Financial markets are a sea of red as we walk across the swish new trading floor at Barclays’ Canary Wharf offices. Silicon Valley Bank, the specialist tech lender, has just collapsed and people are scrambling to understand what this means for the broader financial system.

“It’s a busy day. We’re going to have busy days like this this year,” said Stephen Dainton, Barclays’ co-head of global markets, as we sit down in a nearby meeting room.

“I’m not sure whether it’s the canary in the coal mine, but it’s definitely given the market a very big wake-up call,” he added.

The stress in financial markets certainly provides an interesting backdrop to this meeting, originally scheduled to discuss the material gains Barclays has made in sales and trading in recent years. The turmoil will only intensify in the following days, culminating in UBS’ emergency rescue of longstanding rival Credit Suisse.

These events, isolated as they may seem, have inevitably drawn comparisons with the dark days of the 2008 financial crisis. European bank credit default swaps came under renewed pressure on Friday as IFR went to press, amid concerns over the value of Additional Tier 1 securities that were wiped out in the Credit Suisse rescue.

Deutsche Bank was hit hardest, but five-year CDS on Barclays also jumped to 150bp, according to S&P Global Market Intelligence, the widest they've been since the aftermath of the UK government's disastrous mini-budget in October (though still far away from crisis territory).

Despite such wobbles, bankers are quick to highlight important differences to the events of 2008. Investment banks (Credit Suisse to one side) appear far sturdier now, with large amounts of capital and liquidity to hand. Another notable contrast is that most, until now at least, have thrived during the various bouts of volatility that have rocked financial markets since the start of the pandemic three years ago – and generated bumper trading revenues along the way.

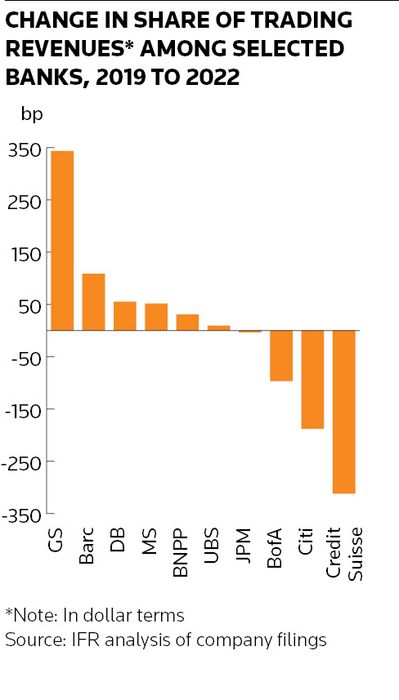

Barclays typifies that trend. The UK lender has expanded its global markets revenues over 60% since 2019 to about US$11bn last year. That has allowed it to grow its share of trading revenues among its main rivals at the second-fastest rate over that period, behind only Goldman Sachs. So can that resilience of bank trading units – and their ability to turn a profit – continue in 2023’s febrile environment?

“[We] are well positioned to deliver for clients through 2023 and into the future,” Dainton said in a follow-up email after UBS’ takeover of Credit Suisse.

Rebound

Barclays’ trading comeback has contributed to a remarkable turnaround in fortunes for its investment bank, which was cut back in the first half of the previous decade. That rebound began under former chief executive Jes Staley and continued following his departure, when markets head CS Venkatakrishnan took on the top job in 2021.

Dainton, who joined from Credit Suisse in 2017, subsequently became markets co-head with responsibility for sales, while Adeel Khan (who formerly ran the bank’s credit unit) oversees trading as the other co-head of the business.

There have been some bumps along the way, most notably a roughly US$1bn loss following an embarrassing regulatory blunder in Barclays’ US structured notes business. But that hasn’t deterred senior management from pursuing its goal of grabbing enough share of client activity so that its trading unit can continue to generate attractive returns even when markets settle back down.

“We want to be the non-US option in the elite group of banks,” Dainton said. “Prior to 2017, the markets business had not been invested in. What we did was set about a very disciplined approach to having a diversified portfolio of businesses. That meant we were in a very good position to benefit from that real movement in volatility you saw from the start of the pandemic."

