Friend in need

Financial industry dealmaking slowed in 2022 but there was still hot M&A activity among banks and asset managers, a jump in work to defend companies from activists, and a need for more bespoke financing for fintech firms. For its leading role in all of those areas, Goldman Sachs is IFR’s Bank for Financial Institutions.

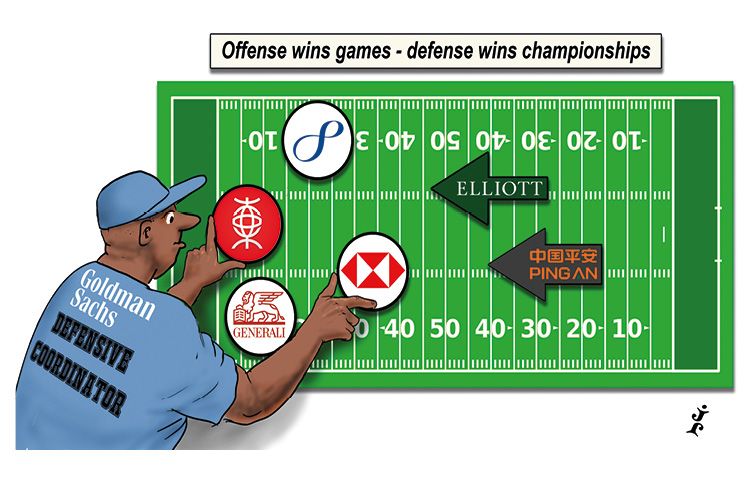

In finance, as in sports, when the glory dries up in a difficult year, the mark of a franchise can be best shown by a strong defence. For bankers, that means getting mandates to protect companies against outside threats, and in 2022 Goldman Sachs advised a slew of firms on how to defend themselves from activist investors, including Generali, Bank of East Asia and others who kept the mandate quiet.

IFR reported in August that Goldman was advising HSBC on its strategy to defend itself from its biggest shareholder Ping An, which wanted the Anglo-Asian bank to sharpen up its act and consider breaking up. That role showed another feature of Goldman’s financial institutions group work – it is often picked by rival banks when they need advice at a critical time.

Goldman advised BNP Paribas on the US$16.3bn sale of Bank of the West, for instance, and Royal Bank of Canada on its US$10.1bn purchase of HSBC’s Canadian business, which is expected to close in 2023. It also advised Kuwait Finance House on its complex US$11.6bn takeover of Bahrain’s Ahli United Bank, the largest ever M&A transaction in Kuwait and Bahrain.

Bankers working in FIG may have seen activity slow from the bumper levels of 2020 and 2021, but 2022 certainly wasn’t quiet and often deals required more bespoke financing.

Goldman’s roster included advising Baring Private Equity Asia on its US$7.4bn sale to EQT; US insurer Alleghany on its US$11.6bn sale to Berkshire Hathaway; Life Insurance of India’s US$2.7bn IPO; and tailored private placements for a bunch of fintech outfits that had to come to terms with a tougher financing landscape.

“In a very turbulent and complex year like 2022 clients really came to us more than any other bank for what we would say are global solutions. That ranges from complex cross-border M&A to carve-outs to transformational M&A, and then importantly in fund finance and sourcing liquidity in what was an otherwise shut market,” said Pete Lyon, who heads FIG globally for the bank.

“And when other big banks hire banks, we've been hired. And I think that's a testament to our franchise,” Lyon said. “We've also seen a big uptick in our defence mandates.”

Goldman has prided itself on having the leading FIG franchise ever since it set up its team as the first industry group on Wall Street more than 40 years ago. It now has about 300 people in the team globally, and can reach further through alumni sitting in top positions across the financial ecosystem.

But it knows it can’t sit still. FIG is a fiercely competitive area on Wall Street, and even in 2022’s tough year, FIG accounted for US$35bn in investment banking fees, down 34% from the record level in 2021 but still accounting for 32% of all fees, according to Refinitiv estimates.

