Trading volumes in credit default swaps linked to European banks have increased sharply in recent weeks, undercutting theories from regulators and investors that thin trading in illiquid markets drove extraordinary moves in the cost of default insurance on banks such as Deutsche Bank and triggered a broader meltdown.

Regulators including the European Central Bank have sought to blame a rout in European bank stocks last week on a dramatic move in CDS on Deutsche Bank. Bloomberg reported that regulators have pinpointed a roughly €5m transaction on swaps referencing the German lender’s junior debt that they believe may have fuelled the dramatic sell-off on March 24.

But industry-wide data of CDS transactions reported to the Depository Trust & Clearing Corp paints a different picture of these markets. European bank CDS trading volumes have risen steeply since concerns began to mount in March over the future of Credit Suisse, casting doubt on the ability of one or two small trades to move the entire market.

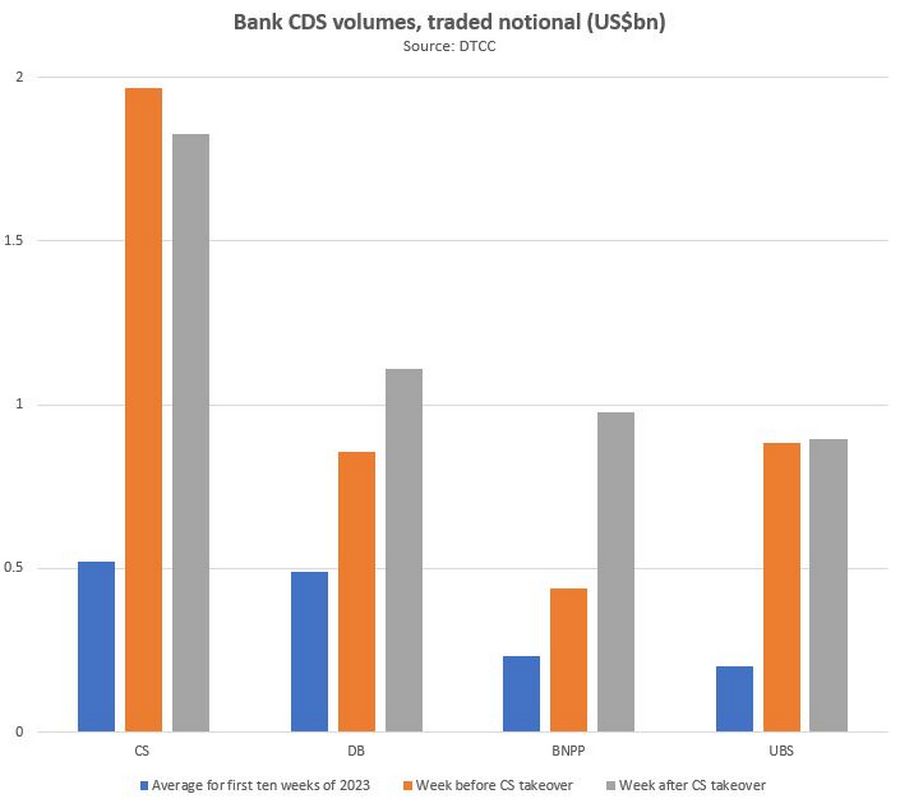

There were 277 CDS transactions on Deutsche Bank for a total of US$1.1bn in the week following UBS’s takeover of Credit Suisse, according to the DTCC data. That represents a more than four-fold increase by trade count and doubling in notional transacted compared with average volumes over the first 10 weeks of the year.

“From my experience, there are decent enough trading volumes in these names to reflect the economic reality of the situation. The idea that one trade can move the whole market is totally exaggerated,” said Athanassios Diplas, a veteran trader who helped design much of the modern CDS market architecture.

"Away from the Twittersphere, no market professional is going to change their fundamental views ... on a credit based on a US$5m trade," he added, referring to the reported Deutsche swaps transaction.

The DTCC data didn't specify how many reported transactions were linked to Deutsche's senior or junior debt. Trading activity tends to concentrate on senior CDS, which usually serve as the main reference point for investors and analysts tracking these markets.

