Buffeted by Covid-19 and caught in the crosshairs of Sino-US tensions and an authoritarian Chinese regime, Hong Kong’s ability to adapt is under sharp focus as it seeks to remain relevant as a global financial centre.

Financiers led by HSBC chief executive Noel Quinn put on a united front in November when Hong Kong hosted the Global Financial Leaders Summit. Timed to coincide with the resumption of the Hong Kong Sevens rugby tournament after a two-year coronavirus-induced hiatus, the conference was designed to herald a return to business as usual.

"We have to help Hong Kong through this next phase of post-pandemic restrictions and continued economic growth to strengthen the confidence of Hong Kong as an international financial centre,” Quinn told the conference.

Quinn has more motivation than most to seek a return to normality as the bank he runs stands as a symbol for the challenges facing Hong Kong. As an international bank deriving the bulk of its profits from the Asia-Pacific region, its future is under threat from rising Sino-US tensions and the challenges of the pandemic.

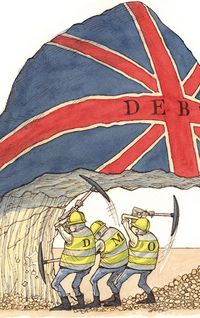

During Covid, the UK regulator banned HSBC from paying a dividend in return for financial support, a move that angered the bank’s retail investors and has thrust the bank into a fight with its biggest shareholder, Ping An Insurance, which is calling for a break-up. HSBC has rebuffed the calls, arguing that its strength lies in acting as a crucial bridge between East and West.

It’s hard not to draw a parallel between HSBC’s travails and Hong Kong’s shifting status from being an international financial centre to one more dependent on China than ever before.

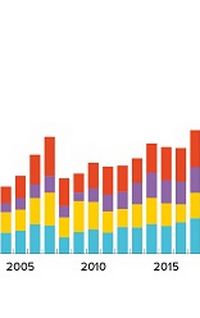

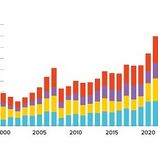

“Since 2015, Hong Kong’s capital markets activity has become highly concentrated around mainland China,” said Alicia Garcia-Herrero, chief economist for Asia-Pacific at Natixis in Hong Kong. “Hong Kong used to be a real global offshore centre. You would have foreign companies listing or using US dollar bonds. All of that business disappeared because onshore [Chinese] companies needed Hong Kong to expand overseas. So because of that concentration, it’s hard for Hong Kong to maintain a balanced profile as a global offshore centre.”

Benjamin Quinlan, CEO and managing partner of Hong Kong-based consulting firm Quinlan Associates, takes a similar view. “Hong Kong has run a dual narrative for a long time. Partly it’s an international financial centre and partly it’s part of the Greater Bay Area [the cities of the Pearl River delta]. It’s a difficult approach to straddle both and the two often don’t coalesce with each other,” he said.

Price to pay

Putting so many of its eggs in the China basket paid off for much of that period, but there was a price to pay once the pandemic began, with both China and Hong Kong putting in place severe restrictions, both in terms of people’s daily activities and their ability to travel.

Deal volumes were also affected by China’s property crisis, its dispute with the US (and the move to delist companies from US exchanges) and its efforts to get what some saw as over-mighty tech companies to toe the line.

Take Hong Kong’s equity capital market, where Chinese companies dominate issuance. Hong Kong IPO volumes shrank 70% in 2022, even as mainland equity offerings remained healthy.

One result of that collapse in deal volumes linked to mainland China is that banks moved to diversify their revenue streams, building out businesses across the smaller and more fragmented markets of Southeast Asia, using Singapore as a hub.

That dynamic was accentuated by a security crackdown in Hong Kong at the behest of Chinese authorities in the aftermath of widespread protests in 2019 and 2020 against China’s National Security Law being introduced in Hong Kong.

As a result, over the last couple of years, rather than Hong Kong being a magnet for banking talent, it became a place to avoid as tough Covid restrictions and (to some extent) disillusionment with the political situation prompted senior expat bankers to return home, retire or relocate to Singapore and Dubai where they were free to travel to meet clients and colleagues.