At some banks FIG represents an even greater share of revenue, and although Goldman does not break out how much FIG clients contribute, they represent a majority of the bank’s top 100 clients.

Rinse and repeat

Kuwait Finance House’s all-share takeover of AUB was a standout deal in the Middle East.

Goldman had been alongside KFH on a possible takeover since 2015, but any deal was put on ice by the pandemic. Talks restarted in December 2021 and a deal was announced in July. In addition to a cross-border deal requiring a new dual-listed structure, the enlarged bank spans 12 geographies and required conversion of sizeable conventional banking operations to Islamic banking.

Goldman executed other deals on the back of long-standing relationships, such as for the UK government to sell a £1.2bn stake in NatWest via an off-market directed buyback and continuing to advise NatWest on its exit from Ireland.

Alternative asset management continues to grow in significance and the sale of BPEA to EQT in March was the biggest ever deal in the space. Goldman was joint sell-side adviser to BPEA and the mandate added to a raft of alternative asset management deals it advised on in Asia.

Goldman worked on some big deals for exchanges too, including as lead financial adviser to Intercontinental Exchange in May on its US$13.1bn purchase of Black Knight and advising London Stock Exchange Group on a 10-year strategic alliance with Microsoft in December (IFR is owned by LSEG).

In insurance, Goldman was exclusive adviser to Alleghany on its sale to Berkshire Hathaway (which Goldman has also worked with for decades) and advised Resolution Life on a key strategic partnership with Blackstone.

Activists circle

Several insurers also had their hands full in 2022 defending against activists, showcased in Italy where Generali fought off rebel investors in a bitter and long-running dispute. Goldman advised Generali.

Activists have stepped up their game against financial companies. They want firms to optimise portfolios and/or return excess cash to shareholders, by picking their spots better in areas they have a competitive advantage and good returns, and to sharpen up their operational focus.

It often means defence work may start with a simple premise, but can develop into a major strategic review that includes advising on disposals or capital management.

Goldman advised Bank of East Asia in a long-running fight with Elliott Investment Management, which resulted in the first major activism defence for a listed financial firm in Asia. It also advised BEA on four transactions in 2022, including buying back 8.4% of the stock Elliott owned and the sale of its Blue Cross subsidiary.

Goldman’s work advising US insurer Principal on its defence from Elliott included a strategic review and several capital management transactions, while work for Bermuda-based specialty insurer Argo Group in a defence from activist Capital Returns included the sale of a Lloyd’s syndicate and a deeper strategic review. Goldman also advised Australian asset manager Perpetual on a successful defence against an unsolicited offer and its purchase of Pendal.

The bank declined to comment on any work for HSBC in its defence against Ping An.

Bespoke fintech

There was also a rise in the need for bespoke solutions for fintech companies last year. After valuations crashed, options for IPOs, sales and even fundraising became less attractive. Whereas previously unicorns could often just issue equity, 2022 required more work and saw elements like warrants, floor prices and liquidation preferences used to protect investors or embed an upside mechanism to get investors on board.

“There's been a shift from getting these companies ready for IPO to more private placements, but in a very structured and bespoke way,” said Dirk Lievens, head of FIG for EMEA.

Goldman worked on more than 50 private placements in the last 18 months that raised more than US$25bn. They included three of the biggest in fintech where it was sole private placement agent: in February for Scalapay’s US$497m series B equity and debt financing; in July for Klarna’s US$800m financing that valued the Swedish firm at US$6.7bn; and for a €590m private debt and equity placement for SumUp, which valued the UK payments firm at €8bn.

It also advised Pushpay on its NZ$1.6bn (US$933m) sale to Sixth Street and BGH Capital, and US payments company NCR on its plan to split in two, which is due to occur in 2023.

Advising fintech firms early in their lifecycle remains a fierce battle for FIG teams across the Street. So it was significant that Goldman’s new roster of partners at the start of this year included two bankers who advise on fintech: Kelly Galanis in New York and Stephen Considine in London.

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email leonie.welss@lseg.com