When the going gets tough

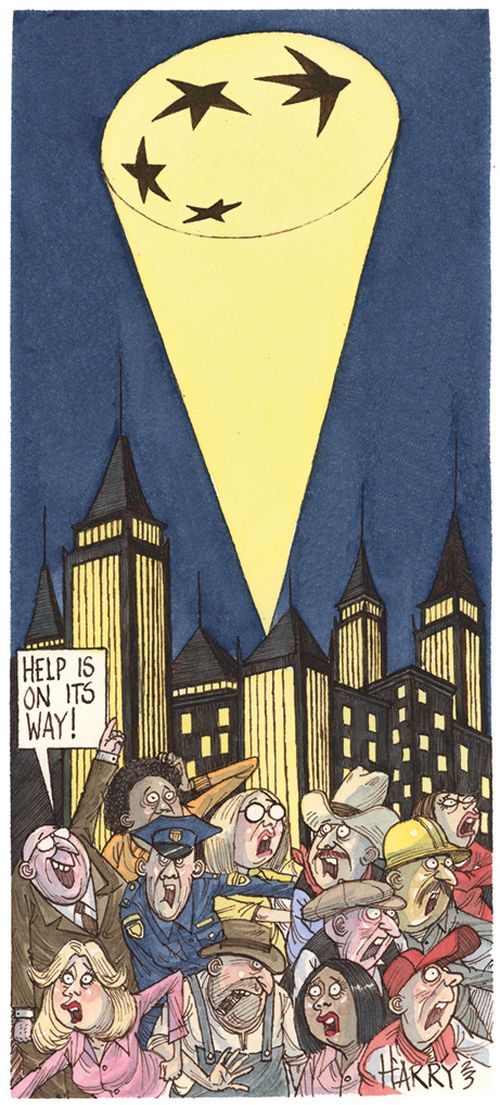

2022 was the 200th anniversary of the oldest of the institutions that came to make up BNP Paribas. In those two centuries the bank has lived through innumerable crises and turned them into opportunities. In the past year – and the decade that preceded it – it did so again. BNP Paribas is IFR’s Bank of the Year.

As the leaves fall from the trees, the thoughts of the editor of IFR turn to which institution should be our Bank of the Year. And to help with that decision he seeks out the great and good of finance to canvas opinion as to which bank has outperformed its peers. The response in 2022 was nearly universal (at least among Europeans).

Only BNP Paribas among European banks, the consensus was, has formulated a clear strategic plan and executed on it even when buffeted by the vicissitudes of volatile markets, a global pandemic and geopolitical instability.

And the result, in terms of market share and deals done (in both capital markets and the trading businesses), became abundantly clear in 2022, even as the markets went through a period of unprecedented turmoil.

But this was not just a 2022 story. It was built on years of hard work and good judgement – and a bloody good plan.

Those envious rivals say that it became evident that BNPP’s plan was coming together not in 2022 but at the beginning of the coronavirus pandemic in early 2020.

One very senior banker at a rival European institution admitted that while his bank was battening down the hatches and triaging customer relationships to see which they could afford to support and which they should ditch (at least temporarily), BNPP was using the crisis to fortify relationships and win business. Even the mighty American banks withdrew resources from Europe to concentrate on their home market.

“When we were pulling back, they were stepping up,” the banker said. “It was very, very impressive and it will have locked in relationships for years.”

Senior BNPP bankers are reticent to boast about that period – no one, after all, wants to be seen to be taking advantage of such horrible circumstances – but when pressed they acknowledge that their ability to stay committed has served them well since.

“Many clients told me that they will remember what we did for them in 2020,” said Yann Gerardin, BNPP’s head of corporate and institutional banking. “We knew we had improved our perception with all our clients. And we had a major acceleration as a result.”

It is possible to put numbers on that acceleration. “If you take the first quarter of the Covid-19 crisis, let's say March, April and May, we originated the most important part of the €400bn of financing we did in 2020 through bank financing, bonds and equities,” said CEO Jean-Laurent Bonnafe. “That was around 35% of market share in Europe. So in the three months at the peak of the crisis, we originated one-third of the pool, which is obviously unique.”

As if to demonstrate that 2020 was no fluke, it was a very similar story in February 2022 when the banking industry found itself reacting to another externally driven crisis, Russia’s invasion of Ukraine, and the consequent fallout in markets. Again, as others were nervously scanning their exposures, BNPP pushed forward.

It was able to do so in part because – unlike so many other banks – it had shrewdly pulled out of Russia after the annexation of Crimea and other parts of eastern Ukraine in 2014. But the fundamental reason it was able to be decisive was, as in 2020, because it had a plan, and the resources and the will to stick to it.

Pushing ahead

The question that naturally follows is why was all this possible? How was BNPP – almost uniquely – able to push ahead in such difficult circumstances?

To answer that question it is necessary to go back even further, to the aftermath of two earlier crises: the 2007–08 financial crisis and the 2009–11 eurozone debt crisis.

