The Middle East was one of the few bright spots globally in equity capital markets in 2022, with IPOs regularly flooded with billions of dollars of demand. Bankers believe that not only is issuance sustainable, but the diversity of sectors, types of deals and even geographic location of companies tapping the market will expand, ensuring the region is a significant part of future ECM activity.

![]() While equity capital markets bankers around the world spent much of 2022 twiddling their thumbs, those in the Middle East were busier than they’ve ever been.

While equity capital markets bankers around the world spent much of 2022 twiddling their thumbs, those in the Middle East were busier than they’ve ever been.

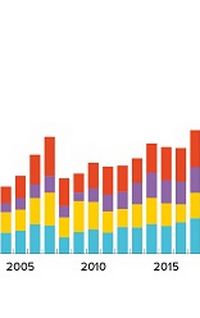

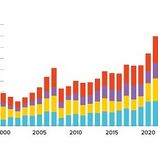

IPO volumes across EMEA dropped to just US$39.1bn in 2022 from US$112bn in 2021, according to Refinitiv data, while Middle East IPO volumes increased to US$23.1bn from US$13.4m. Put another way, the Middle East accounted for 59% of IPOs by volume in the EMEA region in 2022 against only 12% in 2021, while the number of IPOs in the Middle East surged to 56 from 41.

As a result, Middle Eastern banks Saudi National Bank, EFG Hermes, Riyad Bank and First Abu Dhabi Bank were among the top 20 bookrunners in EMEA in 2022. In 2021, the top ranked regional banks were SNB in 36th and EFG Hermes in 50th.

The surge in the Middle East meant that volumes in emerging EMEA (as opposed to the wider region) held up remarkably well. “A decrease in the overall volume of ECM in the emerging EMEA region happened but it was almost entirely made up by the Middle East region – more than offsetting the complete shutting down of the Russian ECM market,” said John Wilkinson, head of emerging markets ECM at Goldman Sachs.

Bankers said the prominence of Middle Eastern transactions will reduce in 2023 as European issuance normalises. They are clear, though, that 2022 was no flash in the pan and a fundamental realignment has occurred.

“UAE and Saudi are the ones that have the powerful combination of relevance on a global scale in terms of their participation and weighting in the MSCI indices. They are important countries for international investors from an index perspective and also have very deep and captive investor bases,” Wilkinson said.

The biggest transaction out of the Middle East in 2022 was the US$6.1bn IPO from Dubai Electricity & Water Authority. That privatisation was only the third US$6bn-plus IPO in the EMEA region since 2010 until Porsche overtook it to be the biggest EMEA float of the year.

Other highlights included the US$2.12bn rights issue from Saudi hydrocarbon and petrochemicals company Petro Rabigh; the US$2bn IPO from Abu Dhabi plastics company Borouge; the US$1.8bn IPO from Abu Dhabi-headquartered fast food chain operator Americana Restaurants; and the US$1.36bn IPO from Saudi pharmacy company Nahdi Medical.

Activity is spreading across the region, with deals in 2023 mooted from Kuwait, Qatar and Oman.

Number one

In the Middle East region, HSBC was the number one bookrunner in 2022, with its share of proceeds at US$4.36bn, followed by Citigroup (US$2.8bn), Saudi National Bank (US$2.5bn), Goldman Sachs (US$2.2bn) and EFG Hermes (US$2bn).

Samer Deghaili, co-head of capital financing and investment banking coverage for the Middle East, North Africa and Turkey at HSBC, said the region’s strong post-pandemic economic recovery was one reason for the surge in deals but even more fundamental is that Saudi Arabia and the UAE have been advancing economic transformation plans that include efforts to deepen and diversify their stock exchanges.

“They have been bringing prized assets to exchanges to improve diversification, to deepen the stock exchanges and to attract new pools of liquidity,” Deghaili said.

“Saudi Arabia has always been busy in terms of equity capital markets; however, the scale and profile of the story has changed during the past few years, with the government more involved in bringing issuers to the market as part of its Vision 2030 [economic transformation] plan. We have also seen the Public Investment Fund, the country’s sovereign wealth fund, bring some of its portfolio companies to the exchange."

