A clear view

The wide funding windows of years past were shattered in 2022 by economic uncertainties and political upheaval. For finding a way through the treacherous environment, Goldman Sachs is IFR’s Americas Structured Equity House of the Year.

In a challenging year, Goldman Sachs provided clients with solutions to difficult problems through sales of convertible bonds, not only outpacing competitors but achieving superior pricing outcomes.

The bank was a bookrunner on 20 CBs and credited with US$4bn of business, giving it a 15% share of all issuance and ranking second, slightly behind JP Morgan without the benefit of its rival's balance sheet.

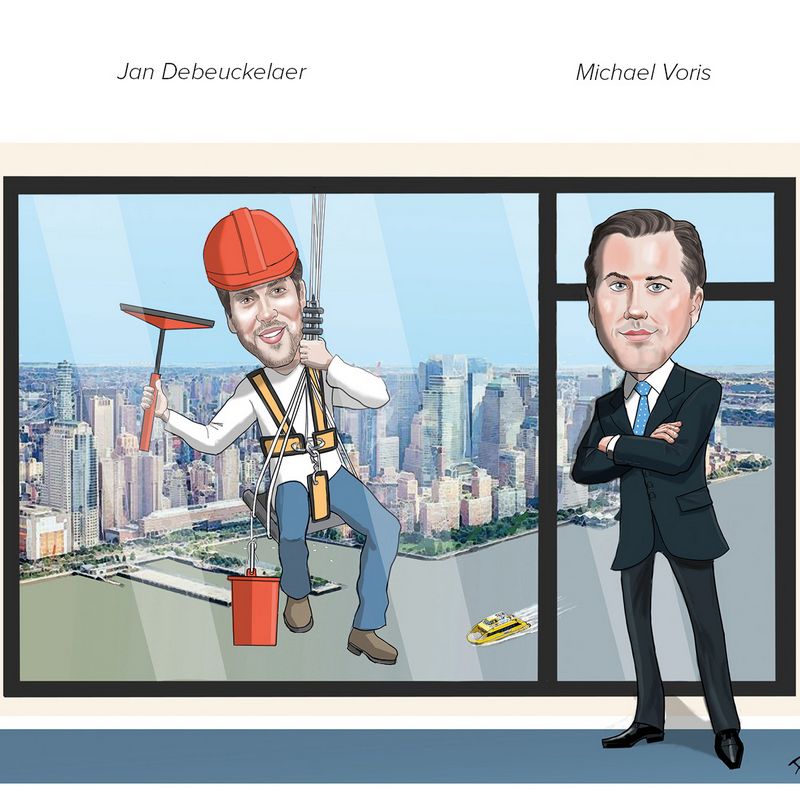

“What we are most proud of is navigating an extremely tricky environment,” said Michael Voris, global head of convertible financing and alternative capital markets at Goldman. “The rotation out of growth equities really accelerated before the onset of the Ukrainian conflict in February, and then the move toward higher rates began to take hold.”

On the evening of February 23, Goldman Sachs had completed confidentially marketing a CB on behalf of Peabody Energy, and intended to launch the next day. Within hours Russia invaded Ukraine.

“We knew we had a free option to walk away [from the deal],” said Jan Debeuckelaer, who heads US convertible financing and joined Voris’ team in 2020. “We huddled together with management that evening, told them we had a deal, and opted to move forward.”

Coal producer Peabody raised US$275m from a six-year CB, priced at a 3.25% coupon and 32.5% premium to its share price at the time, the midpoint of talk. Proceeds were used to tender for high cost 8.5%/6.375% secured debt maturing in 2024–25 which was taken on as part of the coal producer’s emergence from bankruptcy protection in 2017.

Funding a once-bankrupt coal producer is not an easy task in any window.

Peabody was in the process of rehabilitating old coal mines to solar power farms, providing an ESG tint that aided in attracting investors.

Lumentum secured US$750m from the sale of a six-year CB in March, just two weeks after Peabody, at a 0.5% coupon and 32.5% premium to its share price at the time. That was towards the aggressive ends of 0.375%–0.875% and 27.5%–32.5% terms publicly marketed for one day. Despite the timing, a wall-crossing exercise was deemed unnecessary.

The maker of optical networking gear smoothed the financing by concurrently buying back US$200m of stock to facilitate delta-hedging by arbitrage accounts, known as a happy meal.

“By wall-crossing, your ability to move pricing becomes limited because you’ve already had those discussions with those investors,” said Voris. “You are limited to a smaller group of investors in a wall-cross.”

Snap took a similarly aggressive approach of marketing a six-year CB in early February, resulting in an upsized US$1.3bn raise priced at a 0.125% coupon and a 50% premium to the US$37.56 reference price. The social media company purchased a capped call to offset dilution up to a share price of US$93.90, a 150% premium.

Snap shares had popped roughly 50% after the company reported its first ever quarterly profit for the fourth quarter of 2021. For what it’s worth, they closed 2022 at US$8.95, but that only serves to highlight the importance of hitting the right funding window.

Looking from the windows of Voris’ office in New York, the view for CB issuance in the future is far different to what it has been in the past.

"When you think about the world, we may be going into one where rates are higher for longer, and valuations are based on individual company performance," he said. "Converts are an asset class that tends to do well in an environment like we’re moving into.

"It’s most analogous to 2005–07, where we saw less obvious issuers of convertibles."

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email leonie.welss@lseg.com