Enel reiterated its commitment to achieving its long-term sustainability goals despite speculation it may fail to meet its near-term carbon emissions targets, as investors gave a thumbs up to the company's latest sustainability-linked bond.

The SLB pioneer risks breaching its 2023 emissions goal on nine of its bonds after the Italian government laid out plans to raise output from coal-fired power plants. Italy's reversal from its earlier commitments to exit coal was part of a raft of measures to help curb gas consumption, as European countries scrambled to wean themselves off Russian energy supplies and seek alternative sources.

"Any failure to achieve the objectives set in relevant sustainability-linked bonds would be solely attributable to the contingent situation linked to the gas crisis," Alessandro Canta, head of finance and insurance at Enel, told IFR. "Our goal is, and continues to be, achieving zero emissions by 2040."

The noise around Enel (rated Baa1/BBB+/BBB+) didn’t deter bond investors from putting in more than €3bn of orders for its €1.5bn dual-tranche SLB offering on Monday. "There wasn't much pushback from investors regarding the sustainability target and it was a fairly straightforward deal," said a banker at one of the leads. The €750m 2031s and €750m 2043s paid 10bp–15bp in new issue concessions, but the banker said that was down to how often Enel had funded over the past year.

For now, most investors are happy to give the company the benefit of the doubt. "The most important thing for us in the case of failed targets is to understand why the issuer has failed: is it due to external factors or unrealistic targets and lack of a relevant action plan to achieve these on the issuer's side – or both? In the first case, our attention will be directed to the issuer’s ability to meet longer-term ESG targets through dialogue. In the latter case, ... failed SLB targets may lead to a downgrade in our assessment," said Theo Kotula, an ESG analyst at AXA Investment Managers.

Enel has already met its targets for its three outstanding SLBs with observation dates at the end of 2021. Despite the speculation, it said that it would meet its target for 2022, which is achieving 60% of its overall installed generation capacity from renewables. "In the context of our 2023–2025 strategic plan presentation, we unveiled that the expected percentage of renewables on total consolidated capacity is 64%," said Canta.

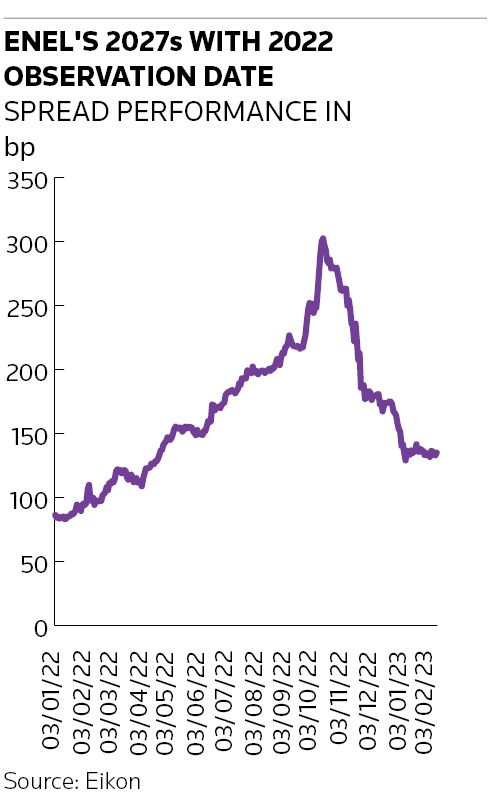

A coupon step-up of 25bp will in theory be triggered if Enel misses its 2023 carbon intensity target at the end of this year, something that would cost the company about €120m in increased interest costs over the lifetime of the bonds, wrote Barclays ESG and credit analysts earlier this month.

"It is, of course, a disappointment if SLB targets are not met, and the costs of missing a target are still too low in certain instances. But a failure to hit a target does show, at the very least, that the structure works to a certain extent, and that is a positive," said Joost de Graaf, co-head of the euro sustainable credit fund at Van Lanschot Kempen.

Respecting the structure

Clauses in Enel's SLB documentation suggest the company might in fact be able to avoid the extra costs. "Enel has included some language in its SLB prospectuses that suggests that under certain circumstances a step-up may not occur, even if a target has not been met," the Barclays analysts wrote. Those clauses mention that step-ups could be dodged if Enel misses key performance indicators as a result of changes to "any applicable laws, regulations, rules, guidelines and policies or a decision of a competent authority".

"This is relevant to both its renewable installed capacity KPI in its end-2022 target and its emissions intensity KPI in its end-2023 target," the Barclays analysts wrote.

Canta said, however, that Enel will not use those clauses to avoid the step-ups. "The group would, in any case, not exercise any clause and, should the targets not be achieved, it would pay the step-up envisaged at the time of transaction ... respecting the structure designed at issuance," he said.

Ultimately, investors said, the point of the SLB structure is about showing trust in a corporate's ESG strategy. "It's important that investors buy the bonds of companies they are comfortable with regarding their fundamentals and sustainability journey. The SLB should not be seen in isolation from the company's credit and sustainability profile," said Philipp Buff, a fixed-income investment manager at Pictet Asset Management.

Enel's latest SLBs incorporated new key performance indicators as it has expanded its sustainability-linked financing framework with updated targets related to EU Taxonomy-aligned capital expenditure that ties its KPIs to specific green uses of proceeds.

The company became the first issuer of sustainability-linked bonds after bringing the product to the market in September 2019. It is also by far the largest issuer in the market with close to US$25bn of index-eligible outstanding SLBs, with generic drugmaker Teva Pharmaceutical Industries being the next largest issuer with around US$5bn outstanding, according to the Barclays analysts.

"At the end of the day, we should encourage companies to reach for ambitious targets, which implies some will miss them. If companies are shunned because they miss the targets despite earnest and credible efforts, then they will not be incentivised to reach for meaningful, positive change. And that is not helpful at all," said Mitch Reznick, head of sustainable fixed income at Federated Hermes.

Bookrunners on Enel's deal were Akros, BBVA, BNP Paribas, BPER, Credit Agricole, CaixaBank, Citigroup, Commerzbank, Goldman Sachs, IMI-Intesa Sanpaolo, ING, JP Morgan, Mediobanca, Morgan Stanley, Natixis, Santander, Societe Generale and UniCredit.

Updated: Quote expanded in fifth paragraph.