Built to last

In a golden age for diversity firms in capital markets, Hispanic-led Ramirez & Co remained a go-to shop despite increasing competition for municipal business and for debt and equity capital markets mandates. Ramirez is also taking on more senior roles and is IFR’s US Diversity and Inclusion House of the Year.

Samuel A Ramirez & Co celebrated its 50th anniversary just two years ago but its top executives already have their eyes set on the next milestone: the first diversity and inclusion financial services firm to celebrate 100 years in business.

The signs are promising for Ramirez, the oldest and largest Hispanic financial services firm in the US. Momentum has been building and more issuers are including D&I firms on deals, and giving them more senior roles. The trend remained in place in 2022, despite a fall in issuance across debt and equity markets from the record levels a year earlier and more difficult market conditions.

Ramirez was joint bookrunner on six bond deals last year, including major transactions for Verizon, Bank of New York Mellon and Wells Fargo. It was joint lead manager on another six deals, and it landed a role on one of the few big IPOs of the year, the US$1.7bn offering from Corebridge Financial.

“D&I has become a front-burner topic for many issuers – that started in 2020 and has accelerated,” said Bob Hong, co-head of capital markets at Ramirez.

Ramirez and other D&I firms have developed their execution and distribution capabilities to meet that opportunity, and have the ability to bookrun business at a high level, which is being recognised by issuers, Hong said. “We are getting more assignments as a result.”

Next generation

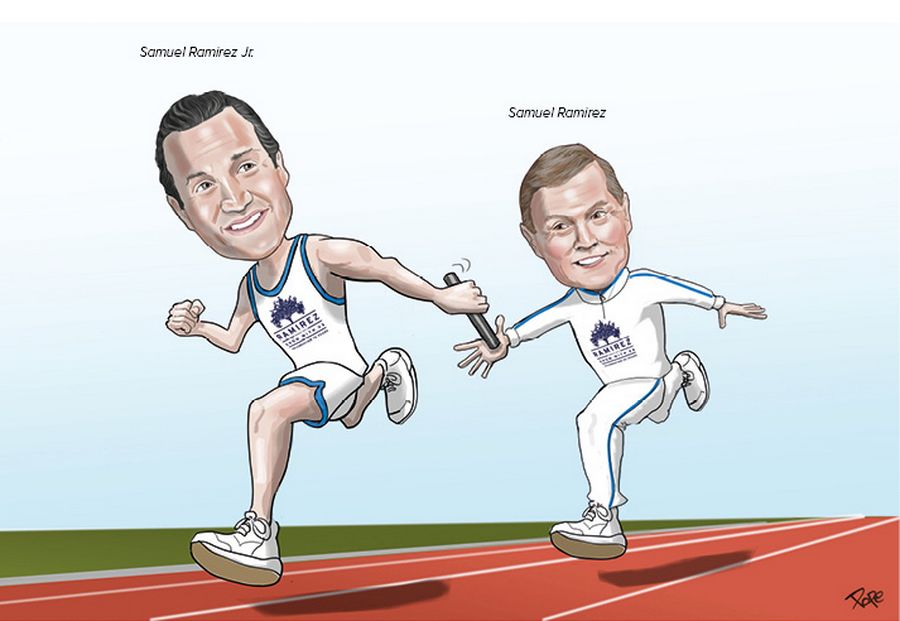

Ramirez’s leadership is preparing for the long haul. Samuel Ramirez Sr founded the firm in 1971 and is still chief executive, but his son and heir apparent is taking on more leadership challenges.

“We have been focused on bringing the next generation in,” said Sam Ramirez Jr, senior managing director, who joined the firm in 1992.

“I am focused on making this the first 100-year-old diverse firm. It would be a fantastic milestone,” he said. “It’s a marathon and we are really focused on the long term.”

The bank is based in New York and has about 150 employees across 12 offices, including in Chicago, Dallas, Los Angeles and San Juan, Puerto Rico.

Ramirez, like many of the older diversity firms, started as a municipal bond shop but is now a full-service investment bank, brokerage and advisory firm and continues to be a top senior and co-manager of public finance issues, in addition to its roughly US$10bn asset management arm, of which Ramirez Jr is CEO.

Golden age

The past two years have represented what many hope is just the beginning of a golden age for D&I firms.

