Healthy solution

PJT Partners’ restructuring practice proved an unstoppable force in 2022, wrapping up legacy restructurings, giving troubled companies runway through aggressive liability management exercises and taking on the pick of new assignments emerging in the second post-pandemic restructuring cycle. PJT Partners is IFR’s Restructuring Adviser of the Year.

PJT Partners entered 2022 not expecting meaningful growth in restructuring activity. That was with good reason.

Stress from the pandemic had created an initial flurry of activity, but global governments’ extraordinary responses quickly short-circuited the restructuring cycle of 2020–21. Indeed Chapter 11 bankruptcies decreased 42% in 2021. And high levels of liquidity and well-funded private investment funds were expected to keep a second wave at bay in 2022.

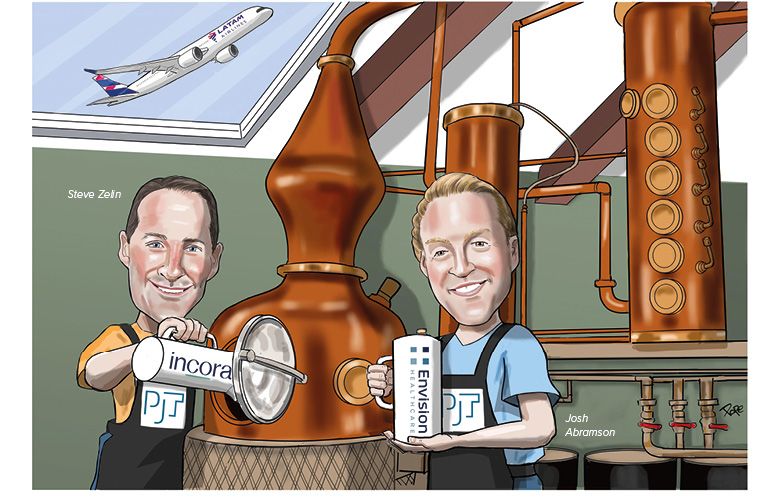

“The activity in the first six months of the year was heavily weighted towards liability management,” said Steve Zelin, PJT's global head of restructuring and special situations. “In the second half, dialogues turned to traditional restructurings.”

PJT won key roles in eight out of the 10 largest situations, advising, for example, cosmetics producer Revlon and cinema chain Cineworld, which have both filed for Chapter 11 bankruptcy protection.

Among the liability management exercises that kept the firm busy in the first half were unique assignments for medical services provider Envision Healthcare, aerospace supplier Incora and cruise line Carnival.

Envision, which runs a medical recruitment service and day surgery centres, was facing near-certain collapse without intervention. PJT embarked on an exercise to infuse the company with US$1.7bn in new liquidity, and find an equal amount of savings on its debt load.

PJT avoided the usual playbook of going to existing lenders for new money. “That would never work,” said Josh Abramson, a PJT partner who was considered by colleagues to be the mastermind behind one of the most aggressive debt exchanges to take place in 2022.

Existing lenders would have given the company new money, but not the savings. Instead, PJT created a process to get new money backed by surgery centres, which were moved into an unrestricted subsidiary. This raised US$1.4bn from investors with no previous exposure to Envision.

Angelo Gordon and Centerbridge Partners came in and agreed to commit to the financing even before the liens on the surgery centres were released by existing Envision lenders. That way, even when lenders tried to block the release of liens – a given – the company would already have committed financing, setting a ball in motion that would be hard to stop.

The second part of the process was to pick apart the lender group by allowing factions of the group to participate in the new secured loan backed by the surgery centres if they exchanged debt for new second-lien paper – at a discount, of course.

The process allowed lenders to bid into the offer by discounting the value of their own existing loans. The lenders that offered to exchange debt at the best price were allowed in.

The bidding process itself would potentially drive down the value of the debt, giving lenders an incentive to bid. PJT was able to get the lenders into a new structure with successive manoeuvres eventually getting holders of most of the US$4.5bn debt to come into the new deal.

