Adani Group’s abrupt decision on Wednesday to call off what was to be India’s largest follow-on public offering has brought back the spotlight on a US$5.25bn borrowing that funded its purchase of a controlling stake in Swiss building materials firm Holcim’s cement businesses in India last year.

A stinging report from short-seller Hindenburg Research, which criticised the group for its high debt levels and accused it of misusing offshore entities in tax havens, led to steep slides in the shares of the group's seven listed companies and a Rs200bn (US$2.45bn) follow-on for Adani Enterprises was pulled on Wednesday, despite being fully subscribed.

The acquisition financing helped Adani companies acquire controlling stakes in Ambuja Cement and ACC in September from Holcim. The group began discussions in September with lenders to raise up to US$4bn through a three-year term loan to refinance the M&A bridge loans as well as a portion of a US$1bn two-year mezzanine financing that also funded the acquisition of the cement businesses. The existing financing includes a US$500m six-month cash bridge due in March and a US$3bn 18-month piece maturing a year later.

Sources say the US$500m six-month bridge loan will be grouped into the take-out facility, which puts the group under pressure to wrap up the refinancing by next month. Failing that, it would have to extend it – something that would send a negative signal to the market in the light of the share price collapse.

Liquidity and refinancing risks are key for the Adani companies, but debt bankers insisted they aren’t too worried – at least for now.

A senior banker in Singapore said those risks were manageable. “The underlying businesses of ports, airports, power and cement are synonymous with the India infrastructure story and are well-performing, cashflow-generating companies. Of course, earlier plans that were being considered for the debt refinancing will need to be recalibrated in light of recent developments, but credit exposure to the operating companies of the group is not an issue,” he said.

A credit research analyst at an asset management firm in Singapore shared similar views, saying: “we do not foresee a default risk on interest payments in the coming months, because most of the operating entities of Adani Group have decent cash, the group has good assets to divest, and highly leveraged entities like Adani Green Energy can reduce capex plans.”

Reviewing the situation

Adani Group’s founder Gautam Adani, in a video address on Thursday, said: “Our Ebitda levels and cashflows have been very strong and we have an impeccable track record of fulfilling our debt obligations. We will continue to focus on long-term value creation and growth will be managed by our internal accruals. Once the market stabilises, we will review our capital markets strategy.”

Less than a third of the proceeds of the follow-on were intended to repay debt at Adani Enterprises and its unlisted subsidiaries.

The group is known to have several share-backed loans, though bankers declined to disclose whether steep declines in Adani companies' share prices had triggered margin calls.

A US$750m two-year share-backed financing at a holding company level made up the remainder of the US$5.25bn debt funding package that helped the Adani empire acquire the stakes in Ambuja Cement and ACC. As at the end of December, Adani companies held 63.15% in Ambuja Cement and a 56.69% stake in ACC.

“For the US$750m holdco level loan, Adani has plenty of room to top up more shares as collateral despite the recent significant drop in their prices," said the banker in Singapore. "Fortunately for Adani, there is no maturity wall coming up this year.”

Bloodbath

The group has Rs140bn of debt maturing during the 2023 and 2024 financial years, according to Care Ratings, and had combined liquidity of Rs260bn as of December 31.

Adani Ports and Special Economic Zone and Adani Green Energy have a total of US$1.9bn in principal amount of bonds coming up for refinancing next year.

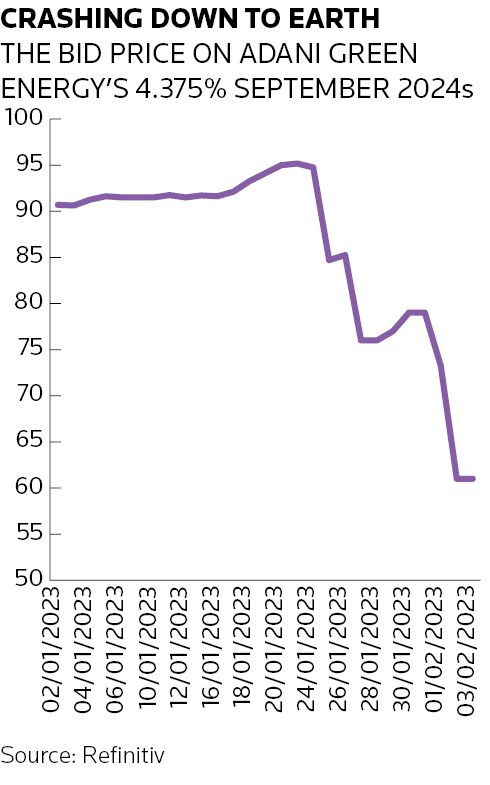

The Hindenburg report and the subsequent cancellation of the follow-on offer sent prices for Adani companies' US dollar bonds lower by between 12 and 34 points.

Adani Ports' US$650m 3.375% notes due July 24 2024 slumped to 84 cents to yield 15.80% as of Friday, according to Refinitiv data, having traded at a yield of 6.10% before Hindenburg's report was released. Adani Green Energy’s US$750m 4.375% holdco notes maturing on September 8 2024 sank to 61 cents to yield 39.70% and the US$500m 6.25% notes due December 10 2024 for Adani Green Energy's project companies fell to 87.10 cents to yield 14.40%. Adani Transmission's US$500m 4% August 2026 bonds fell to 74.60 cents to yield 13.30%.

“It is difficult for the prices of existing bonds to return to pre-saga levels, due to investor aversion and potential event risks,” said Leonard Law, a senior credit analyst at Lucror Analytics. “Hence, the bonds will likely continue to yield a premium to Indian corporate peers for some time.”

The biggest risk is if the Adani companies faces a severe deterioration in access to financing, particularly at its highly leveraged entities. “A liquidity crunch at any one of the entities may have a ripple effect on financing access for the wider group,” Law said. “The group can likely continue to raise funds from onshore banks and bonds for now.”

The three major credit ratings agencies rate Adani Ports Baa3/BBB–/BBB–, all with stable outlooks. On Friday, Moody's said the adverse developments are likely to reduce Adani Group's ability to raise capital to fund committed capex or refinance maturing debt over the next one to two years, although it noted that some capex is deferrable and rated Adani entities do not have significant maturing debt until 2024. Fitch said there was no immediate impact on the Adani entities that it rates and it expects no material changes to forecast cashflow.

Most bondholders and analysts are confident Adani Ports can refinance the US$650m bonds up for refinancing in July 2024. According to a Lucror note on Thursday, the company could issue “new offshore bonds (albeit at a high yield premium), or repay using a combination of internal free cashflows (after reducing capex), onshore bank and bonds, and raising new equity”.

Another senior banker in Singapore said: “The past few days have been like watching a Netflix movie with every day bringing a new development. Cancelling the [follow-on offer] was the right thing to do, but some form of equity raising is important for Adani to prove that it enjoys long-term support and is serious about deleveraging. Equity is important from the standpoints of perception, confidence and investors and will go some way in comforting lenders and bondholders.”

Additional reporting by Mirzaan Jamwal

Updates size of Adani Transmission's bond in paragraph 16