There is potential for a revived CS First Boston to shine again as a standalone New York-headquartered capital markets and advisory firm and investors are showing interest in taking a stake. But much will hinge on how many top dealmakers the bank can keep, how its ECM, DCM and research platforms look after the carve-out, and how it will work with Credit Suisse.

Industry sources said "CSFB: the sequel" has a chance of success as it will be rooted in the deep and lucrative US capital markets and Michael Klein could galvanise the firm. Klein is a former star Citigroup M&A banker who joined Credit Suisse’s board in 2018 and has now been charged with running CSFB.

CSFB will be a spin-off of Credit Suisse’s advisory and capital markets activities. The new firm will be based in New York and outside investors will be invited, allowing the Swiss bank to sell down its stake over time. Klein is expected to merge his own M Klein and Co advisory firm into CSFB in return for an equity stake.

Former Barclays CEO Bob Diamond’s Atlas Merchant Capital is interested in investing, but it is too early to say whether it will go ahead, two sources said. Credit Suisse has said a “highly respected investor” has made a US$500m “hard commitment” to invest, but the investor has not been named.

There are key elements for optimism, in addition to CSFB's strong position in US markets. It is a top-tier franchise in M&A, ECM and serving financial sponsors; it will be focused on less capital-intensive areas; Klein is aiming for a "partnership culture" to build on the entrepreneurial spirit long championed at the firm; and it has a strong brand and history that should play well on Wall Street.

But details on the structure of the new firm are sketchy. It first needs to set up a legal entity, and the spin-off may not happen until 2024, reflecting how much of the planning still needs to be done.

“It’s ambitious. But judge us in two years, not now,” one insider said.

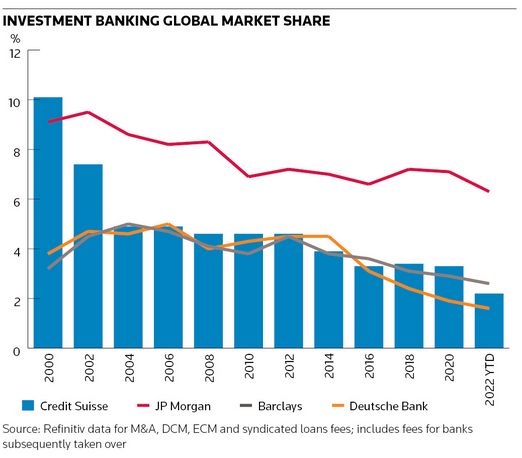

Stabilising revenues in 2023 will be a challenge before the carve-out. Credit Suisse’s revenues from M&A advisory, debt and equity underwriting and syndicated loans in the first 11 months of this year were down 52% from a year earlier, far steeper than the 34% drop across the industry and the biggest drop among the top 15 banks, according to Refinitiv data.

But it is still in seventh place for global fees, behind only the five US bulge-bracket firms and Barclays, showing the franchise is strong despite a run of scandals and blows. In the last two years Credit Suisse has still pulled in more in investment banking fees than UBS and HSBC combined. Klein knows that stopping the rot early next year is crucial to keeping staff and attracting investors, and bankers at the firm know that too.

The reaction among current investors has been grim, however. Credit Suisse shares have slumped 39% since the restructuring plan was unveiled on October 27, and on Thursday hit SFr2.65, their lowest level for at least 33 years. That values the bank at barely US$11bn.

Much of that decline is due to the drag of the bank’s SFr2.2bn rights issue. Credit Suisse also warned last month its investment bank will make another loss this quarter and the overall bank could lose SFr1.5bn. There has also been a dramatic outflow of funds from its wealth management arm.

The share price fall also reflects wariness about the complex spin-off of CSFB. The carve-out will include equity and debt capital markets teams, but research and trading platforms will sit with within Credit Suisse in its markets division, leaving many to wonder whether such a model is workable. ECM and DCM also need distribution capabilities, which again look like they will sit in sales and trading in Credit Suisse.

“If anyone can pull the First Boston idea off, Klein can. He was a great motivator at Citi,” said a senior banker who previously worked with Klein. “But it’s not clear at all how running an ECM/DCM underwriting business can possibly work in such a boutique. How would the risk be taken on by such a firm?” he said.

Others offered similar views. “I’d be questioning with equity research – what’s going to happen? To have an advisory team you need research ability really to pitch IPOs. Even for DCM, you need research publications to be readily available,” said a former Credit Suisse FIG banker.

A third banker said the service level agreements between the two entities would be crucial. They will provide clarity on the extent to which CSFB will be more than an M&A advisory boutique, and how much the two sides can avoid duplicating resources and costs.

“There are not many details available currently as to the nature of the partnership structure, what level of external capital CSFB plans to attract, the nature of relationship of CSFB with Credit Suisse Group post these changes,” Kian Abouhossein, an analyst at JP Morgan, said in a research note on Thursday. He also said more clarity was needed on the cost base of CSFB and how it would be funded once it is carved out.

Klein network

The plan is for CSFB to sit between M&A advisory boutiques and full-service banks. “More global and broader than boutiques, more focused than bulge-bracket players,” Credit Suisse said. The closest comparison is probably Jefferies, which has grown strongly over the past 20 years and had record revenues of US$7.1bn last year, including US$4.4bn from investment banking.

Credit Suisse expects CSFB to produce at least US$2.5bn of annual revenues. It will have about US$75bn of assets, or US$21bn on a risk-adjusted basis, compared with US$90bn of RWAs currently in the investment bank.

One banker at a rival firm said managing directors at CSFB would be expected to deliver at least US$5m in annual revenues at the new firm, although Credit Suisse said that was not a message that had gone out from Klein.

Klein, 59, launched M Klein and Co in 2012 after 23 years at Citigroup, where he was a star dealmaker and co-headed its investment bank, before leaving in July 2008. He has advised firms including Dow Chemical, Unilever and Glencore, and has an extensive network that may have helped draw the interest of Atlas Merchant Capital.

New York-based investment firm AMC is led by Diamond (who worked at CSFB for four years before joining Barclays in 1996), and the two know each other well. Discussions between Diamond and Klein are at an early stage and a decision on the size or structure of any investment has not been made, if it even happens, sources told IFR.

Klein advised Barclays when it bought the US operations of Lehman Brothers in 2008. That deal involved a complex carve-out of an investment bank, so could pave the way for the relationship between AMC and Klein to go beyond just an investment. Tom King, another former head of Barclays’ investment bank, is also an operating partner at AMC and worked with Klein at Citi.

A spokesman for AMC said the company would not comment on speculation.

Break-up threat

Bankers said key to CSFB’s success would be its ability to retain staff. Details on retention or reward packages have not been released to employees – including whether they could get equity or synthetic exposure to the new firm if they stay.

There was a flood of departures last year, when Credit Suisse’s troubles started mounting, and more exits this year. One headhunter said those holding on were waiting to see what retention payments were like. “Out-of-the-money options on the Klein trade seems to be what people are warming to,” he said.

Credit Suisse CEO Ulrich Koerner claimed the plans for CSFB had gone down well with bankers: “This has generated a lot of excitement among our investment banking colleagues as well as with talent currently outside the bank.”

The flip side to enticing staff to stay, however, is the risk of paying them too much and transferring value from Credit Suisse to the bankers.

Abouhossein said there might be another risk to the plans for CSFB if Credit Suisse shares remain near such low levels: “If Credit Suisse’s market cap were to stay around US$10bn for a prolonged period of time … M&A speculation [is] likely to increase and it may lead to an IPO of the Swiss retail legal entity worth SFr14bn, a full closure of the investment bank and retaining wealth management and asset management in the [new company].”