Investment banks are gearing up for a marked rise in Japanese fixed-income trading volumes as focus intensifies on whether the Bank of Japan is set to ease its vice-like grip on markets.

Citigroup and Barclays are among the firms that have been hiring staff and ploughing more resources into Japanese debt trading, according to sources familiar with the matter, in anticipation of one of the world’s largest bond markets springing to life in the months ahead. Goldman Sachs is another that has been preparing for an uptick in client activity, sources said.

Japan’s fixed-income markets transformed into something of a sleepy backwater following the BoJ’s extraordinary efforts to stoke inflation through pinning long-dated government bond yields close to zero from 2016 onwards. But the central bank’s commitment to this policy of “yield curve control” has come into question lately as inflation has accelerated.

Japanese bond and derivatives volumes have already moved sharply higher in recent months amid increased excitement around these markets, with many firms betting that an expected shift in central bank policy will herald a more volatile trading outlook.

“We do believe Japan trading is an area of growth, so we're certainly adding resources in terms of balance sheet or value at risk to the Japan business and making sure we're appropriately staffed,” said Pedro Goldbaum, global co-head of rates at Citigroup.

“People have tried and failed to call the end of yield curve control for a long time. It would be foolish to try and predict when it will happen, but our view is it will be driven by what inflation does and what the economy does. Our indicators on inflation suggest that [the YCC policy] warrants some revision and it should be just a matter of time,” he said.

Net zero

Japan has struggled with tepid economic growth and low inflation for years, prompting a series of dramatic government and central bank interventions in the previous decade. While central banks around the world bought huge amounts of debt to stimulate their economies in the aftermath of the 2008 financial crisis, the BoJ went a step further when it introduced yield curve control in 2016 and vowed to keep 10-year government bond yields near zero.

But the BoJ's extraordinary policy has looked increasingly untenable as inflation has spread across the globe in the past year, forcing other central banks to raise interest rates at a rapid pace. Japan hasn’t been immune from that trend. Core inflation rose to 4.2% in January from a year earlier, the fastest increase in prices since the early 1980s, before easing somewhat to 3.1% in March.

The BoJ widened the range in which 10-year yields could trade to 50bp either side of 0% in December, from 25bp either side, as pressure grew from investors betting that the central bank would have to adjust its policy. Ten-year yields have traded above 0.5% on several occasions this year, Refinitiv data show, suggesting investors believe the BoJ has further to go.

The BoJ met on Friday for the first time under new governor Kazuo Ueda and decided to keep rates on hold, while also announcing a broad review of its monetary policy.

"We think that [the BoJ's] monetary policy will be revised over the coming months," said Derek de Souza, Japan fixed-income trader at Nomura, in an interview shortly before the BoJ announcement. "When there are changes, our expectation is that YCC will be amended or dropped before they move short-term interest rates.”

Trading surge

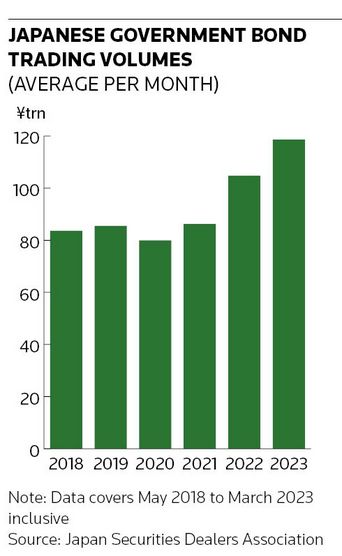

Speculation that the BoJ will have to move at some point has already led to a surge in trading volumes in Japanese markets. Average monthly JGB volumes increased to ¥119trn (US$890bn) in the first quarter, according to data from the Japan Securities Dealers Association, a rise of 13% from last year and up nearly 50% from 2020.

There were also over 20,000 yen interest rate derivative transactions worth US$1.4trn in the first three months of the year, according to ISDA, making it the busiest quarter by trade count for at least a decade. That stands in stark contrast to the depressed activity of recent years, when investors had little incentive to trade a market that the central bank was keeping in a tight range.

“It’s not necessary for YCC to go for Japan trading to become more interesting,” said Goldbaum. “When we’re deploying resources to a business we think over a one year or longer timeframe. I’m confident that Japan will be a more interesting market to trade in a one year-plus timeframe, but even with YCC in place there has been a lot of volatility and a lot of trading there [this year]."

Another senior rates trader said some hedge funds were looking to increase headcount in Japan including hiring people specifically to trade Japanese interest rates. That’s particularly true for specialist equity funds that expect moves in interest rate markets to have more influence on local stocks as volatility picks up. Global macro funds have also been more involved.

"Global funds are more interested in yen markets than they've been for a long while," said de Souza. "YCC dampened liquidity and loosened correlations with other markets. That reduced the number of investors that would otherwise have been interested and made the [JGB] market particularly quiet at times. We’d certainly expect activity to increase with the normalisation of monetary policy."

Lifers return

There are also expectations that Japanese life insurers will further increase their holdings of long-dated yen bonds in the coming months, as hedging costs associated with buying foreign debt have increased. Japanese lifers had previously piled into foreign bonds in search of returns as the BoJ's ultra-loose monetary policy pressed down domestic yields.

But lifers decided to offload large amounts of these securities in the last fiscal year as hedging costs ate into their returns. That came as foreign central banks raised interest rates to tame inflation, widening the interest rate differential to policy rates in Japan where the BoJ remained on hold, and increasing the cost of currency hedges for Japanese investors.

Dai-ichi Life Holdings, Japan Post Insurance, Meiji Yasuda Life Insurance, Nippon Life Insurance and Sumitomo Life Insurance, which collectively manage ¥247trn in assets, said this month they would continue to invest in long-dated yen bonds, while restraining their foreign bond investments in this fiscal year.

Nippon Life said it shed ¥2.4trn worth of foreign bonds in the last fiscal year because of rising hedging costs. It also unloaded an additional ¥1.1trn in unhedged foreign bonds to take profits when the US dollar strengthened against the yen, while boosting domestic bonds by ¥3.1trn. Dai-ichi unloaded more than ¥3trn of currency-hedged foreign bonds in the April to December period.