Not many will shed tears for expat bankers – and for everyone who leaves there are 10 people from Hong Kong and China willing and able to step into their shoes – but it does mean that Hong Kong as a financial centre will become less international.

“Most of the heads of banking onshore are locals now and once the last generation of expats goes in the next five years Hong Kong will be almost exclusively China-centric,” said a headhunter who has worked in Hong Kong for more than a decade.

There is certainly a deep talent pool of local bankers with skills that are more aligned with Hong Kong’s ever-tighter links with China. “Expats are a sunset talent pool,” said Quinlan. “China’s capital markets opened up in 2003 and expats now make up a fraction of the talent pool. It used to be that expats ran product or regional teams. Now it’s Chinese talent, given the importance of the mainland to Hong Kong.”

Officially, Singapore (for fear of upsetting its citizens struggling with increasing rent and decreasing availability of school places) has not encouraged finance pros to relocate from Hong Kong to Singapore. But some have certainly made the move.

But will the reopening of Hong Kong and China reverse that trend?

Miranda So, co-head of Asia excluding Japan at New York-headquartered law firm Davis Polk in Hong Kong, certainly hopes so. “There’s been some movement of talent to Singapore but I don’t think it has damaged Hong Kong. A lot of people who moved out are looking to come back,” she said.

Li He, So’s fellow co-head of Asia at Davis Polk, added: “Talent follows deals and money. Singapore is becoming the biggest wealth management centre in Asia but it is less developed as a capital markets centre. Singapore is not very big or geographically close to a homogenous market as big as the US or China. Singapore is becoming more important but at the same time we are committing to the China market. Both can co-exist as financial centres.”

Pro-market

After three years of restrictions, Hong Kong is certainly showing signs of a more pro-market stance under John Lee, who was appointed last year by China to replace Carrie Lam as chief executive of the special administrative region. Lee, a former police officer who has pledged to restore Hong Kong’s status as Asia’s pre-eminent financial centre, has announced plans to make it easier for talent to move to Hong Kong, while in October the Stock Exchange of Hong Kong published a consultation paper aimed at changing its rules to make it easier for fast-growth companies to list.

One key question as Hong Kong gets dragged closer to China, is whether the undoubtedly greater influence of China on Hong Kong’s legal system will infect commercial law as it has infected governance of social and political matters.

So, who was born in China and trained as a lawyer at Harvard and is one of the rising number of Chinese nationals running regional businesses, doesn’t think it will. “Transaction parties are still comfortable using Hong Kong law as the governing law for transactions. I’m optimistic about Hong Kong’s future as an international financial centre,” she said.

Either way, there is no question that deal-making activity boomed in the weeks following both Hong Kong and China reopening.

Hong Kong saw HK$13.9bn (US$1.8bn) of equity follow-on offerings and IPOs in the first two weeks of 2023.

In the first week alone, the Hong Kong government raised US$5.8bn-equivalent from green bonds in three currencies, while the city’s airport authority brought a US$3bn trade. The two deals rode on investor optimism about China’s reopening to draw a combined US$60bn in demand.

The following week, Dalian Wanda Commercial Management Group sold the first offshore high-yield bond from the China property sector since May, raising hopes of a revival in issuance.

Some of that is like champagne bursting out of an uncorked bottle, but it is also a symptom of tensions with the US easing (at least for the moment) and China’s President Xi Jinping making moves to get the economy rocking again, including introducing more support for the struggling property sector and releasing pressure on tech companies.

“Since China has opened the borders, the mood in Hong Kong has improved,” one senior banker said. “There is more confidence that China has more of an economic agenda. The country is more focused on economic growth; now that Xi has been given absolute power he will focus on common prosperity.”

In other words, the mood is better because of what is going on in China. In itself that’s obviously good news. But it does underline Hong Kong’s fundamental challenge: is it just a somewhat freer Chinese city with a convertible currency, or is it a world financial centre?

“With Hong Kong reopening it now has a chance to re-establish its openness and be clear about where it wants to play,” Quinlan said. “That means either embracing being an international financial centre or acting as a gateway to China … Where it decides to push forward will drive the type of talent it will attract – and the place it will become."

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email leonie.welss@lseg.com