Moves in bank CDS have attracted heightened scrutiny from regulators and investors following an increase in stress in the European banking system. Many highlighted a surge in Credit Suisse’s CDS levels before its emergency rescue as a symptom of its ailing fortunes.

Other bank CDS also widened in the week before UBS’s takeover of its former rival, but the moves were far more subdued. That changed following the announcement of Credit Suisse’s rescue and the wiping out of its Additional Tier 1 bonds, which raised concerns about the value of these securities in the broader market.

Five-year senior CDS on Deutsche jumped as high as 222bp on March 24, according to S&P Global Market Intelligence, up from 142bp two days before, while CDS on other banks such as Barclays and UBS came under pressure too. Banks stocks also took a dive, with shares in Deutsche declining as much as 14% that day.

Dim view

Some investors and regulators have taken a dim view of the alleged role of CDS in the turmoil. Andrea Enria, chair of the European Central Bank’s supervisory board, has called for a review of the market, claiming “opaque” CDS trading had contaminated bank stock prices and could cause deposit outflows.

One holder of Additional Tier 1 bonds agreed, calling the situation around Deutsche “completely unwarranted and completely unjustified", he said. “Deutsche Bank is not defaulting, it is not losing deposits, it is not losing business. It was just somebody decided to buy large notional amounts of very short-dated CDS and these trades go public and they trigger all sorts of unwinds and then you break the CDS market."

AT1 bonds have sold off dramatically in the past few weeks both before and after Credit Suisse's AT1s were wiped out by Swiss regulators.

While regulators conduct their review of events, high-level market data on CDS volumes don't support the idea that poor market liquidity helped drive wild price swings. There were certainly signs that traders were becoming more cautious towards Deutsche and Credit Suisse, with average trade sizes on both declining more than 40% to about US$4bn and US$3bn, respectively, in the week ending March 24 from typical levels earlier in the year.

But that came against the backdrop of a substantial uptick in overall trading volumes across the market. CDS volumes on Credit Suisse jumped six-fold in the weeks either side of its takeover compared with the first 10 weeks of the year. CDS on other lenders, including Barclays, BNP Paribas and UBS, also registered notable volume increases – with some becoming almost as active as Deutsche in the week after the Credit Suisse rescue – confirming that traders didn’t single out the German lender as a target.

“CDS tends to be favoured as the instrument of choice in times of crisis because it allows people to hedge or speculate against a particular name much more easily than trading individual bonds,” Diplas said. “The fact that we see this uplift in volumes is completely normal given that people get more worried or interested in a name in a crisis."

Symptom or cause?

This isn’t the first time European policymakers have looked to blame CDS for destabilising the financial system, underlining how the market has struggled to shake off its association with the 2007–08 financial crisis despite undergoing major reforms since then.

The European Union cracked down on sovereign CDS trading during the eurozone debt crisis over a decade ago, claiming the contracts were exacerbating turmoil in bond markets. Many traders argued that moves in CDS markets simply reflected investor concerns over government debt burdens and the robustness of monetary union.

Proponents of derivatives markets have pointed out how the landscape has changed over the past 15 years, with regulators now armed with better information on what’s being traded and the introduction of central clearing to reduce counterparty risk in these transactions.

“Far from being opaque, regulators now have access to data showing who is trading what, when and in what size,” Scott O’Malia, chief executive of the International Swaps and Derivatives Association, wrote recently on the trade body’s website. “Likewise, clearing is much more prevalent than it was in 2008.”

And for all the scrutiny of CDS lately, analysts say there have been equally dramatic swings in bond markets, raising questions around how much CDS has been the cause – rather than merely a symptom – of market stress.

“Post the sub-prime crisis, equity investors have always had this half-paranoid sense that ‘credit investors know stuff’ – and [so] are very sensitive to [any] underperformance of credit versus equity,” one analyst said.

There was “a lot of focus on how much the CDS moved [on Credit Suisse]; in reality, the cash bonds were selling off much more than CDS", the analyst added.

Additional reporting by Tom Revell