Following a summer of social justice protests in the US in 2020, policies of inclusion became a cornerstone of corporate ESG programmes, which included inviting diversity banks to fully participate in capital market offerings across the spectrum.

As companies implement ESG frameworks, many are embedding D&I as a core value and including D&I participation in ESG deals.

“It’s a natural, straightforward, easy way for issuers to recognise how important D&I is to their company,” Hong said.

He said that was happening at all levels – from co-manager to co-lead manager and bookrunner.

In addition to the dozen bookrunner and joint lead manager bond deals, Ramirez was co-manager on 154 deals and continued to break into the asset-backed market, working on nine ABS transactions and 21 mortgage-backed deals.

In all, Ramirez worked on 166 bond deals involving 102 issuers and hit a new high of US$3.5bn in aggregate underwriting liabilities in fixed income.

“We compete on good execution and good ideas, not lending,” Ramirez said. “The business has evolved where D&I firms are leading with lending relationships – we have chosen to go the route of good coverage and good ideas and advisory capabilities.”

For a small firm relative to Wall Street’s bulge-bracket banks, 166 is a substantial number of deals, meaning Ramirez is busier than ever doing multiple deals every week. The total number of deals in 2022 was its second-best year ever behind the record set in 2021.

And despite fewer deals in total, the number of bonds the firm had to distribute hit an all-time high as D&I firms were able to get their hands on more inventory. That showed investors placing orders with the firm were being taken care of and its sales people were being recognised. It also meant issuers were diversifying their investor base and getting value for fees.

“It took issuers well over a decade to recognise that a total syndicate can be just D&I dealers,” Hong said. “I think we are there, and I think we are not far from a point where one D&I firm will be sole bookrunner in a benchmark deal.”

The tough get going

Last year was a tougher environment to get deals done and D&I firms nonetheless stepped up.

Ramirez’s role as bookrunner for a US$1bn green bond for Verizon, the US telecoms firm that has emerged as a champion for D&I firms, showed that. It was the fourth in a series of bonds for the issuer, but the comparison to the third bond issue was like night and day.

For the third bond in September 2021 underwriters were talking about negative new issue concessions and big greeniums. The book was comfortably oversubscribed and orders were coming from all over the world. The fourth bond was offered in difficult markets in February 2022. It took a lot more navigating to build the book, there were some obvious buyers who did not participate and those who did put in smaller orders, Hong said.

“In a hot market, bonds sell themselves. In a tough market you earn your pay,” Hong said.

In the end the book was still oversubscribed, though not as much as the prior deals, and Verizon got the best pricing available and the bond traded well.

“Kudos to Verizon to be willing to have D&I bookrun syndicate in a tough market,” Ramirez said. Bank of America and fellow diversity firms Siebert Williams Shank and Loop Capital were joint books, each taking 25%.

Ramirez’s other key deals in 2022 included teaming up with Citigroup, Goldman Sachs and US Bancorp as joint bookrunners on a US$1bn offering for New York Life. It also joined Citigroup, Deutsche Bank, Loop, RBC Capital Markets and Siebert as joint books for a US$1.7bn three-part issue for BNY Mellon, the first time the bank had picked D&I firms at that level and offering each the same economics and using firms with extensive bookrunning experience.

Wells Fargo issued its second sustainability bond, a US$2bn fixed-to-floating rate note, featuring D&I dealers at all levels of syndicate. Five D&I dealers, including Ramirez, acted as joint bookrunner along with Wells.

The average size of bookrun transactions for D&I firms has also grown from about US$300m a decade ago to more than US$1bn now. That shows they are not special carve-outs, but regular transactions, reflecting the shift in perception of the value added by using diverse firms.

In ECM, Ramirez worked on 16 transactions, including three IPOs, one convertible and 12 secondary offerings.

That included working as co-manager on the largest US IPO of the year: Corebridge. The listing of the life insurance and retirement division of AIG was one of the few deals to come to market in one of the weakest years for ECM in a generation.

Ramirez also took on 13 share repurchase assignments from 10 issuers, including Coca-Cola. And while share repurchases are a highly commoditised offering at large banks, for Ramirez it’s a great relationship builder.

“It is a commodity business at big banks, but that’s exactly why issuers come to us,” Hong said. “They initially start with us because they want to include D&I firms in a different product area – but they soon discover our level of service and communication is better.”

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email leonie.welss@lseg.com