Emergency extension

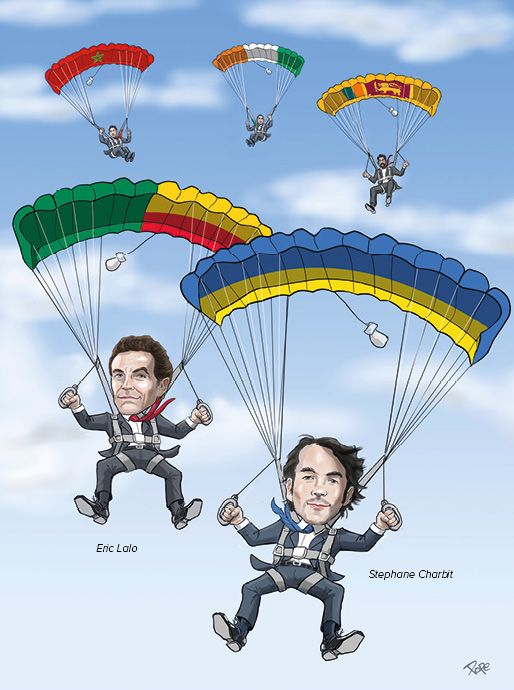

The restructuring of Ukraine’s debt after Russia’s invasion, crucial for the nation’s defence and future economic stability, was hammered out under intense scrutiny. For its role on that landmark deal and advisory work for Chad, Benin, Germany and beyond, Rothschild & Co, for the second year running, is IFR’s Bank of the Year for Governments.

Ukraine’s need to bolster its finances, and restructure its debt, following Russia’s invasion of the country in February showed the reality that quick and good financial advice can play a crucial part in protecting citizens and supporting a country at war.

Restructuring Ukraine’s US$21bn of debt and putting in place a package that would support its defence did not happen overnight. It was a transaction which involved a finance ministry in the midst of a war seeking agreements from international bondholders, warrant holders and other investors, many of whom had differing views on the conflict.

The package to restructure the external debt, both bilateral and Eurobonds, took three months to put together and was orchestrated by Rothschild.

Rothschild’s role as sole financial adviser to the government in Kyiv put it at the centre of financial negotiations after Russia’s invasion, as urgent talks were required with other countries, multilateral organisations and investors.

“If there is one difference between sovereign advisory and other types of financial advisory, you realise it with this and you live through it in this type of circumstance,” said Stephane Charbit, a sovereign advisory banker at Rothschild who was one of the key architects of the deal. “It was a stimulus to be frank … it was an extraordinary moment of possible impact.”

The transaction was complex, however. And while there was strong support from official creditors such as the US, France and the UK, not all creditors had the same view and many just wanted the best chance of getting their money back.

Eric Lalo, head of sovereign advisory at Rothschild, said despite the backdrop of war, Ukraine also wanted to show its discipline to the financial community.

“Even though we thought it was very challenging, very difficult, we knew it was a must because Ukraine had established this track record of not defaulting,” Lalo said. “It wanted to be in a position to demonstrate that, despite this very catastrophic event that was brought on them, they had the strength and the support of the international financial community to defend their reputation, and their population.”

There were three parts to the deal: a consent solicitation on US$21.1bn of Eurobonds; the suspension of debt service payments on all G7 and Paris Club bilateral debt until December 2023 (and the possibility of extending that by a year); and the amendment of terms on US$3.2bn of outstanding GDP-linked warrants.

A deal was signed on July 20. It allowed Ukraine to suspend debt services to external creditors for two years and preserve precious foreign exchange liquidity for more pressing needs, saving Ukraine more than US$6bn in the first two years.

Charbit said other options were considered before settling on the speed and efficiency of the consent solicitation with the use of collective action clauses, while working on discussions with warrant holders at the same time.

“Given the very strong track record that was built between 2017 and 2022 with fixed-income investors and bondholders, it was essential for the ministry to engage in the voluntary transaction,” he said.

