Recent US bank failures have triggered a surge in demand for interest rate hedges among regional lenders, consultants say, as executives have scrambled to assess the risks lurking in banks' securities portfolios over the past week.

The scrutiny on US banks’ exposure to rising interest rates has intensified following the collapse of tech lender Silicon Valley Bank and Signature Bank this month. Depositors had started yanking money out of SVB amid concerns about paper losses the bank was facing on its Treasury holdings, which had grown substantially to soak up a rapid rise in the bank's assets and deposits.

That episode has prompted a flurry of activity among other lenders looking to protect themselves against the impact of higher interest rates on their security portfolios. Zack Nagelberg, chief growth officer at consultancy Derivative Path, said his firm had seen as much regional bank hedging activity in the last week as in January and February combined – a period when volumes were already elevated.

“We’re on pace to exceed the level of hedging activity that came about in March 2020 at the start of the pandemic, which was the busiest period for regional banks in the derivatives space I’ve seen since the global financial crisis,” said Nagelberg.

“We’ll definitely see more banks looking at financial and interest rate risk management, whether that means locking in their cost of funds or hedging longer duration loans or bonds,” he added.

There has been a stark divide among US regional banks when it comes to hedging of Treasury portfolios, with data showing that most non-swap dealer US lenders don't have any derivatives protection against a rise in bond yields.

Domestic US banks had security holdings of about US$5.2trn at the end of February, according to Barclays strategists. These non-dealer banks held interest rate hedges worth around US$1.7trn of five-year Treasury equivalents at the end of the third quarter, Barclays strategists wrote in a recent report, adding that "comparable hedging exposures” would probably have been maintained heading into the start of 2023.

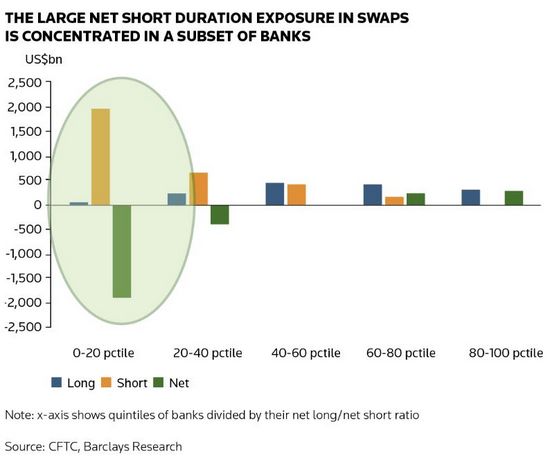

But those hedges appear to have been highly concentrated in a small group of banks, with nearly 60% of non-dealer banks not holding any such protection or even using derivatives to bet on a fall in bond yields, Barclays said, citing data from the Commodity Futures Trading Commission.

“While the aggregate net short duration exposure in derivatives is significant [among US regional banks], these net short positions seem to be concentrated among a subset of participants, rather than being widespread,” the Barclays strategists wrote.

Paper losses

A “net short duration exposure” refers to hedges that would help offset losses sustained as a result of rising Treasury yields. Losses on banks' security portfolios have increased sharply in recent months as yields have climbed in response to the US Federal Reserve raising interest rates.

SVB reported a US$1.8bn post-tax loss following the disposal of most of its "available-for-sale" security portfolio prior to its collapse as part of an unsuccessful bid to shore up its finances. The Fed has since announced a new funding programme allowing banks to borrow money against Treasuries and other securities at 100% of face value.

“The problems with SVB and Signature Bank were caused by the gross mismanagement of balance sheet risk. This fiasco will likely lead to increased oversight of financial institutions that are not considered to be 'systemically important'. It should also lead to more focus on risk management and increased hedging activity by these banks," said Michael Koegler, managing principal at consultancy Market Alpha Advisors.

“Some of the policies that relaxed the regulatory oversight of these institutions under the Trump administration may get reversed, with an increase in the frequency of stress testing and hedging activity for regional and community banks," he added.

SVB used to hedge a large portion of securities it held as available-for-sale on its balance sheet – about 56% of that US$27bn portfolio at the end of 2021. But it unwound or didn’t replace those hedges as they expired over the course of 2022, leaving it with hedges covering just 2% of its US$26bn available-for-sale portfolio at the end of the year. It also had US$91bn of “held-to-maturity” securities, which weren't hedged.

While other banks will have different business models to SVB and Signature, there is no doubt that the whole episode has provided a wake-up call for the wider industry of the problems rising rates can cause. Many banks' earnings suffer under lower rates, but they also hold bond portfolios that lose value with higher rates – making for a “complex and challenging position to address”, said Nagelberg at Derivative Path.

Still, those looking to hedge right now certainly appear to be more focused on the risks of higher rates in light of recent events.

“Before SVB, the balance sheet hedging activity we were seeing was two way: asset-sensitive banks hedging falling rates to protect NIM [net interest margin] as well as liability-sensitive banks hedging against rising rates. Now, all the flow we’re seeing is hedging the potential for rates to rise more,” Nagelberg said.