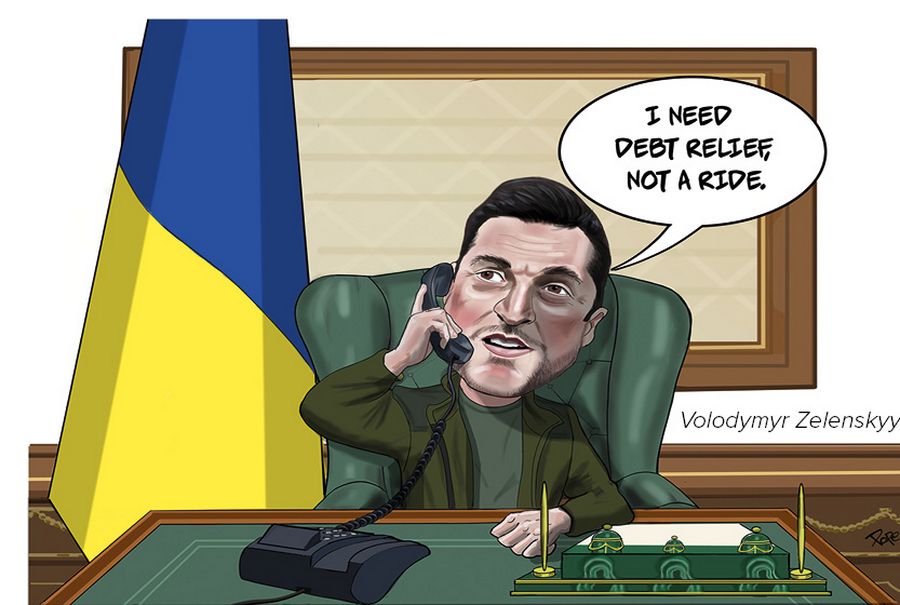

A huge relief

No event had a more material impact on the world in 2022 than Russia’s invasion of Ukraine. While the economic ramifications are still being felt in all corners of the globe, clearly the pain was most evident in Ukraine. But the country found some respite from the financial devastation through a crucial debt relief solution. It is IFR’s Financing Package and EMEA Restructuring of the Year.

Russia’s invasion of Ukraine in February 2022 was devastating to the country on many fronts, not least financially. Ukraine’s economy had already been damaged by Russia’s annexation of Crimea in 2014 and the war in Donbas.

The impact of 2022's events was an even bigger blow and left a large portion of Ukraine’s economy struggling to function. So while the government repeatedly expressed its commitment to servicing its debt, it became clear this would become nearly impossible.

The country's fiscal shortfall was soon running at about US$5bn a month and by July its FX reserves had rapidly depleted, falling to US$22.8bn. A chasm, meanwhile, had grown between the financial commitments made by the official sector of around US$30bn versus actual disbursements of less than US$15bn.

Some form of debt relief therefore became an urgent priority. Ukraine, with advice from Rothschild, appointed JP Morgan as solicitation agent to help with a complex process that involved different types of securities and hundreds of different creditors. The approach was to ask private sector creditors to let Ukraine use its scarce FX liquidity for priority budget expenditures. The plan also included an amendment of the sovereign GDP warrants, which were created as part of Ukraine's restructuring in 2015.

The overriding strategy was that the proposals should be transparent, fair and treat all investors equitably.

War-torn Ukraine sought to defer payments on nearly US$20bn in face value of US dollar and euro-denominated bonds for 24 months from August 1. The offer included the payment of accrued interest, with no consent fee.

The warrants offer addressed US$3.2bn of instruments and included an option that, subject to certain criteria, would allow Ukraine to buy them back at their nominal value, potentially capping any upside. Ukraine would be able to trigger the option between August 1 2024 and July 30 2027 at its own discretion. Ukraine said it would pay accrued interest and a consent fee on the GDP warrants proposal.

JP Morgan worked before the announcement to wall-cross Ukraine’s largest institutional investors, including BlackRock, Fidelity International, Amia Capital and Gemstock, gathering feedback and support. Still, the outcome was far from certain. Ukraine held a global investor call that was attended by more than 300 investors, while almost 100 different investors were individually called by officials from Ukraine and JP Morgan.

“Normally when you talk about wall-crossing for a sovereign with an investor, they put the phone down – to make that call during a war is an additional hurdle,” said Alexander Karolev, head of CEEMEA bond syndicate at JP Morgan. “Then you were dealing with hundreds of investors all with different positions, mindsets and views, and the instruments were very different too.”

Importantly, the consent offer announcements were also timed to coincide with a statement from official sector creditors, including the G7 and Paris Club (excluding Russia), which provided for a debt service suspension of up to 29 months.

“Credit to Ukraine for how aligned they were with the official sector,” said Stefan Weiler, head of CEEMEA debt capital markets at JP Morgan. “I’ve not seen those kinds of concurrent announcements before and I am extremely proud of that.”

Eric Lalo, head of sovereign advisory at Rothschild, said Ukraine wanted to show that despite the catastrophe it was enduring it “had the strength and the support of the international financial community” to defend itself and its citizens.

The terms of the overall package were adjusted slightly, with the Most Favoured Creditor principle implemented. The principle signalled Ukraine’s commitment to treating all its public market creditors fairly by restricting its ability to offer improved terms to holders of any particular Eurobond tranche if the offer was only partially accepted.

Holders of around 75% of the outstanding principal of Ukraine’s 13 Eurobonds agreed to the proposal, while investors accounting for more than 90% of the notional amount outstanding of the GDP-linked warrants also gave their backing.

The final successful outcome saw Ukraine secure much-needed relief, which would save the country about US$6bn over the following two years.

Similar debt standstill requests were also approved for two other state-owned companies, public road agency Ukravtodor and utility Ukrenergo, which both have government-guaranteed bonds, meaning there is no burden to repay any foreign currency debts until 2024. Before the year was out, state-owned Ukrainian Railways had also struck a deal to delay payments for two years on US$895m of Eurobonds, with the support of the Ukrainian government and finance ministry.

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email leonie.welss@lseg.com