The plan that Bonnafe and his lieutenants put in place when the dust of those upheavals had settled was ready to go in about 2014.

They had concluded that Basel III regulations (and the resulting increase in banks’ cost of capital) required an overhaul of the way the whole of the bank – and particularly CIB – operated.

“Jean-Laurent told me [in 2014], ‘I would like you to not only deliver the quarter-after-quarter figures, but also to reposition the CIB of BNP Paribas for the long term and to industrialise it’,” Gerardin said. “We knew we wanted to be closer to the US way of financing the economy with less balance sheet.”

That meant running CIB not as a standalone business, but fully integrated with the rest of the bank. It also meant emulating the kind of “fortress balance sheet” that had turned JP Morgan into the major winner of the post-financial crisis banking landscape. It required abundant liquidity and robust capitalisation, but it also relied on identifying where BNPP needed to be strong – where it had an edge – and consistently investing in those areas to build an integrated business model, while establishing an international network that was much more effective at distribution and an increasing focus on digitalisation.

The strategy was consciously based on using BNPP’s resources to take market share from other banks, many of which were retrenching in light of the changed circumstances.

The result was that when the inevitable setbacks or external crises came along, BNPP could treat them as opportunities rather than threats that required consolidation.

“For 10 years we have been investing massively in those platforms and business lines in which we believe we can be the leaders throughout Europe. And progressively exiting anything that is not a part of that within our CIB,” said Bonnafe.

“If I focus on the investment bank, we built something that is very cohesive, 100% relevant, meaning covering all counterparty needs. It took us six or seven years to build something very robust and integrated. And if you have the willingness to stand up, you can move much faster than others because they do not have the comprehensiveness of the business model, and maybe not the willingness.”

Another pillar of Bonnafe’s plan was a move to integrate the bank’s various businesses into a cohesive whole, in particular improving linkages between CIB and the commercial, personal banking and services operation.

Thierry Laborde, head of CPBS, gives a telling example of the result, saying that cross-selling between CIB and CPBS increased by 16% in 2022 with €1.18bn in revenues supported by that enhanced cooperation and the bank’s international network.

“We have accelerated cross-business initiatives and synergies by leveraging our strong corporate franchise,” he said. “We are working on several key initiatives such as Mobility [the bank’s push to encourage sustainable travel], where CIB supports and advises major automotive manufacturers, and CPBS, through its different activities, offers financing and mobility solutions.”

Staying power

BNPP showed its determination to stick with the programme – even when things got bumpy – in how it responded to sustaining large equity derivative losses in 2020 when markets slumped at the start of the pandemic. The bank chose not to scale back like some rivals, but rather double down on equities trading to establish a fully fledged global offering.

Indeed, it is that area – equities, derivatives and the wider markets operation – that has shown BNPP at its best in 2022 and underscored the huge strides it has taken towards becoming the top European investment bank. That, of course, proved invaluable in a year when underwriting volumes plummeted, forcing banks to rely more heavily on sales and trading to generate income.

BNPP raked in a record €7bn in the first nine months of 2022 – two-thirds higher than the same period in 2019, the last pre-pandemic year. The French lender was the second-fastest growing bank in global markets between mid-2019 and mid-2022, according to analytics provider Coalition Greenwich, cementing its spot as the seventh-largest firm in this space by revenue – up from 10th in 2016.

Olivier Osty, head of global markets, highlighted two areas to explain the bank's continued growth in 2022's choppy markets: the material investments it has made in its equities platform; and a rejig of its fixed-income division in early 2022 to emphasise macro trading.

In equities, BNPP’s landmark acquisitions of Deutsche Bank’s prime brokerage in 2019 and the remaining stake in cash equities specialist Exane in 2021 have bolstered the flow business of a bank historically renowned for its structured equity derivatives franchise – and opened doors to a wealth of new clients.

This expansion in flow and financing brings not only ballast, but some much-needed balance to BNPP’s stream of equity revenues, while helping it make inroads in the ultra-competitive US market. And even if much work lies ahead, there’s no doubt that the results are encouraging.

BNPP increased its equities revenues 25% in the first nine months of 2022, a period when many of its rivals were roughly flat or even down slightly compared with the previous year. The fact it did that in a year that saw a 20% slump in global stocks and virtual freeze in equity capital markets made it even more remarkable.

“Despite all the adverse situations [in markets] we've been able to actually grow the business and make sure that our clients consider us more as a real equity player rather than just an equity derivatives player,” Osty said.

And clients have certainly noticed. "For me, BNP Paribas are really competing with the US banks and, frankly, in terms of pricing they are often better," said a senior investor at a large European asset manager. "We traded a lot with them during the Covid crisis. They're always there proposing a competitive price whatever the market conditions."

