Alternative definitions of the year's buzzwords

Bond portals

Where Indian retail investors do their online shopping.

Buy now pay later

A new way to lend to people who can’t afford to repay.

Cryptocurrency

A decentralised asset that does away with everything that holds back the conventional financial system, like rules and accountability.

Dim Sum

Survival fare for fee-deprived Hong Kong syndicate banks.

Double label

1 ) Debt transaction encompassing more than one kind of ESG financing;

2) Banker put in charge of ESG financing on top of their main job.

Due diligence

Elon, it’s a bit late to read this now.

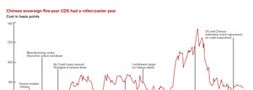

Dynamic zero

1 ) What China-focused fund managers delivered in the past two years;

2) Late stage of the Bank of Japan’s yield curve control policy.

Fed put

Replaced in 2022 by the Fed call.

GDR

New way for Chinese companies to reach Chinese investors.

Hamster

The ultimate gauge of Hong Kong’s Covid policies. If it’s moving, that means the special administrative region has loosened restrictions.

Holdco discount

100%, in the case of Chinese property developers’ debt.

Hybrid working

Taking a second job to make ends meet.

Liability management

What banks do when an analyst makes an ill-judged remark at a conference.

Lying flat

Portfolio performance to brag about in 2022.

Mezzanine

Something that’s hard to finance in the loan market and the Chinese property sector.

New economy

The term technology companies now use to distance themselves from other technology companies.

NFT

A way to lose money without actually buying anything.

Opportunistic transaction

Any capital markets deal that managed to price in the second half of 2022.

Overall coordinator

Designated bank to blame if something goes wrong.

PCAOB

US regulatory body that is under the illusion US auditors are any better at spotting frauds than Chinese firms.

Ping (verb)

To send a message, about breaking up for instance (see HSBC).

Pre-paid forward contracts

The Schrödinger’s cat of derivatives, whereby shares are simultaneously sold and not sold.

Private credit

Deals with only a handful of investors. Not to be confused with LGFV bond offerings.

Public Investment Fund

The world’s biggest sporting promoter.

RAT

Rapid Covid tests, or your RSVP to Hong Kong events.

River Valley

Singapore’s haven for bankers fleeing Hong Kong.

RTO

Return to office, or remember: trousers on.

SBLC squared

Structure that arises when a borrower obtains a standby letter of credit from a bank, which obtains another SBLC from another bank. Probably nothing to worry about.

Shanghai Free-Trade Zone

New way for Chinese companies to reach Chinese investors (see GDR).

Sleeper hit

A loan that becomes much more popular when it’s converted to an SLL late in marketing.

SPAC

Seemed Promising Ahead of Crash.

Stabilisation agent

IPO arranger tasked with defying gravity.

Terra

The main emotion cryptocurrency investors felt last year.

Transition

ESG policy built around the realisation that banks will have a lot less business if they exclude carbon-intensive industries.

Truss (verb)

To leave something, like a currency or economy, in a bind.

Z-spread

The amount of extra concession needed for emerging market credits since Russia invaded Ukraine.

To see the digital version of this report, please click here

To purchase printed copies or a PDF, please email shahid.hamid@lseg.com