There is a stark divide among US regional banks when it comes to hedging of Treasury portfolios, with data showing that most non-swap dealer US lenders don't have any derivatives protection against a rise in bond yields.

Non-dealer banks held interest rate hedges worth around US$1.7trn of five-year Treasury equivalents at the end of the third quarter, according to a note from Barclays' interest rate derivatives strategists. "Comparable hedging exposures” would probably have been maintained heading into the start of 2023, the report says.

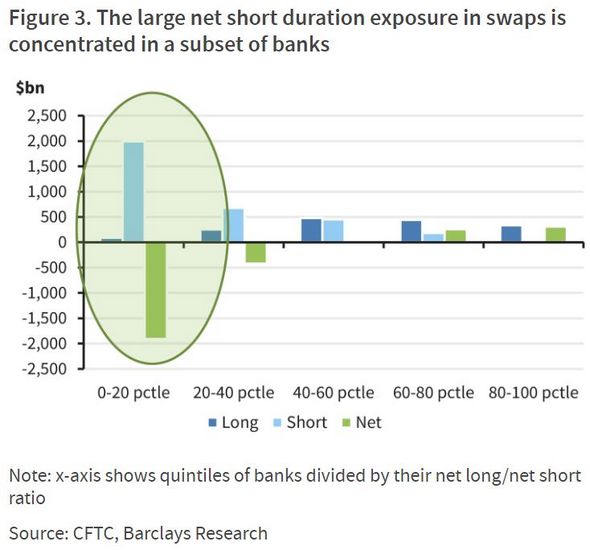

But those hedges appear to have been highly concentrated in a small group of banks, with nearly 60% of non-dealer banks not holding any such protection or even using derivatives to bet on a fall in bond yields, Barclays said, citing data from the Commodity Futures Trading Commission.

“While the aggregate net short duration exposure in derivatives is significant [among US regional banks], these net short positions seem to be concentrated among a subset of participants, rather than being widespread,” the Barclays strategists wrote.

A “net short duration exposure” refers to hedges that would help offset mark-to-market losses on banks’ bond portfolios sustained as a result of rising Treasury yields. Those losses have increased sharply in recent months as bond yields have climbed in response to the US Federal Reserve raising interest rates.

The scrutiny on US banks’ exposure to rising rates has intensified in recent days following the failure last week of tech lender Silicon Valley Bank and Signature Bank over the weekend. Depositors had started yanking money out of SVB amid concerns about paper losses the bank was facing on its Treasury holdings, which had grown substantially to soak up a rapid rise in assets and deposits in recent years.

SVB had taken a large loss on the sale of a US$21bn portfolio of Treasury and agency securities prior to its collapse as part of an (ultimately unsuccessful) bid to shore up its finances. The Federal Reserve has since announced a new funding programme allowing banks to borrow money against Treasuries and other securities at 100% of face value.

The Barclays strategists noted that domestic US banks had security holdings of about US$5.2trn at the end February, nearly half of which was held by the six largest banks, they estimated. On average, these securities tend to have a “key rate duration” of about five years, the report said.

But not all banks have been using derivatives such as swaps and options to hedge their exposure to rising rates. Only about one-fifth of banks accounted for the large short duration exposure across the industry, Barclays said, holding US$1.9trn in five-year equivalent protection between them. Meanwhile, 60% of US regulated banks held a net long exposure through derivatives, meaning they would suffer from a rise in bond yields.

“While the banking sector as [a] whole appears to have had substantial protection against rising rates, for about 60% of banking entities, their aggregate derivatives exposure may have hurt, rather than helped, as rates sold off, even as security holdings incurred unrealised losses,” the Barclays strategists said.