Meanwhile, the overhaul of BNPP’s fixed-income division to put greater emphasis on macro trading proved remarkably timely in a year when moves in interest rates, currencies and commodities dominated markets. BNPP’s fixed-income trading revenues increased 30% in the first nine months of 2022 to €4.1bn, comfortably outstripping growth at the likes of JP Morgan, Bank of America, Citigroup and Morgan Stanley over that period.

“Our capacity to put in front of [clients] a consistent organisation … made the difference,” said Osty. “We've seen it in the growth of our revenues for 2022. It's a huge machine: the macro business is the biggest business right now in global markets.”

Again, BNPP is reaping the rewards of remaining committed to these activities through the cycle. That contrasts with many European banks that scythed back fixed-income divisions over the previous decade when volatility was lower and high capital charges crimped returns.

BNPP ranked number one for euro government bonds in the first nine months of 2022 on trading platforms Bloomberg and Tradeweb, the bank said. In FX markets, it was the top dealer in non-deliverable forwards and swaps on Bloomberg over the same period. In credit, it had the second-largest market share on Bloomberg for euro corporate bonds and the largest share in financials in the third quarter.

Rest of the world

So far we have concentrated largely on BNPP’s European heartland. And there is no question that it has more work to do in the US and Asia. But it has a strategy to win more business from clients in those regions that builds on its strength in Europe.

“The more we make noise in Europe, the more it can be heard by clients in the US or Asia,” said Gerardin. “[A US client will say], ‘I have my portfolio of US banks, but I need at least one European bank in my portfolio’. And the European bank should be BNP Paribas. And the same thing for Asian clients.

“We are going to grow this in a very disciplined way. We will never be a kind of US domestic investment bank. We are going to stick to certain franchises that are value-added. And there's a lot to do.”

He added that the bank is increasingly making progress with US clients. “It's very clear that a number of counterparties, especially in the FIG universe, have started to work with us in the last four or five years. They start to realise our ability to deliver the right level of services for them.”

Deals, deals, deals

What all this big-picture talk of pillars, industrialisation and digitalisation misses out is the actual deals that a successful strategy makes possible. And when all is said and done, it is deals that IFR cares most about. There is not the space available here to go through them all, but this awards book contains details of the deals that have enabled BNPP to win seven IFR gongs in 2022: EMEA Loan House, Equity Derivatives House, EMEA Structured Equity House, Euro Bond House, SSAR Bond House, Asia-Pacific ESG Financing House and Bank for Sustainability.

The last one in particular is worth highlighting. It is important because few banks have been as committed for as long to ESG finance – and sustainable banking – as BNPP.

Gerardin said BNPP’s management had been moving towards a more sustainable model for more than a decade.

Bonnafe explained why. “It is very clear that the best interest for a bank is not to stay with counterparties that are going to be out of business in 10, 15, 20 or 25 years,” he said. “We have strong commitments to the energy transition. By 2030, the bank will have completed 80% of its transition in less than 15 years, confirming our position as the leader among the major international financing players.”

The numbers

So how to quantify the results of all that hard work?

In market share terms it translates into BNPP jumping from eighth position in Refinitiv’s European fee league table in 2014, when the transformation properly began, to third in 2022 – behind only US giants JP Morgan and Goldman Sachs. Its European market share was 3.79% in 2014; in 2022 it was 4.21%. BNPP has become, in other words, quite clearly the dominant European bank in Europe.

In 2022 (a terrible year for the banking industry, don’t forget) BNPP’s fees fell relative to 2021 (one of the industry’s best ever years) by 31%. On a standalone basis, that might not look great, but it is an outperformance compared to nearly all of the world’s big banks. JP Morgan’s fees, for instance, were down 48%.

That progress has certainly impressed knowledgeable outsiders. “They have been growing CIB at a time when a lot of their European peers have been under pressure, and they have been successfully playing the card as one of the main European alternatives that can compete with the US investment banks,” said Amit Goel, a banking analyst at Barclays. “I see them as having taken share. That is especially true in Europe.”

Goel highlights one particular reason why that success should be sustained: the proceeds from BNPP's US$16bn sale of its US retail bank, San Francisco-headquartered Bank of the West, to Bank of Montreal. “This clearly gives them the ability to continue to invest and grow the balance sheet as and when they see selective opportunities – so organically through lending, as well as some inorganic methods. And that gives you more confidence they can deliver on the earnings and the earnings growth,” he said.

Finally, Bonnafe highlights another measure of success. When BNPP was created in 2000 from the merger of Banque Nationale de Paris and Paribas, he said, the combined entity banked about 18% of the mid-to-large corporates in the European markets where it is active. That number is now around 70%.

“If you want to stand up in the midst of crises, you need to have the right assets – business models, tools, platforms, product offerings, including skills, people, and so on,” he said. “You need to have the strength, meaning equity and liquidity. And you need to have the right intimacy with the real economy. Based on these levers you can deliver what we have delivered.”

Additional reporting by Steve Slater

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email leonie.welss@lseg.com