Hire, fire or sit still? That's a dilemma facing banks as opportunities to pick up senior bankers from Credit Suisse and elsewhere have surfaced, but a sharp slowdown in deal activity is putting pressure on firms to rein in costs.

A flood of bankers departing Credit Suisse for rivals and boutique firms in recent weeks has shown that many firms are willing to take the opportunity to fill gaps or grab senior bankers in the hope that activity will pick up soon.

“We are seeing a large number of candidates from Credit Suisse,” said Paul Webster, managing partner at recruitment consultancy Page Executive. "Some of the remaining bankers are MDs who were not readily able to move or involved with the business transition to UBS,” he said.

Many of the bankers still at Credit Suisse would previously only consider buyside roles at private equity and hedge funds or were just too expensive. Those bankers are available now.

Santander, Deutsche Bank, Citigroup, BNP Paribas, Evercore and smaller firms have all hired teams or senior bankers from Credit Suisse since the ailing Swiss bank was bought by rival UBS in a shotgun rescue backed by Swiss authorities on March 19. UBS is aiming to complete the deal in the next few weeks, but it is expected to cut hundreds of jobs and many people are choosing to leave if they get a decent offer, rather than wait for the outcome, industry sources said.

"It's a buyer's market," said one industry source. "If a good opportunity comes up, people are taking it. Money talks."

Credit Suisse does not break down how many staff it has in its investment bank, but it is estimated to be as high as 17,000 globally.

Another source said even though M&A and equity capital markets activity is slow, opportunities to pick up senior bankers don't come up too often and are usually costly, especially as banks often target the same areas.

The hottest areas now are technology, media and telecoms, healthcare, and pockets such as industrial technology and financial sponsors. Other areas are not seeing as much activity and could remain quiet.

Some banks are taking the opportunity to implement expansion plans which had previously been set out, but others have moved more opportunistically, the sources said.

Santander has hired at least eight senior bankers from Credit Suisse, sources said, which will help drive bolder ambitions for the US, which the Spanish bank has been planning for some time. The hires include Steven Geller, who joined Credit Suisse in 1994 and was head of technology M&A and global head of M&A since January, and David Hermer, who was head of equity and debt capital markets.

Santander could only have dreamed of this a year ago, said one M&A banker. "They are not seen as a true investment banking player in the US," he said, likening it to a once in an economic cycle opportunity for them akin to Barclays picking up Lehman people.

Santander had just hired Christiana Riley from Deutsche Bank to lead its North America business, and new CEO Hector Grisi in February flagged plans to expand CIB in the US, partly to cater to what its clients in Brazil, Chile, Mexico and Spain wanted from US platforms, so the chance to poach staff has been timely.

Leaking ship

Deutsche has also jumped in, reflecting its bolder ambitions and confidence in its own turnaround. Sources said Deutsche hired Martin Blanquart as head of technology for EMEA from Credit Suisse, where he worked for 14 years. It has also hired from Credit Suisse in Asia and took five bankers to cover Latin America in New York.

Wells Fargo has hired Malcolm Price as head of financial sponsors in New York, similar to the role he had at Credit Suisse where he spent 36 years. Citigroup hired a trio of senior Credit Suisse bankers in Europe in consumer and retail banking and industrials, who spent a combined 53 years at the Swiss bank.

BNP Paribas has hired three equity traders from Credit Suisse and boutique Australian advisory firm Gresham picked up Credit Suisse's four-person Australian metals and mining team. Other senior Credit Suisse bankers have moved to William Blair, MUFG and Brazil's Banco J Safra.

As ever, moves in some parts of Wall Street or the City of London can have knock-on effects.

UBS has poached 10 senior investment bankers in the US from Barclays, mostly in TMT. They include Marco Valla as co-head of global banking, who had been global head of TMT and consumer retail at Barclays.

UBS is keen to beef up in the Americas and in sectors aligned with its wealth management customers, such as technology and healthcare, and sources said it had selectively hired for that aim. But the hiring may also reflect the departure of senior Credit Suisse bankers from precisely those areas.

TMT bankers have also been picked up from Silicon Valley Bank after it collapsed in March. MUFG took more than 20 people from SVB to accelerate the growth of an emerging technology banking platform it launched three years ago, and HSBC snapped up 40 people from SVB for a new team targeting early-stage companies.

But at a cost

Evercore has hired a trio of senior media and telecoms bankers from Credit Suisse, including Giuseppe Monarchi, a 31-year veteran who was global head of media and telecoms and co-head of the investment bank for EMEA since September, and EMEA telecoms head Laurence Hainault, sources said.

Evercore CEO John Weinberg said on its first-quarter results call last month that it was hiring, especially to build up in Europe. “We are seeing significant opportunities to recruit high-quality talent in many areas,” Weinberg told analysts.

That was echoed by rival independent firm Moelis, which last month hired 11 senior bankers from SVB in New York, San Francisco and Boston, to almost double its tech team. It also nabbed Credit Suisse's global head of metals and mining Douglas Pierson in New York.

CEO Ken Moelis likened it to when his firm ramped up after the 2008 financial crisis by picking up good bankers. “The current dislocation in the banking market has once again given us the opportunity to expand our franchise for the long term,” he told analysts.

In the last six months, Moelis has hired 22 managing directors in technology and health.

But that brings some pain. Moelis' compensation/revenue ratio ballooned to 80% in the first quarter from 59% a year earlier, and Moelis said it was likely to remain inflated for at least the next year.

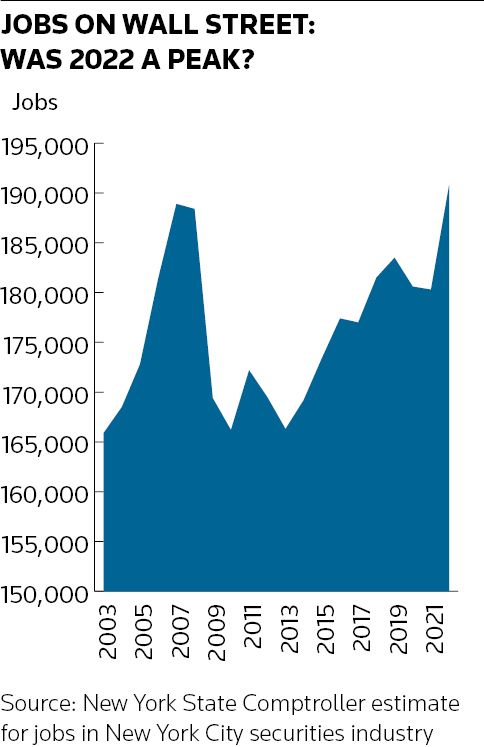

That reflects the risk: banks may need to take some pain but are betting there will be an upturn in activity in areas in which they are hiring. Many other banks, including Goldman Sachs, Morgan Stanley and Lazard, are cutting staff, and firms across Wall Street are expected to continue to squeeze costs this year.

Global fees from M&A advisory, debt and equity underwriting and syndicated loans in the first four months of this year totalled US$31.5bn across the industry, down 23% from 2022, according to Refinitiv data.