a reminder of the potential for leveraged investors to blow up following sharp swings in financial markets. That includes the collapse of Archegos Capital Management last year, which inflicted roughly US$10bn of losses on its banks (a saga JP Morgan avoided), while the recent pension fund-related fireworks in the UK provided another timely example.

Badrichani said there is no perfect solution to guard against these scenarios. Instead, he said banks’ risk appetite should be dictated by the amount of visibility they have on a client’s overall position.

“Liquidity is always at the centre of what could go wrong,” Badrichani said. “Managing liquidity and concentration risk properly is the lesson to take.”

Keeping engaged

Half-Lebanese and half-French, Badrichani joined JP Morgan in 2005 and moved up through the ranks to sit on the bank’s operating committee. Alongside global markets head Troy Rohrbaugh, he oversees the bank’s strategy in sales and trading under investment bank chief (and JP Morgan president) Daniel Pinto.

He inevitably spends a lot of time thinking about what makes clients tick. That amounts to more than just offering strong trading execution, with Badrichani also emphasising the importance of servicing clients both before and after a transaction is completed.

"The post-trade is as important as the trade itself: ensuring that everything goes smoothly after a client trades with you," said Badrichani. "The number one reason Amazon is so successful is because their post-trade is brilliant – you press a button to order something and it arrives tomorrow."

Among other things on the “pre-trade” side of the ledger, Badrichani said JP Morgan has overhauled its research offering, even quizzing newspaper executives about how they retain readers’ attention as the world moved online.

“You can have the best content in the world, but if it’s in the wrong format, people are not going to read it,” he said. “Pre-trade is essential. The more we're able to personalise that content, the more connectivity we have with you and know what trade ideas you’re interested in.”

As to the overall mood among clients right now, Badrichani said it’s “pretty grim”.

“Clients aren't sure what probability to put on a range of outcomes from Russia's war in Ukraine and on any deterioration in the relationship between China and the US. Every client we meet is focused on these two topics,” he said.

And, finally, what about crypto? Jamie Dimon famously labelled bitcoin as "worthless", but behind the scenes banks like JP Morgan have been gradually gearing up for increased institutional demand for trading in crypto markets (while also exploring the uses of blockchain technology). Does the current crypto meltdown spell the end for institutional interest?

“Everybody is watching the space. You have a couple of hedge funds who have been very active, but it’s still too volatile for most institutional accounts,” he said. “They’ll feel more comfortable when it’s regulated, and that will happen. It’s just a question of time.”

QUICK-FIRE Q&A

Office or working from home? Office.

Sales or trading? I've spent my life in sales.

Humans or machine traders? Humans.

Invest in fixed income or equities? Fixed income.

Hard or soft landing? Bumpy.

Bullish or bearish? Constructively bullish.

US or Europe? To work: US. To live: Europe.

What keeps you up at night? Apart from my kids? The geopolitical situation in the world.

Will France win the World Cup? We have a better chance of winning the rugby world cup than the football world cup. Maybe this time it's really 'coming home' and England win.