The GDP-linked warrants were a legacy of the 2015 restructuring and were tackled to mitigate post-war repayment risks, because payouts are linked to GDP growth. That could see payouts jump if a slump is followed by a sharp recovery, so a cap on payments for 2025 was lowered and a call option was introduced to repurchase the instruments at par, effectively capping payments after that.

Rothschild has been the official financial adviser to Ukraine's finance ministry since April 2017. “At that point, we made the decision to advise the public sector in Ukraine, and not in Russia,” Charbit said. “Being mindful of possible conflicts, we made that decision at the time and we stuck to it since then.”

Credit enhanced

The firm’s sovereign advisory team was busy elsewhere in 2022, too, including advising Saudi Arabia’s sovereign wealth fund, Chad and Morocco. It structured novel credit-enhanced transactions for countries under strain, and helped diversify government funding to more sustainable options for others. The Anglo-French firm is IFR’s Bank for Governments for the second year in a row.

Paris-headquartered Rothschild has a long history of giving advice to sovereigns throughout its 200-year history. In 2022 it worked on about 25 advisory mandates for governments and state-owned enterprises that were disclosed, as well as other deals which were confidential.

Many of the mandates helped countries where finances, already strained by the Covid-19 crisis, had been stretched further by higher interest rates and inflation. That required more innovative financing structures, and Rothschild led the way in structuring credit-enhanced transactions and getting backing from export credit agencies.

It worked on a slew of deals for Benin in 2022 and was sole financial adviser on the structuring of a €133m export credit agency financing to fund a new ministerial city in Cotonou. That was Benin’s seventh ECA transaction since 2017, all advised by Rothschild. The financing from Deutsche Bank and UK Export Finance had three components including a €64m UKEF covered loan; a €57m UKEF direct lending facility; and a €12m tied commercial loan.

Rothschild also advised Moroccan state-owned OCP on a €503m social loan which will be used to refinance a university campus in Rabat, backed by the Multilateral Investment Guarantee Agency; and Ivory Coast on a €337m social loan, which benefited from an insurance policy provided by the African Trade Insurance Agency.

Rothschild was sole adviser to Chad, which in October became the first country to reach a restructuring deal with creditors under the G20 Common Framework. It was notable for including a contingency factor dependent on the oil price, and included agreement with major commercial creditor Glencore and bilateral creditors including China and India.

Saudi to Sri Lanka

More countries are looking for sustainable financing solutions, and Rothschild was strategic financial adviser to Saudi Arabia’s Public Investment Fund on a US$3bn triple-tranche green bond, which included a century tranche. The deal generated a lot of interest and a final order book of more than US$24bn and was considered well timed in rocky markets.

It was PIF’s debut bond and is part of Saudi Arabia’s Vision 2030 plans. Rothschild was appointed PIF strategic financial adviser in July 2021, advising on a wide range of issues.

In Sri Lanka, in a rare creditor mandate, Rothschild was appointed to work for an ad hoc group of bondholders in the restructuring of the country’s debt. It involves advising on strategies and tactics for the restructuring, while trying to keep the group unified and growing.

There were also significant deals for developed countries. Rothschild was sole financial adviser to Germany on the €1.1bn profitable monetisation of its remaining 14% stake in airline Deutsche Lufthansa; it advised key energy group Uniper on its state bailout; and advised the Dutch finance ministry on the balance-sheet impact of a €50bn-plus investment plan for state-owned company TenneT.

All this came at a time of rising geopolitical tensions across the world, heightened by events in Ukraine. That has increased pressure on government finances and raised risks of more sovereign debt restructurings, while potentially making it harder to coordinate solutions.

But Lalo said 2022 showed progress was possible with Ukraine’s restructuring potentially opening a path for smoother and more collaborative deals in future.

“The example we have seen with Ukraine, with an alignment of the private sector, multilaterals and the official sector gives me hope,” he said.

“I am hopeful that everybody can see the benefits of closing deals quickly rather than making the population starve because they lack foreign exchange or a central bank lacks the necessary foreign exchange.”

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email leonie.welss@lseg.com