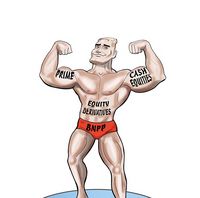

Beefing up

Stock markets had their toughest year in 2022 since the global financial crisis, hurting long-only investors and testing the risk management prowess of banks’ trading desks. For continuing to expand its business in this challenging environment, BNP Paribas is IFR’s Equity Derivatives House of the Year.

![]()

A 20% slump in global stock prices doesn’t sound like the ideal environment in which to grow an equities trading business. But that was the backdrop with which BNP Paribas had to contend as it moved forward with a crucial part of its plans to establish itself as the go-to European investment bank in global markets.

Long famed for its prowess as a structured derivatives house, BNPP’s acquisition of Deutsche Bank’s prime brokerage business in 2019, as well as the remaining stake in cash equities specialist Exane in 2021, underlined its ambition to become a full-service equities shop.

The French bank proved its mettle in 2022 as it registered a 25% annual revenue increase in equities trading in the first nine months of the year, amounting to a near doubling of revenues versus 2019 levels – the last pre-pandemic year.

“We’ve been able to grow our market share on the equity [business] despite markets being tough,” said Olivier Osty, head of global markets. “When you look at the growth of the results and the traction we had from the clients … the equity story is a success, even though it was not an equity market this year.”

This all constitutes a remarkable turnaround for a business that sustained heavy losses on structured derivatives books in 2020 when markets swooned at the start of the pandemic. Rather than following some rivals in scaling back, BNPP decided to double down on its equities division through a planned expansion in flow trading and financing to give it a more balanced stream of revenues.

Completing the integration of Deutsche’s prime brokerage activities gave it access to many hedge funds it had previously struggled to reach, while Exane’s cash equities franchise bolstered its standing with stock-pickers, including long-only asset managers. That has not only created more cross-selling opportunities, but also changed BNPP’s image in the eyes of clients from being primarily a structured derivatives specialist.

This strategy is already producing impressive results. Renaud Meary, global head of equity derivatives, said 2022 was on track to be a record year for equity derivatives at the bank. That would top the previous high set in 2021 despite a less conducive market backdrop.

“It is the year of the creation of the global equity platform for BNP Paribas,” Meary said. “With the integration of the prime and of the cash business, we are now able to deploy a fully fledged offer to our clients and this definitely is changing the perspective for our flow and our corporate business.”

The boost to flow trading is already apparent, with the bank registering a record year in 2022 in terms of revenues, new clients and new traders onboarded onto the platform, according to Emmanuel Dray, global head of hedge fund and asset manager sales for global equities. BNPP’s investments are helping to attract new trading talent as well as new clients, he said, with the bank already making 130 cross-client introductions across the whole equity complex.

“The complementarity of the client segments between cash, prime and derivatives is extremely good,” Dray said.

Nathalie Texier, co-head of global equities sales Americas, said the integration of prime and cash equities had been transformative for the bank’s brand in the US in particular, where BNPP added around 40 clients in 2022 alone.

“The US platform will be one of the biggest beneficiaries of [our] equity ambition,” she said. “Clients want a very strong European partner.”

BNPP can point to headway it has made in Asia too, whether that’s in the flow business, quantitative investment strategies (an important area of growth for the bank globally) or in Japan.

“It's obviously been a challenging year on the structured products side in Asia, but the business overall remains very resilient, as we've diversified it on [those] three fronts,” said Tim Parker, head of equity derivatives institutional sales for Asia ex-Japan.

All this has helped BNPP expand its equities division in what has been a tougher environment for retail structured products, one of its mainstay business lines. But the French lender has still been active in this space, increasing its recycling of the more illiquid risks stemming from these products, such as spot dividend and spot repo.

“We are today pretty happy and comfortable with the global risk management of our positions,” Meary said.

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email leonie.welss@lseg.com