He added that the US$29.4bn IPO of Saudi Aramco brought Saudi's Tadawul exchange to worldwide prominence in 2019. “It was the largest IPO ever done globally and that has put the Saudi exchange on the map in terms of attracting foreign pools of capital and proving its high standards,” he said.

While Aramco was deemed by some to be a flop at the time as international investors were cut out of the IPO for failing to meet the government's valuation, the process still saw many foreign investors set themselves up to buy Saudi stocks.

Dual in the crown

The Middle East ECM story is dominated by IPOs of mature and predictable companies. In normal years, such companies might have been considered as too boring to garner much IPO excitement. But in 2022 they were prized for offering steady financials, tangible products and – most important of all – profits.

In November, the first dual listing was seen in the region when Americana Restaurants floated a 30% stake on the Abu Dhabi Securities Exchange and on Tadawul. Orders for the IPO topped US$100bn.

"Americana is listed in Abu Dhabi and Saudi Arabia and there is a technical link between the two exchanges, which they invested in a few years ago as part of their strategic initiative," said Deghaili. "Saudi Arabia has done the same with Bahrain and has also signed a memorandum of understanding with the Oman Stock Exchange. I wouldn’t be surprised if eventually that expands into other Gulf Cooperation Council markets."

Indeed, HSBC has popped up on an even more significant transaction since Deghaili talked to IFR late in 2022. In January, Singapore's Olam Group said it plans to list subsidiary Olam Agri on both the Singapore Exchange and Tadawul. It will be the first non-GCC company to list in Saudi and could trigger a rapid acceleration in the ascent of Saudi's stock exchange.

The US$500m–$1bn spin-off could come in the first half of the year. Olam Agri's link to the kingdom is through Saudi Agricultural and Livestock Investment Co, which last year acquired a 35.4% stake in the agribusiness unit.

Banker views are mixed on whether the reference shareholder is sufficient to attract Saudi investors to a company that otherwise is not linked to the kingdom. But what is certain is that when Saudi investors turn out for IPOs the levels of demand are enough to make most issuers giddy, with book coverage often well into double digits. If Olam Agri is able to capture just some of that demand it seems inevitable that companies with major Saudi shareholders would at least consider a Tadawul listing when completing an IPO.

The story is not quite as exciting in the UAE where issuance has traditionally been dominated by the government. But privately owned companies are now beginning to list for the first time. Americana was 50% owned by Saudi’s PIF but also partly owned by Adeptio Investments, a Dubai-based private company. In November another private sector company, Dubai schools operator Taaleem Holdings, raised Dh750m (US$204m) from an IPO in Dubai. As more privately held companies come to market that will also offer more opportunities to invest in fast-growing businesses.

Liquidity premium

The region is also certain to see more follow-on activity as local companies mature and regulators seek to encourage more liquidity on regional exchanges.

“I think we will continue to see IPOs to promote the local exchanges but the important next step is to develop MENA equity markets through follow-on offerings,” said Rudy Saadi, head of Middle East and North Africa ECM at Citigroup. “We have to work with the authorities, regulators, and investors on their understanding of accelerated equity offerings and fully marketed offerings and how they are priced.

“For example, there are a lot of companies that went public 10 to 15 years ago but aren’t considered very liquid today. It is very challenging for these companies to raise capital with no obvious catalysts, little or no research coverage and with low liquidity. We can promote some of these companies via fully marketed offerings on the back of a prospectus, which allows us to refresh the equity story and offer the stock to both institutional and retail investors.”

He also expects to see more rights issues plus exchangeable and convertible bonds.

In May 2021, Abu Dhabi National Oil Company raised US$1.64bn by issuing exchangeable bonds and additional shares to investors in its listed retail unit Adnoc Distribution, while later that year Saudi Telecom – a PIF portfolio company – also undertook the first fully marketed secondary sell-down from the region.

“We have not seen many of these kind of offerings in the Middle East to date,” said Saadi. “On rights issues, they were mostly done by banks for specific financing needs in the past. In the future we could see rights issues by non-financial institutions groups or issuances for M&A objectives. Over the next five years, I see more sophistication in the GCC market towards all types of follow-on offerings and, as bankers, we have an important role to play in promoting that market.”

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email leonie.welss@lseg.com