It was in 2020, when the pandemic struck, that Barclays’ reinvigorated investment bank really came into its own. A sharp jump in fixed-income revenues helped offset a slump at the lender’s retail operations and ultimately forced activist investor Edward Bramson to end his bid to shrink the investment bank.

“Barclays did not report a statutory loss in any of the four quarters of 2020," said Dainton, drawing a contrast to other UK lenders. "Why? Because we had a macro business – that’s diversification."

Still, many investors remain sceptical about the value of banks’ markets divisions. Analysts tend to view trading revenues as too volatile compared with steadier, fee-earning businesses like wealth management. But Dainton suggests that industry trading revenues may now have moved structurally higher following a particularly fallow period in the years leading up to the pandemic.

“For 15 years following the great financial crisis you had zero interest rates, so your natural supply of volatility disappeared from markets. The revenue wallet has grown now because we’ve moved back into a normal interest rate cycle. That’s a big event," he said.

Method

Barclays has been methodical and focused in its trading expansion, building on areas of traditional strength such as credit trading and equity flow derivatives, while also investing to fill in gaps such as in structured finance.

The bank now closely monitors which parts of its markets business perform well in different environments after breaking down its four core trading activities (macro, equities, credit and securitised products) into about 35 smaller cells. That enables it to see its risk, capital consumption and profits and losses at a granular level on a daily basis, including which individual desks are faring better at different times.

“We’ve expanded the portfolio of businesses so our capital base has got bigger, but it’s not about taking outsized risk,” said Dainton. “We’ve stuck to a very disciplined risk approach. It’s less about making the absolute right turn in a particular asset class and much more about how the portfolio acts in each market cycle.”

Barclays' headcount in global markets has only increased marginally since 2017, although its technology budget is up 40%. If anything, Dainton sees room to “de-manualise” the business further given advances in fixed-income electronic trading.

Like many of its peers, it's also focusing on doing more business with the largest clients that trade the widest range of products. Barclays said it had a top five wallet share with 41 of its top 100 clients as of June 2022, up from 30 six months before. Dainton said they are aiming to get to 70 of those clients in the coming years.

“We have no control on whether the wallet goes up or down. What we really can control is our market share with clients,” he said.

Financing, where Barclays lends to clients such as hedge funds to lever their investments, has been central to that push. Finance director Anna Cross has said financing provides more stability to the revenues from its global markets business, with these revenues increasing 61% over the past three years to about £3bn in 2022.

“Financing is the glue,” said Dainton. “If you finance a hedge fund, they tend to transact with you.”

Prime time

Perhaps inevitably, prime brokerage is one area that Dainton identified for continued expansion. Another is structured finance, where Barclays has already invested heavily in recent years, along with securitised products trading. Asia is another point of focus, with Barclays hiring Hossein Zaimi from HSBC last year to lead the charge.

The bank also has high ambitions in equities trading, which Dainton recently took over temporarily following the departure of the co-heads of that business. “The strategy for equities hasn’t changed, it’s an acceleration of that strategy,” Dainton said, adding there’s a chance to add “significant revenues” in the coming years by growing that franchise.

Barclays has had some good fortune in the timing of its expansion – and not just because of a sharp jump in the industry revenue pool as market volatility has increased. Deutsche Bank’s decision to shutter most of its equities business in 2019 left a void to be filled, as did Credit Suisse’s retreat from large parts of its markets business starting in 2021.

Others too have looked to step into the breach – and not just the big five US banks. Deutsche is still a force to be reckoned with in fixed income, UBS in equities trading, while BNP Paribas has made a push across asset classes.

Barclays still believes it holds a trump card over its European rivals: the acquisition of Lehman Brothers’ US operations at the height of the 2008 crisis, providing it with an enviable foothold in the US.

“Banks are not the same any more,” Dainton said, referencing the differing strengths of other European lenders.

“We exhibit most closely to a US bank in terms of being geographically diverse and operating business diverse. The main difference is we’re not tied to a US housing cycle like they are,” he said.