This liability management transaction set a new bar, Zelin said. “While creditors are unhappy, if this type of flexibility exists in the documents it's incumbent upon private equity firms to play up the option value.”

Looking south

PJT wrapped up its work in Puerto Rico in October when courts approved a plan to restructure some US$6bn of debt held by the island’s Highways and Transportation Authority. PJT had already led the effort to pull Puerto Rico itself out of a court-sanctioned reorganisation that wrapped up the previous year, the US’s biggest municipal bankruptcy ever.

The plan for the highways authority cut the agency's debt by more than 80% and saved Puerto Rico more than US$3bn in debt service payments. It also had a novel twist of giving creditors two sets of contingent value instruments, one of which gives investors a share of Puerto Rico’s annual rum tax collections.

PJT also led the restructuring for LatAm Airlines, which was forced to confront creditors in 2020 after the pandemic effectively shuttered the global economy and grounded most airline travel.

The Chilean-based airline filed for Chapter 11 protection in the US mainly to access financing. But the airline was still forced to reckon with the laws of its home country protecting shareholder rights as it navigated the reorganisation process.

LatAm exited Chapter 11 in November. Its cases involved more than US$16bn in liabilities and ultimately 38 debtors. The largest shareholders included the Cueto family in Chile, Qatar Airways and Delta Air Lines, which had bought a 20% stake in the airline in 2020 just ahead of the pandemic.

PJT helped pull LatAm out of bankruptcy by engineering a creative capital raise including convertible notes structured to appeal to different groups. One was tailored to creditors who had to subscribe with cash and existing claims.

The structures were designed to corral specific groups and craft a winning coalition, overcoming Chilean law impediments that required shareholders to approve any restructuring.

Commodity concerns

Outside the Americas, Russia's invasion of Ukraine on February 24 changed the outlook for many credits as inflation became an even starker problem as energy costs surged and supply chains buckled.

Initially businesses took the change in circumstances in their stride, apart from those directly linked to Russia via subsidiaries or through shareholders that were sanctioned. PJT saw an accelerated number of enquiries from summer onwards, however.

“There has been a material pick-up in ferocity since the third quarter. Until June or July business incomings were quite isolated,” said Tom Campbell, head of restructuring and special situations for EMEA, highlighting a string of debtor-side appointments.

One deal that was sorted in the first half was the restructuring of agricultural commodity trader ED&F Man. The company faced a liquidity shortfall as prices of coffee and sugar in particular had shot up during 2021, requiring the company to post more collateral to keep hedges in place.

PJT had previously worked on the restructuring of another commodities trader – Noble – and found a similar solution.

It put in an emergency US$300m trade finance facility but at a level above existing debt and then separated a suite of non-core assets from the core trading business. At the same time a restructuring of debt was carried out under new UK restructuring legislation that had only been introduced in 2020.

As a result, these facilities were now junior to the new money. The non-core assets are earmarked for sale to pay back these creditors partially. That left the trade facility untouched against the new spun-out trading business.

“There is a structure in place now to provide waterfall payments to creditors,” said Martin Gudgeon, chairman of PJT's EMEA restructuring business.

One Russian-linked asset that PJT felt comfortable working with was mattress maker Hilding Anders, which is owned by private equity investor KKR. Although not affected by sanctions linked to the invasion, more than half the company’s earnings stem from a joint venture in Russia.

That meant those earnings could no longer support the rest of the group, which was already highly leveraged. PJT came up with a plan to cut debt of €569m by 45% through a debt-for-equity swap, which posed some problems for lenders wary of being seen to invest in a Russian-linked business.

Despite these concerns, the deal succeeded. “It got through with 100% consent without resorting to a scheme,” said Campbell. “The sanctions regime was omnipresent throughout the deal and the critical backdrop was that the creditors might end up owning a Russian business.”

Further afield, the firm remained active in Asia, notably advising on a number of Chinese property developers (including Fantasia Holdings) for offshore bondholder groups. It also worked for materials maker Lycra as it was taken over by its mezzanine lenders from conglomerate Shandong Ruyi.

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email leonie.welss@lseg.com